Using Volatility as an Investment Hedge

Post on: 16 Март, 2015 No Comment

Using Volatility as an Investment Hedge

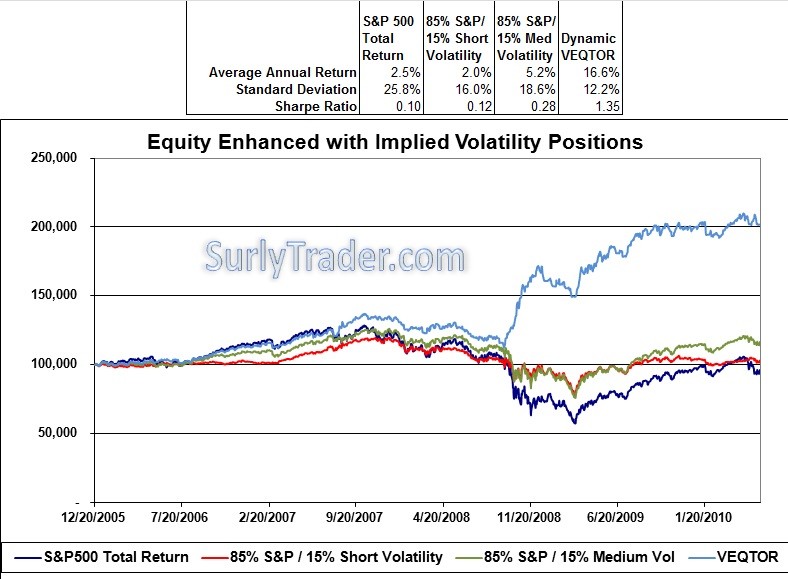

The past fifteen years have been a very volatile time for the stock market. Not only has the market had large corrections and bear markets it has also had huge rallies and bull markets. These swings have made and broken many portfolios. An investor can limit the violent swings in their portfolio by implementing a hedging strategy designed to limit downside losses. With the explosion of ETFs over the past few years there are now several investment vehicles that can be used as a hedge against extensive declines in the stock market. One method that is gaining popularity among investors is volatility.

The most common measure of volatility is the CBOE S&P 500 Volatility Index (VIX). When an investor buys a VIX future or option they are placing a bet that the variance or deviation in the price of the S&P 500 Index (SPX) will increase at some point in the future. Basically it is a bet that the market will experience large price swings. When the stock market declines sharply volatility (VIX) rises. This makes volatility a good instrument to use as a hedge against downside risk if it is applied at the correct time.

Timing is critical in using volatility because it moves very quickly and often suffers losses when the market is rising. A relatively new exchange traded note (ETN) that attempts to negate the losses incurred when volatility is held is iPath® S&P 500 Dynamic VIX ETN (XVZ) . XVZ dynamically changes its allocation between near term and medium term volatility depending on the ratio between VIX and the CBOE S&P 500 3 Month Volatility Index (VXV). The fund goes short in near term volatility and long in medium term volatility when the ratio is low. It increases its exposure to medium and short term volatility as the ratio rises. The underlying theory is: when near term volatility is higher than medium term volatility it signals investors are fearful of an immediate decline in the stock market. Vance Harwood at Six Figure Investing has done an in depth profile of the XVZ portfolio allocations that we found informative.

XVZ has not performed well over the past several months which highlights the importance of only using volatility as a hedge during times of high risk for the stock market. Downside Hedge has developed a Stock Market Risk Indicator that performed well in a back test when used as a signal for hedging a portfolio with XVZ.

The results in the chart above were achieved by by being long the S&P 500 Index when risk was low and applying a 50% hedge with XVZ when our market risk indicator signaled. Please note we used Vance Harwoods back calculation data for XVZ for our back test.

Here is an update that contains information and a performance chart for the hedge through 12/31/2013 .

In addition, heres another post that shows the performance of varying levels of a hedge and also different time periods so you can see more clearly how it performed in different market conditions.