Vanguard Personal Advisor Services Review Low Cost Managed Portfolio and Guidance

Post on: 24 Июнь, 2015 No Comment

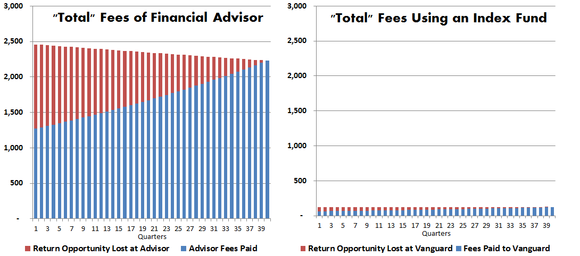

Many people hire a financial advisor because they arent comfortable investing on their own, and they appreciate having an experienced person to talk to whenever they have any questions. However, this usually means paying at least 1% of your portfolio assets every year to that person. Especially given the current low interest rate environment, 1% is a huge number and could eat up a large percentage of future returns.

Vanguard has recently rolled out a new product called Vanguard Personal Advisor Services (PAS) where someone will work with you to create a financial plan, implement your portfolio for you, and be available to update and discuss that plan as needed. The minimum asset size is $100,000 and the cost is 0.3% of assets annually, which is much lower than the industry standard. As a DIY investor, I was interested in this service for my spouse in case I am somehow incapacitated one day. Here are my findings based on calling in as a customer to three different Vanguard reps and various online sources*. Anything quoted below is taken directly from this detailed Vanguard brochure [pdf].

Qualifications. You must have a minimum of $100,000 of investable cash or securities. Eligible accounts include individual accounts (including IRAs), joint accounts, and certain trust accounts. Note that 401(k) plan assets are not included.

Fees and costs. Vanguard PAS will charge you 30 basis points (0.30%) annually. Fees will be calculated quarterly and based on your average daily balance the prior calendar quarter. The fee will be calculated across all securities in the portfolio, with the exception of money market fund positions. This does not include the underlying expense ratios of any mutual funds or ETFs that you may own in the portfolio.

Annual Financial Plan and Personal Review. First, Vanguard will gather information from you via an online questionnaire (and telephone discussion if needed) in order to understand your financial objectives, such as your age, specific financial goals, investment time horizon, current investments, tax status, other assets and sources of income, investment preferences, planned spending from the Portfolio, and your willingness to assume risk with the cash and securities being invested in the Portfolio. They will focus on your specific goals, which can include planning for college, saving for a home, establishing a rainy-day fund, or saving for retirement. They will take into account things like Social Security, pensions, IRAs, 401(k) plans, and other investment accounts held outside of Vanguard.

Vanguard PAS will then create a draft financial plan for you based on this information, which you will discuss with a Certified Financial Planner (CFP) to finalize and approve. At least annually, your advisor will schedule another phone conference with you to see if there have been any changes in your financial situation, other assets or sources of income, investment time horizon, investment objectives, planned spending from the Portfolio, or desired reasonable restrictions that may require a new Financial Plan to be approved.

(Side note: There is a separate Vanguard Financial Plan product that is similar to the plan part of this service, but you must implement the recommended portfolio yourself and it is a one-time consultation. The recommended portfolio for both products should very similar if not identical. The cost is $1,000 for those with under $50k in combined assets at Vanguard, $250 for $50k-$500k in assets, and free for over $500k in assets. The Finance Buff got one and did a review .)

Portfolio construction and Investment methodology. Their investment methodology incorporates Vanguards company values of advocating low costs, diversification, and indexing. As a result, recommended portfolios will mostly include Vanguards broad index funds and/or ETFs. They can and will take into account your existing positions or special requests, as long as they meet certain standards. Taken from their brochure:

The recommendations made by VAI in connection with the Service will normally be limited to allocations in Vanguard Funds and will generally not include recommendations to invest in individual securities or bonds, CDs, options, derivatives, annuities, third-party mutual funds, closed-end funds, unit investment trusts, partnerships, or other non-Vanguard securities, although you may be able to impose reasonable restrictions upon our investment strategy.

They will work to maximize after-tax return. They will not attempt to predict which investments will provide superior performance at any given time. No market timing here.

Quarterly portfolio review and rebalancing. Each quarter (with timing determined by your contract anniversary date), they will review your portfolio. If your portfolio asset allocation deviates from the target asset allocation by more than 5% in any asset class, they will rebalance your portfolio by buying and selling the appropriate funds. There is a prescribed fund hierarchy in order to do this will minimal tax impact.

Ongoing contact and advice. At any time, you can contact a Vanguard PAS advisor to talk about your financial plan. There are no set limits on how many times you can contact them. I was told that if you have $100,000 to $500,000 in assets, you will be directed to a team pool of CFP advisors. If you have 500k or higher, you will be assigned a specific person to be your advisor. Of course that person may change from time to time if they switch jobs, etc.

No DIY Trading! You are not allowed to make any trades yourself in any portfolio managed by VPAS. You must call your Vanguard advisor and discuss and proposed changes for them to execute. Online trading will be disabled in your account. This may be weird for long-time DIY investors.

In your Service Agreement, you’ll agree not to purchase or sell securities in your Portfolio while enrolled in the Service, and you’ll be blocked from such activity until you terminate the Service. You’ll also be prohibited from establishing or maintaining other services on any accounts in the Portfolio, including but not limited to checkwriting and automatic trading services (such as automatic investment/withdrawal/exchange) and setting required minimum distribution (RMD) payments. Other account transactions or services may be restricted or unavailable through the web experience, but can be processed or enabled with the assistance of your advisor.

Recap and Commentary

This is a managed portfolio product. That means that they will determine a low-cost portfolio of Vanguard funds (mostly index) based on your specific needs, implement it for you, and provide ongoing advice and adjustments as needed. Everything will be done through a Vanguard representative, not with the click of your mouse. Such guidance will ideally help you handle your emotions when it comes to investing, as there will be someone to help you keep following your plan during both up and down markets. There will be someone to talk with whenever you have any life changes or additional questions.

0.30% of $100,000 is only $300 a year, making this quite a bargain at that level. At much higher asset sizes, I would prefer switch to a flat fee as paying $5,000 or more every year starts to feel a bit steep. I would say that if you have under $100,000, dont fret and just buy a Vanguard Target Retirement Fund as that is essentially a simple managed portfolio.

After doing my research, my new suggestion to my wife is to pay for Vanguard Personal Advisor services if I am unable to manage our investments. She is brilliant but lacks the interest (and time if Im gone with our kids and all) to do it on her own and I trust Vanguard to do a fine job. The reasonable fees, ability to keep my assets at Vanguard, and assigned human advisor make it better in my opinion than any other robo-advisor option. Still, I hope she never has to sign up.