Warrants Introduction to Stock and Stock Index Warrants

Post on: 10 Апрель, 2015 No Comment

You can opt-out at any time.

Warrants are a derivatives market (i.e. they are based upon another market), and are very similar to options. Warrants are available based upon many different underlying markets, including stock indices, individual stocks, and currencies. Warrants are very popular in Europe (especially Germany), but are also available in Asia. Warrants are not available in the US, and as usual, US traders are prohibited from trading non US warrants by the SEC, so warrants are almost unheard of in the US. Warrants are traded via exchanges, and can be traded both short and long term.

Comparison Between Warrants and Options

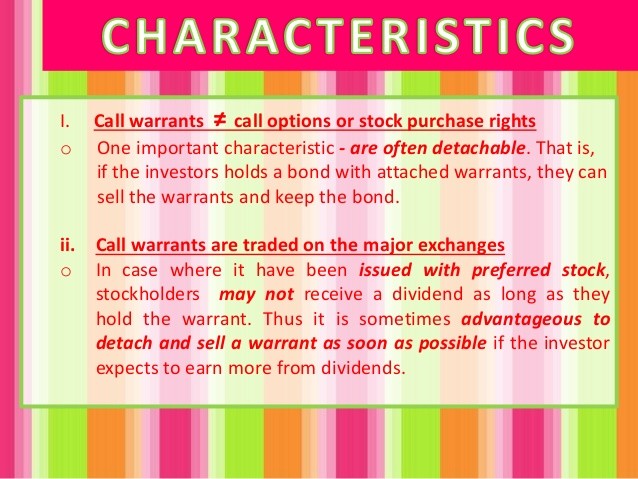

Warrants are traded in the same manner as options, and use many of the same terms (e.g. strike price, etc.). However, there are a couple of differences that need to be taken into account when trading warrants.

Like options, warrants give the buyer the right (but not the obligation) to buy or sell the underlying market, at any time up to the expiration (US style warrants), or at the expiration (European style warrants). Warrants are either call warrants or put warrants depending upon the direction of the underlying trade, and warrants are in profit or loss depending upon the underlying market’s price in relation to the strike price.

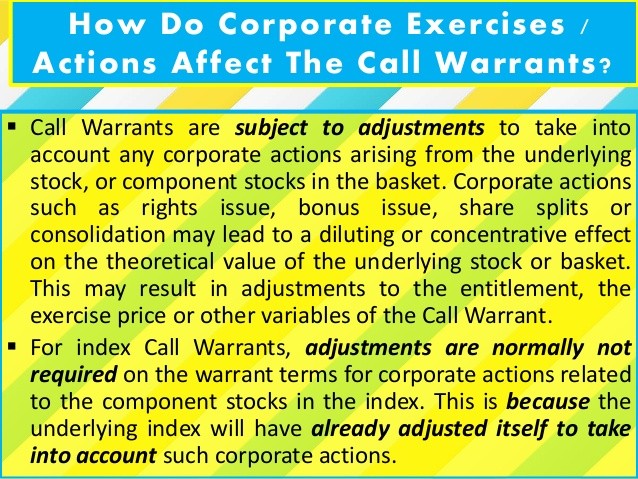

Unlike options, warrants are issued by securities companies (e.g. brokerages, banks, etc.), and can have differing contract specifications from one warrant to another (such as the expiration date). Warrants tend to have lower premiums, and therefore have higher leverage than options. Warrant multipliers are also used slightly differently than options’ multipliers, and also from one type of warrant to another.

Stock Warrants

Individual stock warrants give the warrant holder the right to buy or sell the underlying stock. The amount of stock that is bought or sold is determined by the warrant’s multiplier. For example, a stock warrant with a multiplier of 1 would entitle the holder to one share for each warrant, but a warrant with a multiplier of 0.01 would require one hundred warrants for one share.

In order to determine how many warrants are required for a particular trade, the trader must divide the number of shares that they want to trade by the warrant’s multiplier. For example, a trader that wanted to buy one hundred shares using warrants with a multiplier of 0.1 would need to buy one thousand call warrants (calculated as 100 / 0.1 = 1000).

Stock warrants are usually physically settled, meaning that the warrants are exchanged for the underlying stock when they expire.

Stock Index Warrants

Stock index warrants give the warrant holder the right to buy or sell the underlying stock index. However, as this is impossible (stock indices cannot be traded directly), stock index warrants are settled in cash. The amount of cash that is settled is determined by the warrant’s multiplier. For example, a stock index warrant with a multiplier of 1 would entitle the holder to €1 (or $, or , etc.) per stock index point (above or below the strike price).

In order to determine how many warrants are required for a particular trade, the trade must divide the point value that they want to trade by the warrant’s multiplier. For example, a trader that wanted to trade the FTSE 100 with a point value of 10 using warrants with a multiplier of 0.01, would need to trade one thousand warrants (calculated as 10 / 0.01 = 1000).

Contract Specifications

The contract specifications for warrants are similar to the contract specifications for options, but some of the specifications can vary from one warrant to another (even with the same underlying market). The expiration date and the multiplier are the most likely to vary, but there may also be minimum trading sizes (e.g. a minimum of 100 warrants).

Trading Warrants

When warrants are traded short term (e.g. day and swing trading), a trade is entered by buying either a call or a put, and then exited by selling the same call or put. The profit or loss of a short term trade is the difference between the buying and selling price of the warrant multiplied by the number of warrants that were traded.

When warrants are traded long term (i.e. position trading), a trade is entered by buying either a call or a put, and then exited by exercising the warrant (at any time for US style warrants, and when the warrant expires for European style warrants). The profit or loss of a long term trade is the difference between the warrant’s strike price and the underlying market’s price multiplied by the number of shares (for stock warrants) or the point value (for stock index warrants).