Using the Commitment of Traders Report From the CFTC to Trade Forex Broker News and Reviews

Post on: 30 Май, 2015 No Comment

Using the Commitment of Traders Report From the CFTC to Trade Reviewed by ForexNewsNow on Sep 22 Rating: Read about how to employ the Commitment of Traders (COT) report released weekly by the CFTC as a trading tool when establishing forex positions in an online trading account.

ForexNewsNow – Due to its global and largely unregulated nature, the forex market lacks a true indicator for its overall trading volume. This can be a disadvantage for technical traders who prefer to have confirmation from a volume indicator before taking a position on a chart pattern breakout, for example.

As a result, some of the best forex trader strategies will look to other forex volume indicators, such as the currency futures trading volume figures released by the Chicago International Monetary Market or IMM; exchange traded currency options open interest and put/call ratios; and the Commitment of Traders or COT report that the Commodities Futures Trading Commission or CFTC releases on a weekly basis.

The following sections will discuss the latter COT report, including what it contains, how to read it and how to use it as an indicator when establishing forex positions in an online trading account .

What the COT Report Contains

The COT report for currency futures comes out each Friday and is posted on the CFTC’s website. It contains a variety of data for the previous week that can be useful to forex traders taking a longer term perspective.

For example, it shows open interest data that reflects how many open futures contracts currently exist between traders. In addition, the report includes non-reportable positions in currency pairs that are typically held by smaller speculators, as well as the volume of spread trades which involve holding both long and short futures positions.

The COT report also shows reportable positions which are held by major trading firms that are required to report their positions to the CFTC. Their trading decisions are usually well informed by various forms of analysis and so reflect an educated market view. Reportable positions can either be commercial in nature where the company trading them has a need for the underlying currency pair, or they can be non-commercial where the holder is simply speculating on exchange rate movements.

Overall, the COT report gives the percentage of long or short contracts relative to the total contracts for each category, the number of traders in each category, and open interest changes compared with the previous period reported.

Using the Commitment of Traders Report as a Volume Indicator

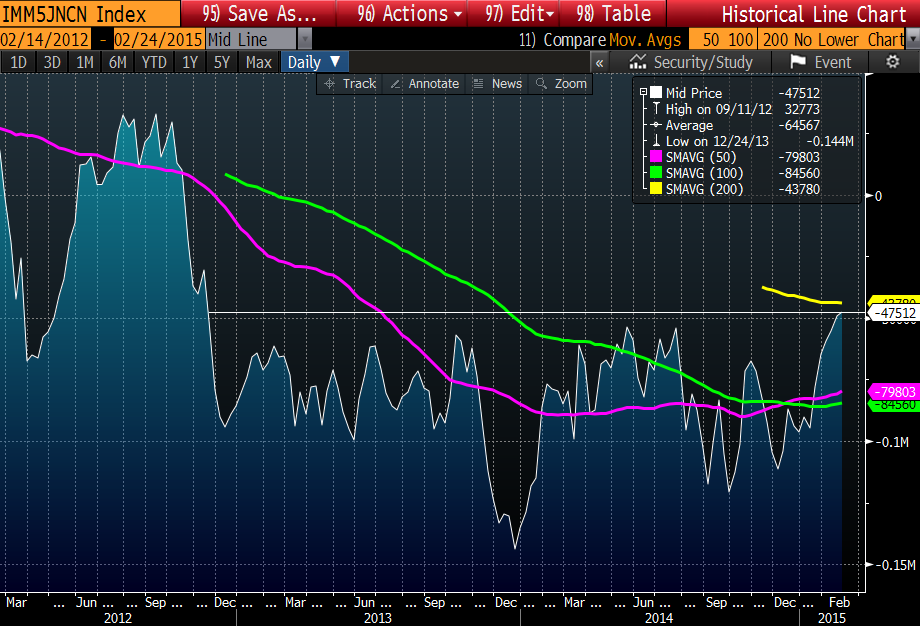

Although primarily useful only as a long term volume indicator due to its lagged release, the COT report can give some of its best online trading results when used along with technical chart analysis in medium to long term trading strategies.

Typically, the best forex trader strategies involving the COT report will involve the observation of a technical signal such as a chart pattern breakout on a medium or long term chart for a currency pair. This trading signal is then either confirmed by increasing open interest reflected in the COT report, or it is not confirmed if COT open interest stays steady or falls. Such traders will then establish positions in their online trading account only when their chart analysis of a breakout is confirmed by the COT report.

Using the Commitment of Traders Report as a Reversal Indicator

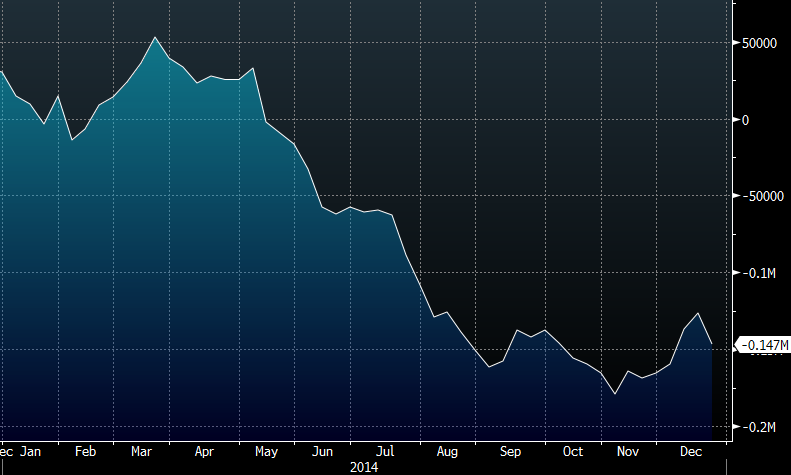

The COT report can also be used by technical traders to signal potential forex market reversals. This could involve a trader observing whether the overall non-commercial positions are long or short in a currency pair and then watching for shifts to indicate a reversal in speculator sentiment.

For example, suppose that the COT report for last week showed that more non-commercial positions for the Pound Sterling were long than short, say by a ratio of 40% long to 20% short. If the COT report for the current week then shows that more non-commercial positions for the Pound Sterling were now short versus long, say by a ratio of 32% short versus 28% long, this would indicate a reversal in speculator sentiment.

Such a sentiment reversal could give an observant trader a signal to sell the Pound Sterling in their online trading account .