Variable Annuity Alternatives Compare Alternative Variable Annuity Investment Options

Post on: 17 Май, 2015 No Comment

An Overview

- Fixed Annuities

- Equity Indexed Annuities

Variable annuities are one among many retirement planning instruments. And, because your variable annuity portfolio can potentially decrease in value, it’s recommended to disperse your savings across several investment types. If variable annuities seem too risky, consider fixed or equity-indexed annuities. If you’re looking for a non-annuity alternative, consider mutual funds, the stock market, a 401(k), a money market account, CDs, or bonds and treasuries.

Fixed Annuities

- Guaranteed Rate

- Can’t lose capital

- Low liquidity; withdrawal fees

- Tax-deferred

- Ideal retirement instrument

A fixed annuity is an interest-based contract issued and backed by an insurance company that locks in a yearly rate of return for a one-time lump-sum fee. Future rates are pre-determined at contract signing, typically ranging from 3-8% depending on the length of term. A 10% tax-penalty is levied against income withdrawals before the age of 59.5.

Fixed annuities offer two key advantages over the variable type. Firstly, they guarantee rates of return, allowing you to know exactly how much money you’ll have at a future date. Secondly, they can’t depreciate in value, making your investment immune to market turmoil. As far as retirement planning goes, these two features make fixed annuities highly desirable.

The prime disadvantage of fixed annuities is low growth at least in relation to equity-based instruments like stocks or variable annuities. For more info, see the Fixed Annuity Guide .

Equity Indexed Annuities

- Index investing with no downside

- Minimum yield of 2-3%; variable maximum yield

- Low liquidity; withdrawal fees

- Tax-deferred

- Secure retirement instrument

Indexed annuities are contracts that invest money in a market index like the S&P 500 and offer a safety-net minimum rate in exchange sharing profits with the insurance company. When the market index rises, the insurance company takes a portion of your profits (up to 60%). When the market index falls, insurance company takes the lose and pays out a minimum rate of 1-3%.

Index annuities are a fixed/variable annuity hybrid. They offer a chance at equity-like growth with reduced downside. If you worry that a variable annuity can lose you money over the short term, an equity index annuity might the ideal alternative.

Mutual Funds

- Moderate growth/ moderate risk

- Variable return with potential for capital loss

- Low Liquidity; withdrawal fees

- Taxed annually as ordinary income

- Suitable for retirement planning

Mutual funds are the closest analogue to variable annuities. The invested money goes to a brokerage house that spreads it across a wide assortment of asset classes, from stocks to bonds to treasuries. Annual returns mirror the performance of the chosen investments and can become negative in a bad economic climate. A management fees is in the range of 1-3% is charged by the brokerage house managing your portfolio.

For retirees, mutual funds are poor alternatives to variable annuities because they offer the same growth potential with fewer features and no tax benefits. Mutual funds offer a single advantage to younger investors: no 10% tax penalty when withdrawing income prior to the age of 59.5.

Stock Market

- Highest growth/ highest risk

- 14% average yield (long-term)

- High Liquidity; very low fees

- Capital gains tax benefits

- Unsuitable retirement instrument

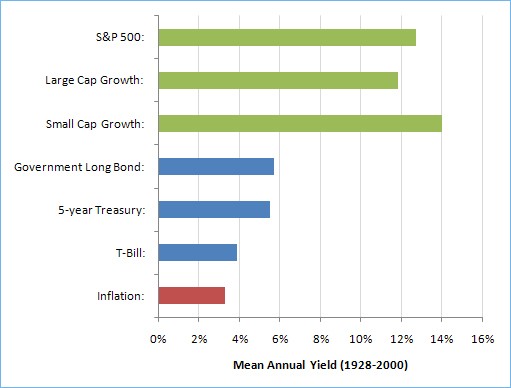

Straight-up stock investment is always an option. Stocks offer the highest growth potential of any investment, but come with the greatest risk. Over the very long term, stocks outperform all other investments, with an average yield of 14%+.

While the stock market is great for bonus investment, and some risk can be mitigated with a balanced portfolio, it is not an advisable retirement saving instrument. Older investors who have already accumulated wealth cannot afford the volatility of the stock market and should seek to preserve their capital with secure holdings like bonds, treasuries, and annuities.

