Uses of Stock Options

Post on: 1 Май, 2015 No Comment

As you may already be aware, calls and puts can be used to place bullish or bearish bets on an underlying stock. However, there are several compelling reasons to add stock options to your portfolio, even if youre not trying to target a time-sensitive directional move in the shares. While there are many different uses of stock options, most traders are pursuing one of these three goals:

Speculation. Stock options can be used to speculate on the future price direction of the underlying shares. Traders predicting positive price action may want to buy calls or long call spreads, while puts and put spreads can be used to capitalize on a stocks expected decline.

Whats more, calls and puts can be combined in various configurations including straddles and strangles, for example that allow the trader to benefit from a sharp move in either direction or, for that matter, a period of complete stagnation in the underlying shares.

Whether the stock is expected to move up, down, or sideways, theres a viable option strategy that can be used to profit from that particular scenario.

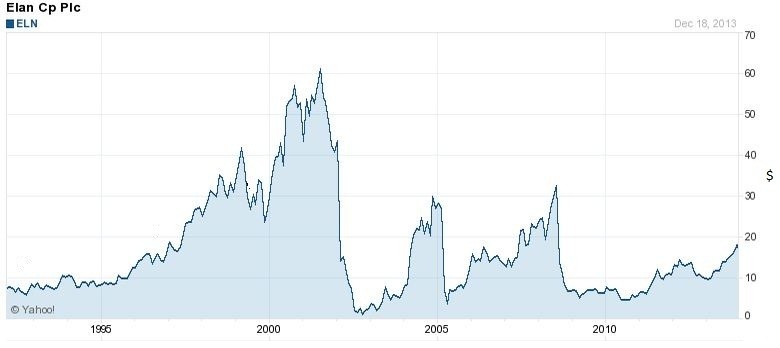

Hedging. Due to their classification as derivatives, options occasionally get a bad rap as risky investing vehicles. However, options are actually a crucial tool in guarding a stock portfolio against the volatile ups and downs in the market.

To cite a popular example, put options can be purchased against existing long stock positions to lock in a favorable exit price on the investment. Depending upon the strike price selected, these protective puts can be used to limit losses, or even to guard some unrealized paper profits. Traders can also hedge their portfolios more broadly by purchasing puts on index-based exchange-traded funds (ETFs), such as the SPDR S&P 500 ETF (SPY) or iShares Russell 2000 Index Fund (IWM).

Inverting this paradigm, short sellers can buy call options to limit their upside risk, or to lock in paper profits on a winning bearish trade.

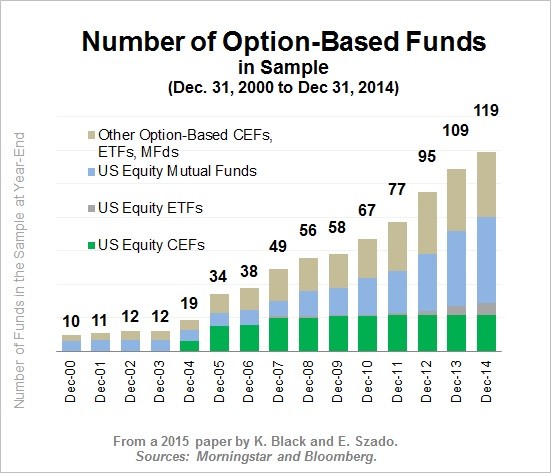

Generating income. During periods of relatively quiet price action, options offer a number of ways to boost your bottom line with premium-collecting strategies. Perhaps the best-known of these is the covered call strategy, wherein an investor sells (or writes) call options against a stock in his portfolio. The sale of the call results in an immediate credit, allowing the trader to profit from an otherwise lifeless equity.

More seasoned investors can use stock options to play credit spreads, which profit from a stocks sideways price trend. These two-legged spreads can be constructed with either puts or calls, with the trader simultaneously selling a higher-priced option and buying a lower-cost option on the same underlying stock. The ultimate goal is for both options to expire worthless, allowing the trader to retain the initial credit received as his or her maximum profit.