Wall Street s Hottest Address K Street

Post on: 14 Июнь, 2015 No Comment

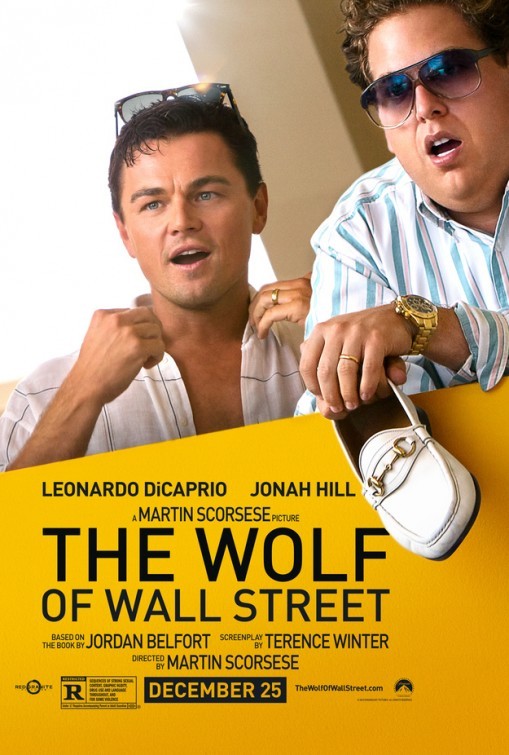

Source: Google Maps

1275 K Street in Washington, D.C.

In computerized high-speed trading, as in real estate, location is everything. On Wall Street, high-speed firms pay fees to locate their computers in the same data centers that house stock exchange computers—so trades aren’t delayed by more than a few feet of fiber optic cable.

But in recent years, high-speed trading firms have quietly been able to add servers in a less expected place: The nation’s capital.

That’s driven by an insatiable demand for economic statistics—many of which are released by the federal government and move markets almost instantly when they become public.

The most high-profile of these is the Labor Department’s employment report, disclosed monthly at that agency’s Constitution Avenue headquarters. The Federal Reserve announces Fed funds rate changes to reporters in a room in the basement of the Treasury building on Pennsylvania Avenue. Just around the corner, the Commerce Department regularly spits out a passel of economic indicators. And the Department of Energy puts out natural gas inventory data from its building on the other side of the National Mall.

All that information is generated within just a few square miles, but instantly affects markets trading around the world. And that presents a business opportunity for the Denver-based data center company CoreSite. which operates a facility where traders can install so called co-located computers right in the heart of Washington. The idea: Get access to federal data milliseconds faster than those traders waiting patiently for it to travel at the speed of light up fiber optic lines to markets in New York, New Jersey and Chicago.

Being the first to trade on market-moving information can be extremely profitable—and that’s what’s driving firms to invest resources in a continuing effort to slice the amount of time between information release and trade into ever thinner increments. All of it—the information’s transmission, translation, and trading in a journey from Washington to market servers in New Jersey, New York and Chicago—happens faster than the speed of human thought. It takes a person 300 milliseconds to blink an eye. But the firms involved in this telecommunications arms race view a single millisecond as a margin of victory—or defeat.

Although it seems like information travels on the Internet instantaneously these days, it doesn’t. Data can’t travel faster than the speed of light. So the telecommunications arms race in markets has become all about getting as close to the theoretical speed of light transmission time as possible—and putting computers as close together as possible, to minimize even the tiniest delays.

The Washington computer facility is located at 1275 K Street, NW, in a bland brick facade office building on a downtown thoroughfare better known as the home to Washington’s lobbying and political consulting firms. In a way, the facility is not that different from K Street’s older industries, which have long known how to take what Washington does and turn it into money. High speed trading is just a 21st-century twist on that old idea.

In a 2010 press release, CoreSite trumpeted the arrival of two economic news service providers at its 1275 K Street facility, saying With critical, market-moving data being released directly from the U.S. Departments of Labor, Commerce and Treasury, these companies identified CoreSite as the best data center in the closest proximity.

CoreSite is a company that operates data centers around the country where its customers pay to house their computer servers. In the facility, customers can connect their machines to a variety of other companies’ servers and a range of telecommunications options to transmit data quickly. The firm provides power, cooling, and even private key card and biometric access devices to its tenants.

CoreSite touted its superiority over competitors located just a few minutes’ drive away in the northern Virginia suburbs.In high-frequency trading environments, a millisecond difference is a major advantage for filling more trades at better prices, it said.

A spokesman for CoreSite declined to comment. Coresite is just one of several tenants of the building, which had included a Cosi sandwich shop on the ground floor. But the building is the focal point of quite a bit of transmission activity.