Don’t Just Shop, Implement a Solid Retirement Strategy

Purchasing an annuity is a big decision. Online research is a good start, but prudent investors should discuss all their options and risks with an independent financial advisor. Request a free, no-obligation consultation today, along with a report of current rates on brand-name annuities.

(limited time offer)

401(k)

- Starting point of any retirement plan

- 7% average yield

- Very low liquidity with penalties

- Designed for pre-retirement investing

A 401(k) is a retirement account established through an employer. Employees typically deposit a small portion of their monthly paycheck into the 401(k) over their entire career, eventually amassing a hefty retirement savings. Money in the 401(k) is invested in bonds and low-risk equities, depending on the chosen portfolio options.

A 401(k) is an excellent retirement savings vehicle, especially because employers often match the employee’s contribution. They’re also tax-deferred, like annuities. While a necessary component of any retirement plan, the 401(k) is often not always enough. 401(k) contributions are limited by law, and a 401(k) is designed for young, pre-retirement investors.

Money Market

- Ideal as a savings account

- 2-4% yield

- High liquidity with no fees

- Suitable for pre- and post- retirement

- Very secure, but offers little growth

A money market is a high interest savings account run by a bank or brokerage house. Money markets are secure, FDIC insured, completely liquid, and offer interest rates in the range of 2-4% substantially higher than ordinary savings accounts. Money markets offer lower interest than CDs and annuities. Moreover, that interest fluctuates daily based on Federal rates.

Money market accounts have moderate minimum balance requirements ($1000+) and may limit withdrawals to several times a month. Even so, they are considered completely liquid, with no withdrawal limits or penalty fees. Money market accounts allow further investments to be made throughout their lifetime and never expire.

CDs

- Similar to, but outmatched by annuities

- 2-5% yield

- Low liquidity; withdrawal fees

- Not tax deferred

- Secure retirement instrument

A certificate of deposit is a bank contract that locks in a fixed interest rate for a period of 1-5 years. At the end of the term, the initial deposit + interest is returned in one lump payout. Interest rates on CDs range from 2-5% and depend primarily on Federal rates. The bank earns money on a CD by re-investing your up-front deposit in higher-yielding government bonds and treasuries, and low-risk equities.

CDs are safe, guaranteed, offer moderate growth with marginal liquidity, and are easy to set up; they’re taxed at ordinary rates and feature no tax deferral benefits. Similar in many respects to fixed annuities, CDs are a preferred choice for younger investors, who would incur tax penalties when withdrawing from annuities.

Bonds / Treasuries

- Low, secure growth

- 2-4% yield

- Low liquidity; withdrawal penalties

- Ideal retirement instrument

Bonds and treasuries are government or corporate loan contracts, like high-quality mortgages and federal promissory notes. Bonds backed by stable institutions like the U.S. government are very secure, but offer low interest rates, at 2-4%. Treasures come with short, medium, or long terms, but generally have low liquidity.

Bonds are the ideal retirement savings instrument. As you get older, approaching retirement, more and more of your assets should be transferred from high-growth / high-risk investments, like stocks, to bonds.

401(k) / IRA

- Starting point of any retirement plan

- 7% average yield

- Very low liquidity with penalties

- Designed for pre-retirement investing

A 401(k) is a retirement account established through an employer. Employees typically despot a small portion of their monthly paycheck into the 401(k) over their entire career, eventually amassing a hefty retirement savings. Money in the 401(k) is invested in bonds and low-risk equities, depending on the chosen portfolio options.

A 401(k) or IRA is an excellent retirement savings vehicle, especially because employers often match the employee’s contribution. They’re also tax-deferred, like annuities. The 401(k) or IRA serves as the foundation of any retirement plan. If you’re employed, strive to match your employer’s matching limit. If you don’t have access to a 401(k) through your employer, open an IRA and make steady monthly deposit.

Although a core component of any retirement plan, the 401(k) is often not enough. If you’re looking for a comfortable retirement is a health reserve of discretionary income for travel and hobbies, an annuity can make up for the difference. It’s important to note that your savings is not guaranteed against loss in a 401(k) or IRA as it would be in an index annuity.

Can a variable annuity make the difference between a basic or dream retirement? Determine for yourself, Request an Actual Prospectus .