Weekly Options Iron Condor

Post on: 26 Июнь, 2015 No Comment

Weekly Options Iron Condor

Posted on March 28, 2011, 5:04 am, by. under Weekly Options .

If you’re new here, you may want to subscribe to my RSS feed. Thanks for visiting!

The weekly options iron condor is one of the most popular option strategies available to traders. Unfortunately, it is also possibly the most dangerous.

The thing is, when rookie option traders first hear of this strategy (perhaps from a late night infomercial or free hotel seminar conducted by slick salesmen touting it as the greatest thing since sliced bread) very few seem to able to resist the temptation to jump right into trading them head first with actual real hard earned money on the line and usually way too much of it.

And unfortunately what always seems to happen to a high percentage of them is that they promptly wind up getting their trading accounts demolished and their heads handed to them on a platter.

Now stop wait hold on just a second.

Before you start to get the wrong impression, please, let me clarify something here.

I absolutely LOVE iron condors. ALOT. In fact, the iron condor is right up there as one of my favorite trading strategies.

And I think it REALLY IS a good solid trade.

And those claims and stories of ten percent monthly gains and ninety percent probabilities? They are absolutely true.

Here is the problem: All those fresh, green and excited new option traders have no idea what they dont know. This trading options for income thing is like an alien planet with a whole new set of rules inside a brand new reality. And when the person who has introduced them to this new way of trading just tells them about the good but forgets to tell them about the bad they wind up jumping in with way too much confidence, misunderstanding, and expectations that are completely wrong.

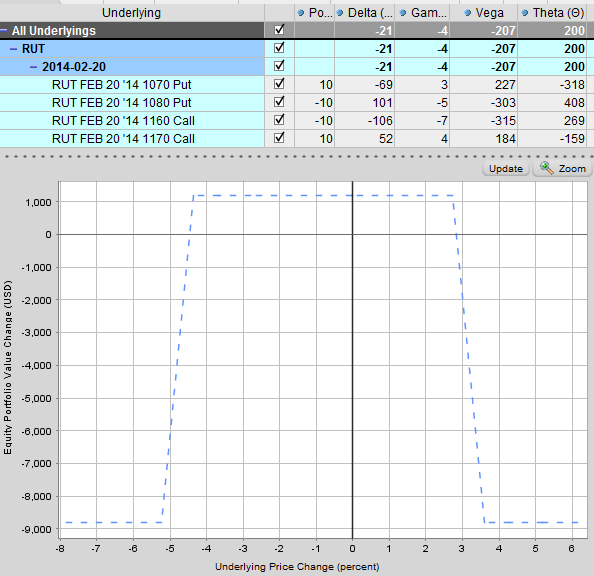

See what isnt being talked about with iron condors is that while yes, they can provide great monthly returns and high probabilities of winning- they also come attached with a horrendous risk to reward ratio sometimes as poor as 10 to 1!

This means that in order to achieve those 80 to 90 percent probability trades you need to risk ten dollars to make just one or to be more realistic you need to put at risk $10,000.00 for the chance to make just $1,000.00.

And as my mammy used to say (God bless her soul) that risk to reward ratio is an awful bad egg. In fact, its an honest to goodness stinking rotten deal.

Because once you do the math you find that even with those glorious monthly returns with 80 to 90 percent probability of winning all it takes is just one problem month to come along and cause a loss that will completely obliterate the 8 to 9 wins youve managed to rack up as well as potentially the rest of your entire account!

Nevertheless

All is not lost

As I mentioned earlier I really do LOVE trading weekly options iron condors.

Over the last ten years its been extremely profitable for me.

So obviously theres a way around that horrible risk to reward issue and the inevitable problematic losing months.

And there is.

Its all in how you manage the trade.

That risk to reward problem quickly becomes a complete non issue as soon as you educate yourself on the proper way to initially set these trades up and how to correctly manage and adjust them.

You just need to take the time BEFORE jumping into trading the weekly options iron condor pool to equip yourself with this little bit of knowledge. A few simple tricks of the trade so when those problem months DO come along (and they WILL believe me) you will know exactly what you need to do to immediately squash that threat, easily adjust yourself out of the problem, and experience the iron condor for all its really cracked up to be.