Using butterfly options spreads to profit on nonfarm payrolls

Post on: 12 Июль, 2015 No Comment

There are many different ways a trader can trade around the all-important unemployment number. However, most strategies would require a trader to take on a large amount of risk compared to the potential reward. Is there a way for a trader to trade the unemployment number, or any number for that matter, with a consistent set up and great risk vs. reward profile? The answer is yes, and the name of this options strategy is the long butterfly.

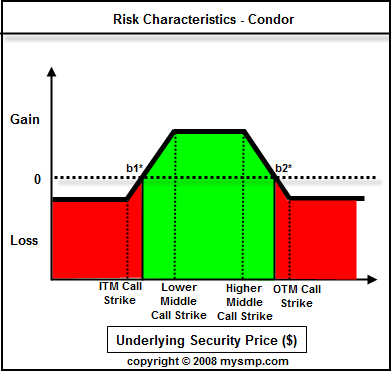

Butterflies can be set up using either calls or puts allowing a trader to take a bearish, bullish, or neutral view of the market. A complex trade, the butterfly is constructed using 3 different options and is profitable within a range. Butterflies can be used to trade catalyst events like unemployment, crop reports, crude inventories or any other market event. The nature of butterflies allows a trader to set up trades with extremely large profit potential with a small amount of risk. With the employment situation tomorrow, there is an opportunity using butterflies in E-mini S&P 500 Futures Options.

Consensus estimates are somewhere around 165K jobs added in February. Wednesdays ADP report showed that 198K jobs were added in February, so the expectation is for tomorrows number to be positive. So now that I know I want a bullish trade the next step is picking a price target.

Looking at the price of at-the-money straddle (price of the calls plus price of the puts) a trader can calculate what the market makers are expecting the move to be by expiration. ES weekly options expire on March 8, so these are the options I want to look at. With the futures trading around 1540 I want to look at the 1540 straddle. The straddle costs around 10 points. A trader can then add this price to 1540 or subtract it and arrive at an upside or downside target. Because I am bullish, my upside target is 1550.

Now I can look at a trade. I want to center the butterfly on the upside target because this is where the trade will profit the most. The trade I want to look at is the 1545-1550-1555 call butterfly. This trade involves simultaneously buying the 1545 calls, selling 2 1550 calls and buying a 1555 call.

Lets breakdown this trade.

Trade: Buying the ES Mar 8 th 1545-1550-1555 Call Butterfly for $0.80

Risk: $40 per 1 lot

Reward: $210 per 1 lot

Breakeven: 1545.80 and 1554.20

Click to enlarge.

As shown above, this trade sets up for a great risk vs. reward profile and allows a trader to speculate on a number or event using the implied move to calculate a price target. This trade gives a trader better than 5-to-1 on their money if the ES futures close at 1550 on tomorrows expiration. The trader also profits anywhere between 1545.80 and 1554.20.