Weighted Average Maturity Measuring Volatility in MortgageBacked Portfolios

Post on: 16 Март, 2015 No Comment

Weighted average maturity definition

Weighted average maturity (WAM) is a method for comparing portfolios of mortgage-backed securities by calculating the average time until full maturity weighted by the value of the principal amount to be paid. Portfolios that contain a large proportion of mortgages with significant durations remaining on their maturity terms will have a larger WAM figure, while the WAM figure will be smaller for investment pools that contain more mortgages close to the end-of-life.

Weighted average maturity calculation

Because WAM figures are calculated based not only on the total duration remaining on the mortgages contained in the mortgage-backed portfolio but also on the proportional value of those mortgages, the method for calculating WAM must assign greater weight to those mortgages that constitute a larger proportion of the total principal amount and less weight to mortgages of lesser value. This is achieved by first mathematically weighting the mortgages by adding the current principal value of all the mortgages together and then calculating the percentage or fractional value of each mortgage in comparison to the total value. This percentage or fractional figure is used as the weighting factor for the equation. Then that fractional or percentage value for each mortgage is multiplied by the number of years remaining until it reaches maturity, and the resulting sums are added to derive the WAM figure.

Weighted average maturity example

For instance, if a mortgage-backed portfolio includes four mortgage investments with these characteristics:

- $10,000 in current value, maturity in 2 years

- $10,000 in current value, maturity in 3 years

- $30,000 in current value, maturity in 2 years

- $50,000 in current value, maturity in 5 years

It is necessary to first calculate the weight of each mortgage by adding together the total value of all the mortgages, as in:

- $10,000 + $10,000 + $30,000 + $50,000 = $100,000

and then derive the percentage (or fractional) value of each mortgage in relationship to the total amount, as follows:

- $10,000 = 10%

- $10,000 = 10%

- $30,000 = 30%

- $50,000 = 50%

The percentage values of each mortgage are then multiplied by the remaining duration until maturity:

- 2 years * .10 = .2 years

- 3 years * .10 = .3 years

- 2 years * .30 = .6 years

- 5 years * .50 = 2.5 years

The resulting figures are then totaled to produce the WAM of 3.6 years.

Applications for weighted average maturity

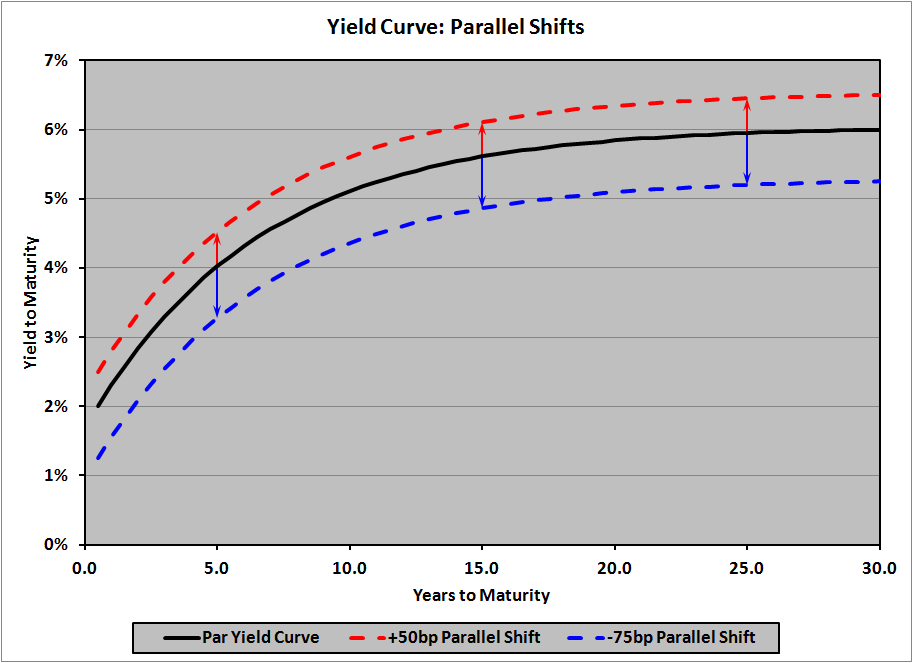

WAM figures are often used to determine the interest-rate sensitivity of mortgage-backed portfolios. Larger WAM figures indicate a higher degree of interest-rate risk due to the longer period of exposure the portfolio will experience; thus, the larger the WAM figure is, the more likely the investment will be affected by interest rate shifts that can materially affect the value of the portfolio in comparison to other investment options.