Weekly Options for Covered Calls

Post on: 19 Август, 2015 No Comment

Weekly Options for Covered Calls

Ive written about Weekly Options in my last post as they have become more popular for use with certain popular options trading strategies but one great way to use them is with covered call writing.

Covered call writing is the most well known options strategy among non-option traders as they are easy to do and considered a safe options strategy.

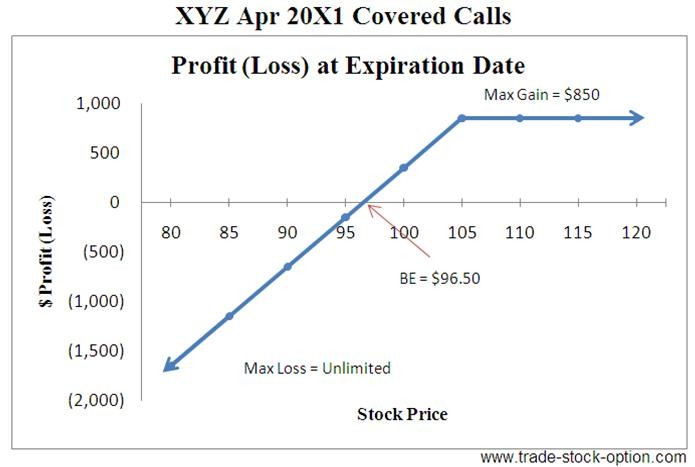

Covered call writing is essentially selling 1 call option against each 100 shares of that stock that you own. There are lots of books and websites that explain the ins and out of covered call writing but essentially its a neutral to bullish strategy because you are long the underlying stock and therefore want the stock to stay flat or move up.

Traditionally covered calls are done each month as the time decay is the fastest in the last 30 days, but with weeklies you can now sell calls against your position every single week (If there are weekly options offered on your stock).

Most people just write a slightly out of the money call option against their stock so that it leaves some room for stock appreciation while also getting the bonus of option premium but investors should realize that covered calls are a great way to play short term moves too.

Weeklies Covered Call Examples:

- BULLISH: XYZ stock at $100. You buy 100 shares of stock and sell near month $105 call at $1.25 if you think the stock will go up but want benefit of decent premium if it doesnt go anywhere. So if stock goes to $110 then you get the $500 appreciation per share on the stock from $100 to $105 and the $125 from selling the option. You miss out on some of the appreciation but you can redo the same trade next month or roll up the call option to a higher strike. With weekly options you can keep reselling a new call every week or easily adjust the strike price depending on where the stock price is.

- BULLISH but concerned stock could pull back. XYZ stock at $100 but market kind of shaky or stock has made big run. Buy stock at $100 and sell near term $95 call for $7.50 if there is decent time value priced in the option so you could collect the time decay($2.50) and roll the call into next expiration as it erodes. You cost basis on that $100 stock is $100-7.50 premium = $92.50 so you have some downside protection and if it shoots higher then you at least made $2.50 in time premium or 2.5% on your $100 stock purchase in a short time period. With weeklies you could do this every week.

- BULLISH but cant afford to buy 100 shares of $100 stock. You could buy a far out option like 3+months that is far in the money(delta over .80) and sell near term(WEEKLIES) just out of the money calls or at the money calls every week against your long call. Example: XYZ @ $100 buy 3month out call that is far in the money like $80 strike call option for something like $23. You need to pay attention to the delta of the call you are buying so that is moves pretty close dollar for dollar with the underlying stock(its called Option Delta) and sell $100 or $105 strike calls at $1.25-2.50 range as an example. So rather tie up $10,000 dollars buying 100shares of a $100 stock you only tie up $2300 on the call and then sell call option for $125-250 each month. You can vary the strike you sell depending on how the stock has moved and whether you are looking for quick price appreciation or just want to make income on the short strike every week. You can also sell in the money calls with decent time premium to lower the cost basis of you long call and then roll the in the money call before expiration each week. This has been a popular strategy with volatily high priced stock like AAPL, BIDU, GOOG,etc.

There is risk with covered calls though in that the underlying stock could move down and then you are losing more on the long stock or long call then the premium you received from the sold call. You can always roll the short call down because if the stock moves down then the short call will decrease in price.

Another risk is with the strategy mentioned above with buying calls instead of stock you have to understand delta, theta decay, and volatility skew(knowing the underlying volatility of the purchased call vs. short call) so that you dont overpay for the long option and risk the volatility decreasing on your long call which can really hurt the value.

As you can see implementing weekly options for covered calls instead of waiting a whole month to see quick time decay is a great benefit of weekly options and something that every call writer so pay attention to.

You can also see my video about using covered calls with weekly options, click here

If you want a great options training product to explaining options, how to manage trades and discussing how to property evaluate the risk I mentioned above then I highly recommend Trading Pro System . I have written about Trading Pro System on this site(see Post 1 & Post 2 before and feel its an excellent value for the information provided in comparison to other options training products out there