United states Retirement Funds Betterment vs Vanguard Life strategy vs Target Retirement

Post on: 22 Июль, 2015 No Comment

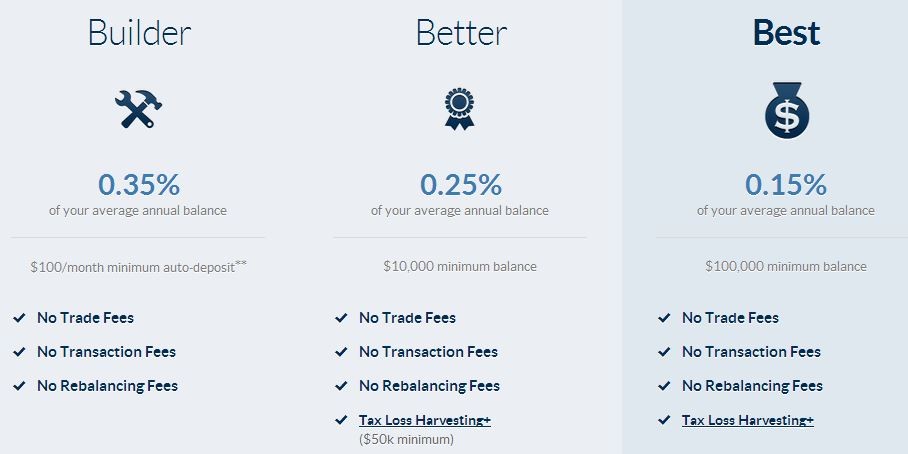

I’m a 20 something grad student and would like to open a hands off retirement account with beta exposure to the market and would make monthly contributions. I’m fairly illiterate when it comes to investing, and the betterment account seems so user friendly. However, I realize it is a more expensive fund. Being that I can do math, I realize these fees add up over time. However, I like that betterment re-balances it self and I really like that it allows one to easily change the allocation of stocks and bonds. I know I said I wanted a hands off account, but what if the stock market crashes and I want to allocate more to bonds. Does Vanguard re-balance and allow you to reallocate?

3 Answers 3

First, congratulations on choosing to invest in low cost passively managed plans. If you choose any one of these options and stick with it, you will already be well ahead of most individual investors.

Almost all plans will allow you to re-balance between asset classes. With some companies, sales agents will encourage you to sell your overweighted assets and buy underweighted assets as this generates brokerage commissions for them, but when you only need to make minor adjustments, you can simply change the allocation of the new money going into your account until you are back to your target weights. Most plans will let you do this for free, and in general, you will only need to do this every few years at most.

I don’t see much reason for you to be in the Target funds. The main feature of these plans is that they gradually shift you to a more conservative asset allocation over time, and are designed to prevent people who are close to retirement from being too aggressive and risking a major loss just before retirement. It’s very likely that at your age, most plans will have very similar recommendations for your allocation, with equities at 80% or more, and this is unlikely to change for the next few decades.

The main benefits of betterment seems to be simplicity and ease of use, but there is one concern I would have for you with betterment. Precisely because it is so easy to tweak your allocation, I’m concerned that you might hurt your long-term results by reacting to short-term market conditions:

I know I said I wanted a hands off account, but what if the stock market crashes and I want to allocate more to bonds.

One of the biggest reasons that stock returns are better than bond returns on average is that you are being paid to accept additional risk, and living with significant ups and downs is part of what it means to be in the stock market. If you are tempted to take money out of an asset class when it has been losing/feels dangerous and put more in when it is winning/feels safe, my concerns is that you will end up buying high and selling low.

I’d recommend taking a look at this article on the emotional cycle of investing. My point is simply that it’s very likely that if you are moving money in and out of stocks based on volatility, you’re much less likely to get the full market return over the long term, and might be better off putting more weight in asset classes with lower volatility.

Either way, I’d recommend taking one or more risk tolerance assessments online and making sure you’re committed to sticking with a long-term plan that doesn’t involve more risk than you can really live with.

I tend to lean toward Vanguard Life Strategy simply because Vanguard as a company has been around longer, but betterment does seem very accessible to a new investor.

Best of luck with your decision!