Understanding VIX futures and options

Post on: 6 Май, 2016 No Comment

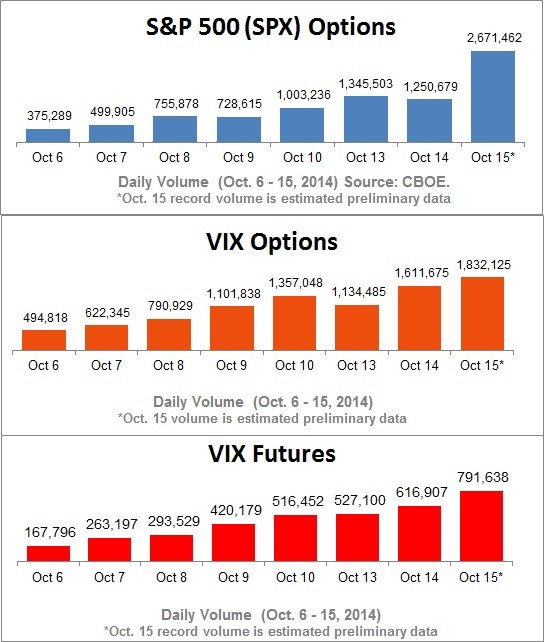

Since the Chicago Board Options Exchange (CBOE) introduced futures and, subsequently, options on its Volatility Index, or VIX. traders have asked why the contracts dont necessarily track the underlying in the same way other equity futures track their indexes. Others may wonder why the put-call parity is violated for VIX options. Then, there are the options that trade underwater, the vastly different implied volatilities for each expiration cycle and the question of arbitrage between S&P 500 derivatives and VIX contracts.

Thankfully, all of these questions can be answered with theoretical research on VIX futures and options pricing and, along the way, can offer guidance to some practical applications of these products. Our findings also apply to recently launched VSTOXX index futures and options listed on Eurex.

While the value of the VIX, which is generally accepted as a broad measure of market volatility, is derived from prices of S&P 500 index options, it is not simply a weighted sum of underlying options (unlike other equity indexes like the S&P 500, where the index is a weighted sum of component prices). The options from which VIX is calculated sum up to the square of VIX, not VIX itself. This non-linear transformation means that you cannot just buy or sell a basket of options whose expiration price equals the index. Because of this non-linear component, there is no way to statically replicate the VIX.

Because the underlying VIX is not tradable, the futures on the VIX are not tied by the usual cost of carry relationship that connects other indexes and index futures. To price the futures that have no tradable underlying, we must follow a statistical approach based on various factors: the distribution of the VIX, the strength of the trend, mean-reversion and volatility. In a sense, VIX futures are much like options, having their own set of Greeks.

Close relationship

The first and most obvious attribute of VIX futures is that their options can be priced off the futures using the Black-Scholes futures options formula. Put-call parity holds and is observed in the market, but it is the put-call parity with the futures contract as the underlying, not the VIX index. In-the-money options do not trade in discount to their intrinsic value when calculated off the futures.

The futures chain forms a curve that connects the current value of the index with its long-term expectation. To simplify: When the VIX is above its long-term mean, the futures chain will likely be in backwardation, and when the VIX is below its long-term mean, the futures chain will likely be in contango. However, the chain does not need to be strictly decreasing or increasing; it can be completely flat, concave, or convex.

The futures and options tend to anticipate moves. If the VIX has made a sharp move up and traders expect it to come down before expiration, futures will trade below the index, and calls will seem relatively cheap. On the other hand, if VIX is low and traders expect the index to revert to some higher level before expiration, futures will trade above the index, and calls will seem relatively expensive. Theoretical models provide quantitative explanation of these features.

The VIX index and futures are connected by a statistical relationship that depends on how fast the VIX tends to move toward its average level, the volatility of the index and how much time is left until expiration. Near expiration, the futures will be close to the index and move in tandem with it, while the long-term futures reflect the long-term expectation of VIX plus risk premium.

VIX futures have a dynamic relationship with the index, just like options are related to their underlying stock by delta. Traders know that VIX futures do not always follow the index. Jacobs (2009) reports 92% correlation, while Standard & Poors (2009) reports an 87% correlation. However, because of the dynamic nature of this relationship, the correlation evolves over time and cannot be quantified with a single number.

Close to expiration, the futures will move right in sync with the index (see Time trials, below). When futures expire in a month (about 25 trading days), the futures will move about half as much as the index. Futures that expire in 125 trading days or more have virtually no correlation to the index. The exact relationship is, of course, dynamic and changes.

The relationship has other intuitive properties. For example, delta gets smaller as the index increases. This is the result of mean-reversion; futures will move up more when the VIX is below its long-term average and less if it is above it. If the parameters indicate that futures are strongly mean-reverting, delta will be smaller because the current level matters less than its long-term level; if mean-reversion is weak, the delta will be greater because futures will be more sensitive to the current index level.