Using Stock Options To Hedge Your Long Positions

Post on: 16 Март, 2015 No Comment

What is Hedging?

Hedging in is a term used to describe an action that is taken to protect your current investment against loss through a price movement that would outcome your profits negatively.

Introduction to Hedging

Hedging is a very important tool for professional stock traders, especially investors. This may be one of the key tools that enables stock traders to carry on year after year. The word Hedging comes from the financial term to Hedge, which refers to a technique used to reduce financial risk.

Actually, Hedging is something that people do in day to day life as well, not only in the stock market. We buy home insurance and health insurance to protect ourselves. Lawyers purchase legal liability insurance for themselves to protect themselves from lawsuits.

How is Hedging performed by Traders?

The simplest way to Hedge a stock would be to buy a stock that would rise just as much as the one youre holding would fall. For example, if you were holding a bullish ETF like TNA, then to Hedge Ithat investment you would also buy a bearish ETF like TZA. In theory this would mean that if TNA dropped 5%, TZA would then rise 5%, therefore Hedging your investment.

In reality however, it is near impossible to find a pair of stocks that move identically in opposite directions.

That is why derivatives like stock options are the most commonly used for of Hedging used today. The most common of these would be the Protective Put or Married Put option trading strategy.

With this strategy the stock trader buys 1 put option contract for every 100 shares of the given stock that he owns. Put options rise more or less $1 for every $1 drop that the underlying stock experiences, therefore hedging against any potential loss by the stock. Buying puts can be considered buying insurance in this case, as they cost much less that buying into the stock (or shorting it for that matter), and you usually hope not to need to exercise it.

Hedging Stocks Using Stock Options

Once you understand the basics, hedging your portfolio of stocks can be quite straigh forward using stock options. Here are a few of the more popular methods:

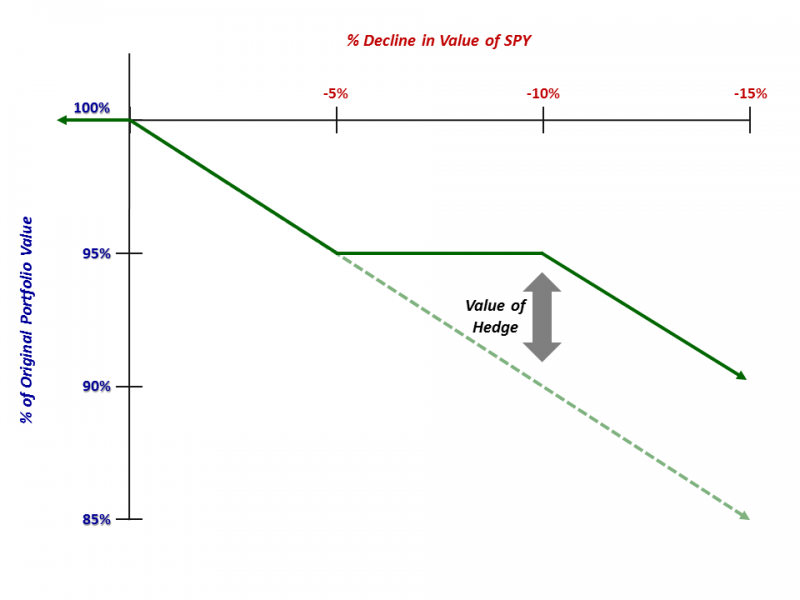

Protective Puts. Using put options to hedging against a drop in the underlying stock. Should the stock suffer a drop in price, the gain of the put options would offset any loss incurred on the stock.

Covered Calls:Â This option should only be used by experienced traders. It entails selling call options at a premium price to hedge against a small drop in the underlying stock. The premium recieved from the sale of call options would then serve to help buffer against a drop in the underlying stock.

Covered Call Collar: This method involves a mixture of the above two strategies. It entails buying put options to hedge against a drop in the underlying stock, while also selling call options in order to further increase profitability. This strategy is less balanced than the previous two and involves more risk. Therefore, it is recommended to use this strategy only after gaining experience in practicing the previous two.

Factors Influencing Options Trading Hedging

There are four main forms of risks, also known as the Option Greeks, that any options trader needs to take into account when using stock options to hedge their portfolio:

Delta Δ : Directional risk

Gamma Γ : Change in directional risk with a change in the stock price

Vega ν : Volatility risk

Theta Θ. Time decay risk

The type of stock option hedging used depends on what the bigger risk is for the portfolio. It could be time decay, a drop in underlying stocks, or other risks. When hedging, the hedge ratio is usually taken into consideration.

How Come Not All Traders Practice Hedging?

Many stock or stock options traders like Santam consider themselves long term investors. These investors typically buy stocks and hold them for a long period of time, riding out all the ups and downs. This type of investing would not benefit from stock options hedging since the stock options would expire a long time before the investor plans on selling, especially if the stocks are planned to be held for a period of 10-20 years.

Sometimes, the cost of hedging also simply isnt justified compared to the risk in the portfolio