VICARIOUS INVESTING How Long Can a Hedge Be a Haven

Post on: 13 Июнь, 2015 No Comment

By GERALDINE FABRIKANT

Published: September 2, 2001

MANY wealthy investors fleeing from the stock market have sought refuge in hedge funds that invest in convertible bonds.

Convertibles provide interest income and the right to convert bonds to common stock at a preset price. Hedge funds, which are loosely regulated investment vehicles for the wealthy and often require a minimum investment of $500,000, offer even more flexibility. Because hedge funds can short stock, they can profit when shares decline.

Convertible bond hedge funds have had impressive returns in a shaky market. In 2000, they rose 25.64 percent, on average, compared with a decline of 10.14 percent for the Standard & Poor’s 500-stock index, according to Tremont Partners, a hedge fund tracking and advisory service. This year through July, the sector was up 9.7 percent, versus a decline of 8.26 percent for the S.& P. 500.

Hedge funds have been the largest buyers of convertible bonds this year, accounting for at least 60 percent of the $70 billion in purchases, according to some estimates.

But investors who put money into these funds now may be showing up too late for the party. The decline in stock market volatility is giving short-sellers fewer trading opportunities, and a sputtering economy has raised the risk of default by once highflying companies that issued convertibles, insiders say. Gains in convertible funds have slowed in recent months, to 0.13 percent in June and 1.04 percent in July, versus 2.65 percent in January.

Jane Buchan, managing director at the Pacific Alternative Asset Management Company, which advises institutions on hedge fund investing, said, »The time to get there is right before the big performance occurs.».

David Smith, chief investment director at Global Asset Management, which runs a fund of hedge funds, says the convertible funds carry increasing risk. »You have an awful lot of people doing the same thing,» he said. He believes that if there were an economic crisis, »either investors might want to get their money out, or the lenders to funds might insist on getting their loans repaid.» Both situations could force hedge funds to sell at a considerable loss.

Convertible funds are most successful when the market moves up and down sharply. Volatility has declined recently, making it harder for traders to make money. »A convertible bond is an option to turn your bond into the shares, and options are more valuable when you are uncertain about the future of the market,» Ms. Buchan said.

Some hedge funds benefited last year when volatility was high, and convertible bonds declined less sharply thant the underlying stocks. And traders are certainly still making money this year. For example, Juniper Networks sold $1.15 billion in convertibles in March 2000 when its stock was trading at about $130 a share. In one strategy, an investor owning $1 million in the convertible bonds shorted about $793,000 worth of the underlying stock. By late last month, Juniper’s stock had plummeted to about $16 a share; the trader would have made about $689,000 by completing a short sale that day. The bonds, meanwhile, had fallen, generating a loss of about $270,000, resulting in a gain of $419,000. The fund also earned about $70,000 in bond interest.

THE ability to hedge does not protect traders from all losses. One hedge fund manager, who spoke on condition of anonymity, described how he recently lost more money on the purchase of convertible bonds than he earned by shorting the underlying stock. That happened in a $500 million offering of convertible bonds last February by Exodus Communications.

He said he bought $1 million in bonds. They fell in value to about $160,000, so the fund lost $840,000. When he bought the bonds, he also shorted 43,950 shares at $18, for a total of $791,000. When the stock fell to $1.10 a share, the equity investment was worth about $48,000, so the fund made a profit of only $743,000 on the stock. Over all, there was a trading loss of $97,000, partially offset by $25,000 in bond interest.

There are other risks as well.

Because of the huge demand for convertibles, some companies have been able to obtain financing by issuing bonds with very high premiums. For example, the Mirant Corporation, an energy company based in Atlanta, issued $750 million in bonds whose underlying stock pricewould have to rise by 51 percent before the bondholder could profitably convert the bonds into stock shares.

Some hedge fund managers do not find the terms of these offerings attractive as investments. The Highbridge Capital Corporation, which manages about $4 billion in convertible bonds, has become concerned about diluting current investors’ holdings and has closed itself to new money.

Increasing numbers of new issues, meanwhile, have come from companies with risky credit, Ms. Buchan said. »People are becoming worried about a prolonged recession and companies defaulting on debt,» Ms. Buchan said. »Convertible bonds tend to be issued by weaker companies. If defaults start, convertibles will be hit.»

Hedge funds may not be valued accurately, either. »Bonds don’t trade that often and you don’t know the true price until you go to sell,» said Bruce Ruehl, Tremont’s chief investment strategist.

The convertible bond market is far less liquid than the stock market. »The only time people are interested in liquidity,» Mr. Smith at Global Asset Management said, »is when the markets are illiquid, and then convertibles are illiquid.»

That view is not universal. John L. Steffens, managing director of Spring Mountain Capital Partners, a new fund of hedge funds, and former vice chairman of Merrill Lynch, still likes the sector. »Over the past five years, by traditional measures of risk, convertible funds are one-third less risky than the S.& P.,» Mr. Steffens said.

BUT there is certainly risk. Although many experts believe that hedge funds are not as highly leveraged today as they were in the late 1990’s, there is no precise way of knowing because the business is not fully regulated. Some say they believe that funds are borrowing $1 for every $1 of invested capital, while others put the ratio as high as four to one.

Leverage becomes crucial if lenders become nervous in a declining market and call loans, forcing hedge funds to sell bonds. Albert Slawsky, senior vice president for risk management at M. D. Sass Investors Services, which manages a fund of hedge funds, contends that there is only an outside chance of such a selloff, but he notes that there are precedents. The most recent, of course, was in 1998, when Long-Term Capital Management, the highly leveraged hedge fund run by John W. Meriwether, was forced by its creditors to liquidate positions.

Wall Street firms like Morgan Stanley and Goldman Sachs that sell convertibles also lend money to the hedge funds that buy the bonds. »If those firms got nervous about the markets, they could sell their own convertibles as well as asking for more collateral against the loans they have made to hedge funds,» Mr. Slawsky said. That sets off hedge fund selling, »and reduces the number of buyers in the marketplace,» he said.

In 1998, the year of the Long-Term Capital debacle, convertible hedge funds fell 4.41 percent, according to Tremont, while the S.& P. 500 rose 26.67 percent. Mr. Smith said he believes the declines were even greater for hedge funds, because the data does not include funds that went out of business.

To be sure, there was no crisis last year, despite the stock market decline. But with the economy continuing to soften, some traders say convertible bonds are not as safe an alternative as they once were.

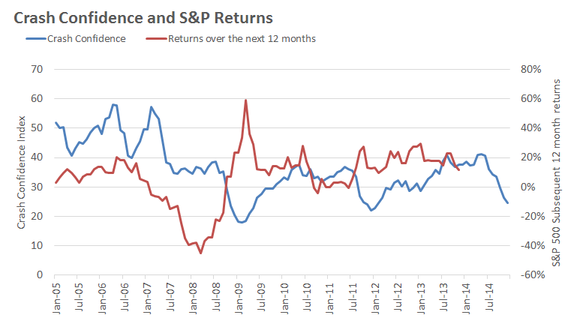

Photo: Jane Buchan of Pacific Alternative Asset Managment said more companies with risky credit were issuing convertible bonds. That could be a problem if defaults rise. (Kim Kulish for The New York Times) Chart: »Convertible Returns» Investors seeking to avoid the falling stock market have earned impressive returns in hedge funds that invest in convertible bonds. Graph shows the Credit Suisse First Boston Tremont convertible bond hedge fund Index and the S. & P. Index for the year. (Source: Tremont Parnters)