Welcome to the TSP allocation guide

Post on: 18 Апрель, 2015 No Comment

I started this blog after having the same frustrating conversation about Thrift Savings Plan (TSP) allocation which I have had with co-workers dozens of times over the past few years. So many of my colleagues are incredibly smart, hard working people who are great at what they do, but they dont have a basic knowledge of investing. Without a well founded Thrift Savings Plan strategy, their retirement accounts are hinging on blind luck and bad advice, and I genuinely fear for their financial security down the road. I started typing up a quick email for one of them to explain how I invest in the Thrift Savings Plan, and a few thousand words later I had written most of what is on this site today. I am sure that a great many Feds and military service members out there are in the same position, so I stuck it online to try to help some others who want to make the most of the opportunities provided by the Thrift Savings Plan, and avoid catastrophic mistakes.

I became a Fed a little over 15 years ago with no savings and almost $100,000 in law school debt. With no income other than my GS salary, I now have well over a million dollars invested in the stock market – mostly because I have made good decisions with my Thrift Savings Plan allocation. As a result, I have hundreds of thousands of dollars more in my Thrift Savings Plan than most of my peers do. Im not telling you this to brag I just want you to think for a minute about what is at stake for you.

My Thrift Savings Plan strategy isnt a secret, it isnt particularly technical, and it isnt hard to do once you develop a basic understanding of what is commonly referred to as the business cycle. This isnt another attempt to time the stock market we look at broad economic trends rather than easily manipulated stock market patterns. And it doesnt require a lot of machinations and decisions – on average I change my Thrift Savings Plan allocation about once a year (and sometimes go years without touching it). You just have to be willing to devote a few minutes a month to figuring out where in the business cycle we are at any given point (and there are plenty of experts out there whose advice you can follow who do nothing but figure that out) and invest in the TSP funds which do well during that phase of the cycle.

Feds and service members allocate their Thrift Savings Plan badly for a lot of reasons. Most TSP talk revolves around simplistic, outdated and flat-out wrong axioms like: “buy and hold” is the key to successful wealth building, being diversified protects their investments, and the stage of their career largely determines what they should be invested in. If followed, all of those half truths and fictions will lead to huge losses when the economy contracts, and tremendous missed opportunities as it expands.

2C150 /% But maybe the worst reason that I have heard over and over again when we have the TSP talk is they dont want to be bothered with it – they want to set it and forget it. The problem with doing that is that none of the options offered in the Thrift Savings Plan is the right choice 75% of time. My colleagues work hard for 50 to 60 hours a week, but they dont want to spend twenty minutes a month to make investment decisions which can often make the difference of thousands of dollars in a single day. I dont want to spend my days worrying about it or doing research either, but I am willing to do a little bit of reading occasionally and to adjust my Thrift Savings Plan allocation on rare occasion. The difference between “set it and forget it” and “set it and adjust it once every year or two” could be hundreds of thousands of dollars as they approach retirement.

Here is the nutshell of my TSP strategy in its very simplest form: the business cycle is a long-term pattern of changes in the economy which follows four stages: expansion, prosperity, contraction, and recession. Each of the basic Thrift Savings Plan funds (the S, C, G and F funds) do very well in one of those phases, but are either flat or do terribly in others. The cycle is not exact and the phases last different amounts of time and result in different fluctuations each time, but it provides the strategic framework for selecting the best TSP allocation.

A host of other factors impact the stock market and your Thrift Savings Plan balance on a daily and weekly basis. But external events, no matter how much importance they are given in the 24-hour news cycle, have very little impact on the business cycle. Certainly a poor jobs report, a sovereign debt default by a European country, or prospects for armed conflicts overseas may cause the markets to fluctuate, but they do not effect the long term trends which this strategy aims to capitalize on. As a result, we do not worry about weekly, or even monthly declines in the stock market and focus on the big picture.

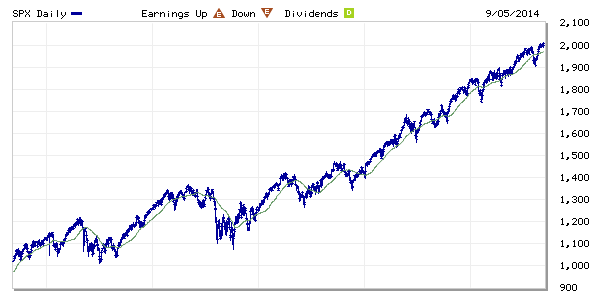

Nobody can predict exactly when the phases of the business cycle will change. And that isnt my goal. When you look a chart of GDP growth rates (the standard by which the economy is generally measured) and you see the broad trends of the economy going up and down, my goal is to miss most of the losses which that downward sloping line represents in my Thrift Savings Plan, and to be on board for most of the gains which the upward sloping line represents. Note that Im not trying to do that for the minor fluctuations, I dont believe that anyone can accurately predict those, but rather for the major cycles in the economy. In my next post I will write in much greater detail about the characteristics of the different phases and the indicators which predict roughly when one phase is going to end and the next begin.2C372 /% At any given point in the cycle, one TSP fund is typically doing very well and the others are doing poorly relative to that fund. As a result, trying to create a balanced mix of TSP funds (or investing in the LifeCycle funds) results in the gains which are made by the strongly performing funds being canceled out in at least some measure by the funds which are weak during that part of the cycle.

The TSP I Fund (International) does very well during certain phases of a business cycle too, but it is participating in a completely different cycle than the US business cycle which governs my selection of the S, C, G and F funds. To invest in the TSP I Fund, you have to understand where the economies of the countries which dominate that fund are in their business cycles. Thats a subject I cover in great detail in this post .

The TSP G and F funds are typically lumped together as fixed income or bond funds, but they have very different characteristics which I explain in F Fund vs. G Fund in TSP Allocation. If I wanted to be out of equities (stock funds) right now I would move my Thrift Savings Plan balance to the TSP G Fund. The TSP F Fund will come back into the mix eventually because when interest rates are declining it will significantly outperform the TSP G Fund. But right now interest rates have nowhere to go but up, so the TSP G Fund will perform on par or better than the TSP F Fund.

I do not have any financial motive in starting this blog, I am just trying to help a few of my colleagues with the benefit of the experience and time that I have put into this subject. Since Im going to the trouble of writing it all down, I feel like the larger the audience I can reach, the better, so I have created this page instead of just emailing it to a few friends. I have been inspired by the example of Dan Jamison and all of the time and effort that he has put into his FERS GUIDE (which every Federal employee should read from start to finish on their first day of work and once a year after that). If I have a long-term goal with this blog, it is to eventually create something which approximates for the Thrift Savings Plan what he has created for the Federal Employee Retirement System.

Please note that Im not telling what you should do with your Thrift Savings Plan or suggesting that you blindly follow what I do. My goal is for this to be a transparent, straightforward, free resource for Feds, and for it to be one of the viewpoints they consider when making important decisions about their financial future.

So what should you do now?

- Subscribe to receive email updates so that you will know when I change my allocation or post about another topic of interest (I only send one email per month with an update on where we stand in the business cycle, and promise I wont share your email address);

- If you find value in what I am doing here, please share it with your friends and colleagues by clicking on the email or social media buttons below;

- Keep reading. In The Business Cycle Theory of Investing I will go into much greater detail on the Business Cycle and which Thrift Savings Plan fund I invest in during each phase.