Value Line Could Have Been Morningstar (VALU MORN)

Post on: 15 Сентябрь, 2015 No Comment

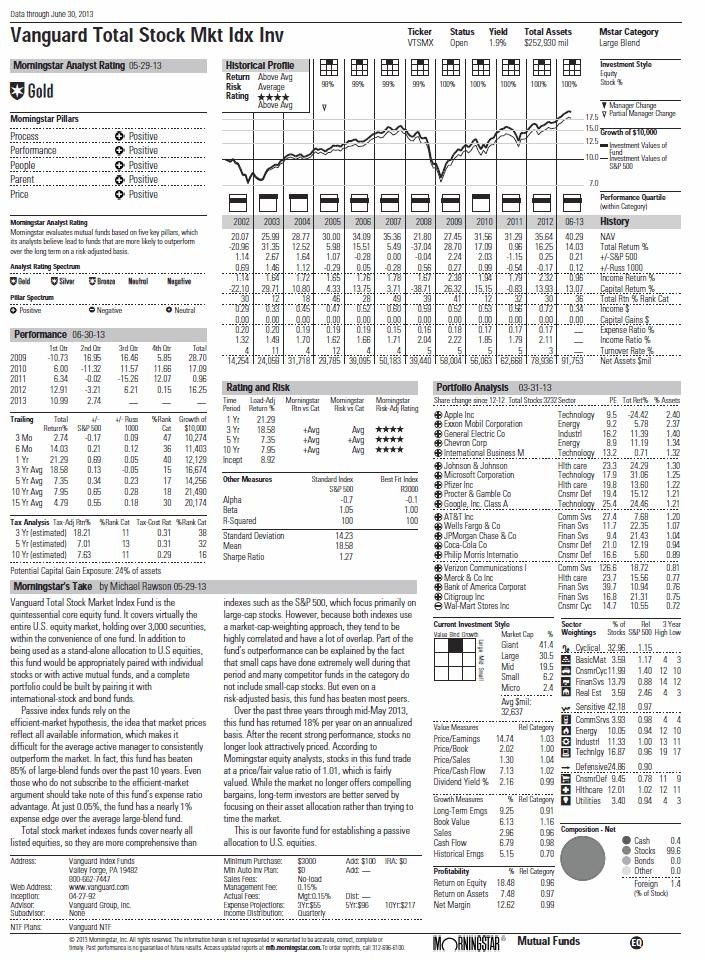

As a matter of fact, Value Line (VALU ) was Morningstar Inc. (MORN ). Founded in 1931 by Arnold Bernhard, Value Line was one of the premier investment research firms in the country, selling the Value Line Investment Survey and spin-offs to everyone from high-end individual investors to mutual funds and institutions. The flagship product still covers 1,700 stocks every week.

In Value Line’s fiscal third quarter, which ended January 31, the company had revenues of $21 million, little changed from a year earlier. For the nine month period, revenues were $63.5 million, little changed from a year earlier. For fiscal Q3 net income rose to $6.7 million for $4.7 million, but for the nine months the change was more modest rising to $17.7 million from $16.4 million last year.

Breaking down the top line, $12 million came from Value Line publications in Q3. Investment management fees for funds that Value Line manages were $8.2 million. Neither line-item moved much from the year before. License fees were small, and rounded out the revenue.

Over the years, Value Line has expanded its services to include mutual fund surveys, options and convertibles data, and a number of institutional products. Corporate and pension funds use Value Line Asset Management and the company earns fees from managing over $3 billion dollars, according to their 10K.

The company has a market cap of $360 million.

Let’s turn to Morningstar for the purposes of a contrast. The company is much younger, and later to the investment advisory business, having been founded in 1984. Like Value Line, the company also markets stock, fund and exchange traded fund advisory services for individuals, investment advisors, and institutions.

For the year 2005, Morningstar did $227 million, up from $180 million in 2004. Year-over-year growth of its premium memberships and advisor workstations has been impressive. The company also has an investment consulting business and acts as a registered investment advisor for institutions.

Morningstar has a market capitalization of $1.7 billion and since its IPO less than a year ago the stock has gone from just over $18 to $42. Value Line’s stock hit $43 earlier this year and now trades at $36.

This is a great case study of the first guy in the market getting his lunch eaten by an aggressive newcomer. In 2001, Morningstar was losing money on revenue of $91 million, about what the Value Line annual revenue run rate is now. But Value Line’s multi-decade head start did not do it much good. Morningstar had operating income of over $46 million in 2005, and there is strong evidence that the number will keep growing.

Value Line’s revenues in 2001 were over $98 million, and they have not managed to get back to that number since then.

When Arnold Bernhard died, his daughter, Jean Buttner, took over as CEO. She has done little to distinguish herself. Certainly, she has taken a company with the clear lead in an important segment of the investment market and let the world pass Value Line by.

VALU vs. MORN: Post MORN IPO Performance

Douglas A. McIntyre is the former Editor-in-Chief and Publisher of Financial World where Value Line was a regular advertiser. He has also been the president of Switchboard.com which was the 10th most visited website in the world at the time, according to MediaMetrix. He has been chief executive of On2 Technologies, Inc. and FutureSource, LLC. In the past, he as served on the boards of TheStreet.com and Edgar Online. He does not own securities in the companies he writes about.