Vertical Credit Spread A beautiful strategy for the income traders

Post on: 13 Апрель, 2015 No Comment

by OptionPundit on January 29, 2007

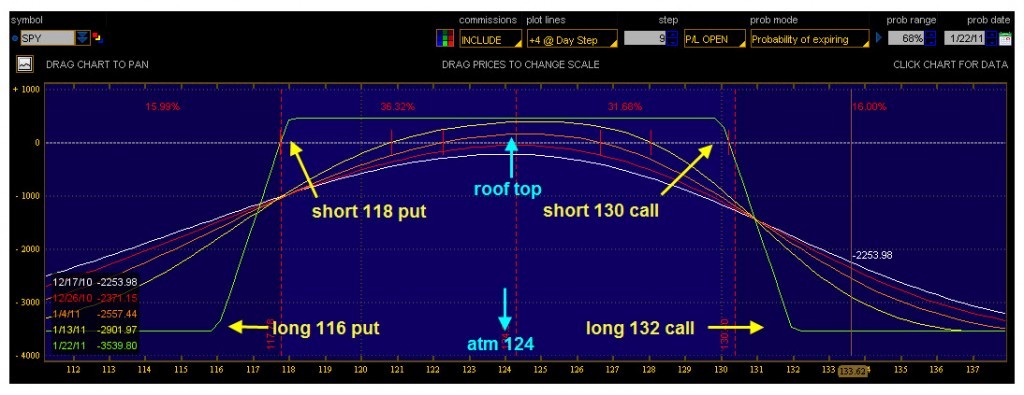

When looking for benefiting from theta in combination to speculating on a stocks direction, you may want to hedge your predictions and that’s where vertical spreads are very useful. These can be done for a debit or credit. Once one understands how vertical spread works, one will notice what a wonderful trading strategy it is. In this article, I am going to focus on vertical credit spread. Later I shall talk about, how one can construct some other wonderful strategies just by looking at various alterations of vertical credit spread.

What is a Vertical Credit Spread: An option trading strategy which includes the sale of a closer-to-the-money option (higher-priced) with the purchase of a further out-of-the-money option (lower-priced) with the same expiration date on a one-to-one basis.

What does it mean: Bullish credit spread will use short put verticals, which is buying an option at a lower strike price and selling an option at a higher strike price. Bearish spread will use short call verticals, which is selling an option at a lower strike price and buying an option at a higher strike price. You profit when the stock either does not move at all, or moves in the correct predicted direction. This options trading strategy is a perfect limited risk/limited return technique for traders looking to take advantage of strong support or resistance points on the underlying stock and overpriced option premiums. The advantage of using vertical spreads is defined-risk, risk-based reduction of buying power, tight markets for liquidity and good executions, as well as easy to understand breakeven points.

In a variety of market conditions, from relatively low to high volatility, and from strongly trending to range-bound prices, verticals are extremely attractive as a low cost alternative to buying and selling individual options.

EXAMPLE: Take a look at what the order looks like on a Vertical Credit Spread on the stock PCP where I bought 1 put option with a strike of 80 and sold 1 put option with a strike of 85. The result is a complete trade that gives me a 1.25/contract ($125) CREDIT to my account (for each contract I choose to do).

The price of PCP at the time of this trade was around $86. I need to consider one key point here, and that is margin, which is defined as “Difference between strikes minus credit received”. In this example it is $85-$80-$1.25 = $3.75. If by Feb 17, PCP remains above $85, I will keep all the credit and my returns will be $125/$375 i.e. 33.3%. My breakeven point is 85-1.25=83.75 and if it falls below $80, I will have max loss of $3.75 per contract on expiration day.

Here is the chart that explains it little more:

The price of PCP at the time of this trade was around $86. I need to consider one key point here, and that is margin, which is defined as “Difference between strikes minus credit received”. In this example it is $85-$80-$1.25 = $3.75. If by Feb 17, PCP remains above $85, I will keep all the credit and my returns will be $125/$375 i.e. 33.3%. My breakeven point is 85-1.25=83.75 and if it falls below $80, I will have max loss of $3.75 per contract on expiration day.Here is the chart that explains it little more:

As with any strategy, run a thorough rish/reward analysis and assess if you are comfotable with the trade and know how to adjust when things go against you. Hope you enjoyed reading this. Do write your comments. In the next article on credit spread I shall share how can this be altered to create ven other winning strategies.

Porfitable trading, OptionPundit