VIX Measures Volatility Concerns of Stock Investors Index Helpful in Anticipating Market Concerns

Post on: 9 Июнь, 2015 No Comment

VIX Measures Level of Concern or Uncertainty

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Fear and greed are the two most powerful emotions stock investors must acknowledge as driving the market over the short-term.

When one of these emotions is running strong, be careful because the market will not always react in a rational manner.

Greed leads to bubbles and excesses (think dot.com), while fear can drive prices down and feed on itself (as prices fall, more investors become fearful and the selling accelerates).

Investors should be cautious in market driven by either emotion, however when fear is running rampant on Wall Street bad things happen and can happen in a hurry.

How do investors protect themselves from a fear-driven market?

The first step is to see one coming or developing.

Reliable Stock Price Clues

That is not easy since there may be few reliable clues.

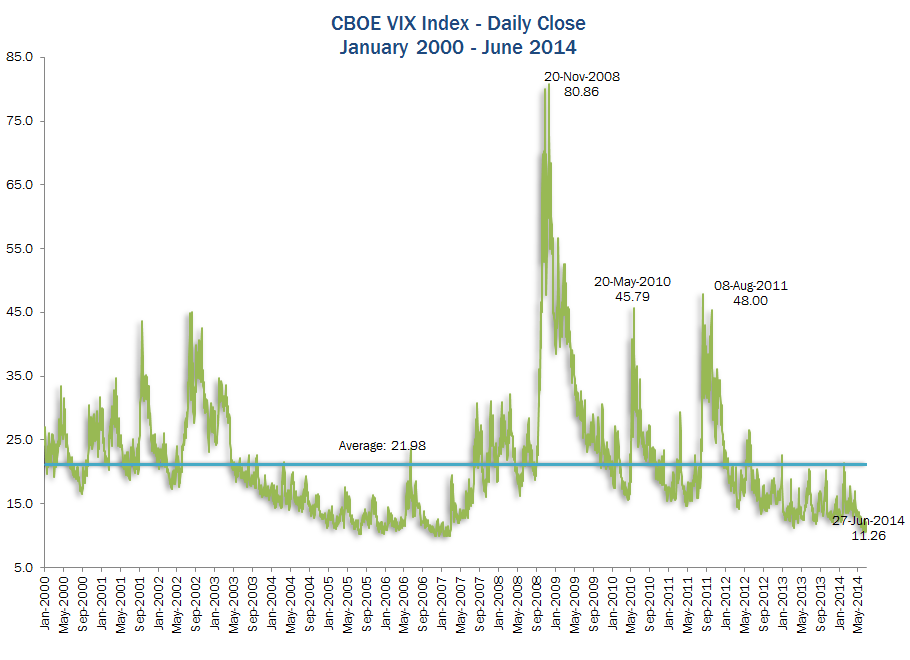

One indicator that doesn’t receive much attention from the average investor is the Chicago Board Options Exchange (CBOE) Volatility Index or VIX.

This link takes you to a quote of the VIX from CNN.

The VIX is a forward looking index that uses options (puts and calls) to gauge investor anticipation of volatility. It is based on the S&P 500. Similar indexes exist for the Dow (VXD) and the Nasdaq 100 (VXN).

You can check these indexes from most quote boxes on major Web sites.

The VIX is the index you most often see quoted in the media — because the S&P 500 is considered by many investment professionals as a proxy for the total market.

Fear Index

The VIX is often called the fear index. When it is high investor sentiment is toward increased volatility and corresponding higher risk.

A lower number indicates investors are less concerned (fearful) about the market and anticipate low volatility.

What scores should you look for?

Any reading of the VIX above 30 indicates a growing concern or fear in investor sentiment. A reading of 20 or less means investors are little concerned with future volatility.

The VIX is an estimate of future volatility and uncertainty as calculated by the way investors buy or sell options.

Like any prediction, it is not discerning the future, but rather anticipating investor concerns.

When viewed with that limitation, it is still a good barometer for judging how investors are anticipating future market direction and velocity.

Forewarned is forearmed.

Read more about:

Market Internals and other indicators: