VIX Notches Biggest Jump of 2012 MarketBeat

Post on: 12 Июнь, 2015 No Comment

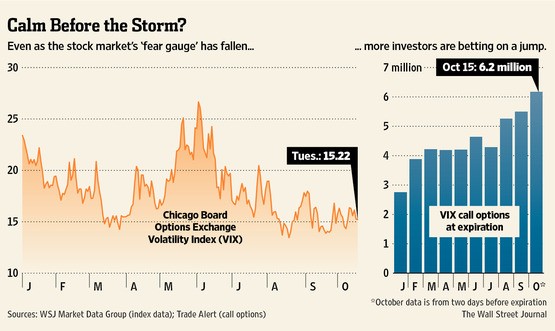

Fear spiked Monday, as European debt worries pushed the Chicago Board Options Exchanges volatility index (VIX) to its biggest single-day percentage gain of the year.

The VIX, the markets fear gauge, headed for its biggest percentage gain in since November as investors worried Spain would soon request a formal bailout. The measure added 2.72 points, or 17%, to 18.99.

The VIX, which measures the prices investors pay for protective options on the Standard & Poors 500-stock index, tends to rise when stocks fall.

Last Thursday, the VIX finished at 15.45, the lowest level since late March, when the stock market hit highs for the year. But Monday, the index soared as investors clamored for portfolio protection after the Dow Jones Industrial Average slipped more than 200 points early in the session.

The Dow recently dropped 125 points, or 1%, to 12698, led lower by Microsoft and McDonalds. while Caterpillar. J.P. Morgan and General Electric pulled on the upside. The S&P 500 was down 1.1% at 1348.

To be sure, the VIX remains at a relatively low point historically, still trading below its 20-year average of 20.49.

People got overly complacent and were shrugging off issues here and in Europe, said Randy Frederick, managing director of trading and derivatives at Charles Schwab. The VIX was not properly displaying the risk in the market, and it was excessively low. Now it looks like it is just playing catchup.

When the VIX last made a one-day percentage gain as big as Mondays, the Dow Jones tumbled nearly 400 points on a day Italian bond yields surged. The VIX more recently traded at its current level late last month, before a group of European leaders agreed on measures to curb soaring borrowing costs and to recapitalize regional banks.

In options trading, investors looked to pick up protective hedges in the SPDR S&P 500 (SPY) exchange-traded fund. In one large options trade on the ETF, 30,000 weekly $133 put options changed hands. The options, which convey the right to sell the ETF at $133 by Friday, protects against an additional 1.6% drop by the end of the week. The SPY fell $2.01, or 1.5%, to $134.47 in recent trading.

Meanwhile, August $128, $130 and $134 put options were also active on the ETF. The puts protect traders from as much as 4.8% of additional downside over the next four weeks. If SPY falls below $128, that would put the fund at its lowest price since early January.

However, not all are convinced Mondays surge holds much significance in the long run.

It is incredibly unusual to see the VIX at the 15 level and then have it blow up. Usually you see a more gradual move up to the 20 level then a rip higher, said Jim Strugger, derivatives strategist at MKM Partners. I think it is far more likely for the VIX to come in again from this rip higher than for it to continue moving higher.

Short-Selling Ban Reeks of Desperation Next