Understanding Bollinger Bands

Post on: 26 Июль, 2015 No Comment

Understanding Bollinger Bands.

by J Victor on March 7th, 2011

What are they?

Introduced by John Bollinger in the 1980s, Bollinger Bands are a pair of trading bands representing an upper and lower trading range for a particular market price. A stock is expected to trade within this upper and lower limit as each band or line represents the predictable range on either side of the moving average. Generally, 80-85% of the price action happens within these bands. All trading softwares will have options to display Bollinger bands.

Bollinger Bands consist of a set of three lines drawn in relation to securities prices. The middle line is a measure of the intermediate-term trend, usually a simple moving average that serves as the base for the upper band and lower band. The interval between the upper and lower bands and the middle band is determined by volatility. The purpose of Bollinger Bands is to provide a relative definition of high and low. By definition, prices are high at the upper band and low at the lower band.

Why use them?

Finds support and resistance levels: The upper band usually indicates a resistance level while the lower band usually indicates a support level. If you take a close look at any Bollinger band, you will find that the price usually bounce off the Bollinger band whenever it touches the upper or lower band. With this observation, you can use the upper and lower bands as support and resistance when planning your trade.

Helps to find where to Enter and Exit: Bollinger Bands can be very useful trading tools, particularly in determining when to enter and exit a market position. For example: entering a market position when the price is midway between the bands with no apparent trend, is not a good idea. Generally when a price touches one band, it switches direction and moves the whole way across to the price level on the opposing band. If a price breaks out of the trading bands, then generally the directional trend prevails and the bands will widen accordingly.

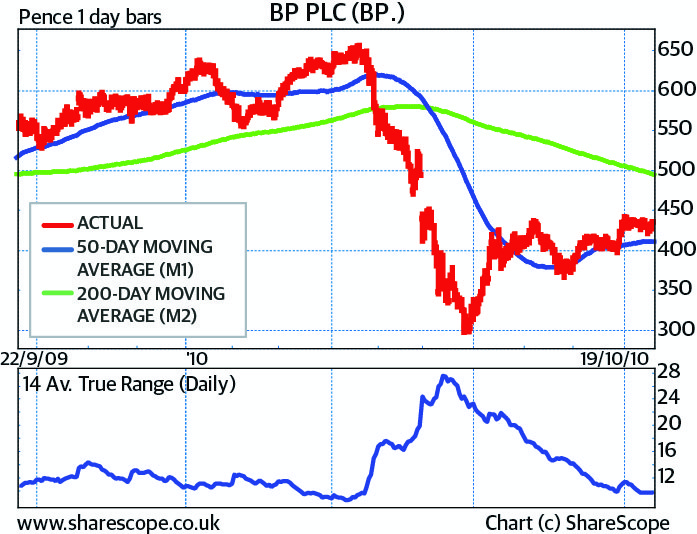

Gauges volatility: The Bollinger Band is an indicator that helps you to measure the volatility of the market. It can tell you the current situation of the market by using its upper and lower band. Whenever the market has low volatility, the bands will be narrow and whenever the market has high volatility, the bands will be wide.

Shows Breakouts —one of the lesser known uses of Bollinger bands is the prediction for breakouts or gaps. As the bands squeeze a share price, the price range grows very narrow. Some trading systems identify that this is a prime time for the price to breakout of this range. Usually a large price gap is the result. The difficulty is to know the direction of the price breakout.

You may like these posts: