Ultrashort Term Bond Funds

Post on: 16 Март, 2015 No Comment

U ltrashort term bond funds (not to be confused with shorting ) are mutual funds that include government bonds, corporate bonds, and mortgage-backed securities. As seen before, bonds offer fixed income with maturities varying from a few months to several years.

The ultrashort bonds have short maturity periods ranging from a few months to a year, thereby making them less sensitive to interest rate changes. So, are ultrashort bonds a solution to park cash needed in the short-term? Are the risks worth it? Lets find out.

Ultrashort Bond Funds vs. GICs and Money Market Funds

Apart from savings accounts, GICs and money market funds are used to park cash required in the short-term such as amounts meant for a down payment, vacation, car, etc. In terms of yield, ultrashort term bonds are supposed to provide better returns than GICs and money market funds. However, this increased return comes with higher risk.

Due to the need to provide a higher return than other typical short-term investment vehicles, these bonds invest in securities with average credit ratings. In addition, unlike GICs, the ultrashort bonds are not guaranteed by CDIC. leaving the principal prone to market risk; an increase in interest rates would entail a drop in bond prices.

Money market funds are also mutual funds (like ultrashort bond funds) but they are required by securities legislation to invest in low-risk instruments and their NAV does not vary too much.

Factors to Consider

- Credit Risk. It is possible that corporations or, sometimes, governments can default on their debt obligations. With ultrashort bonds investing in such debts, the credit risk can be lowered by choosing funds that invest mainly in federal and provincial/state debts. The yield may not be great but the chances of default or downgrades are minimized significantly. The higher the exposure to the corporate segment with lower credit ratings, the better the chance of falling prey to credit risk.

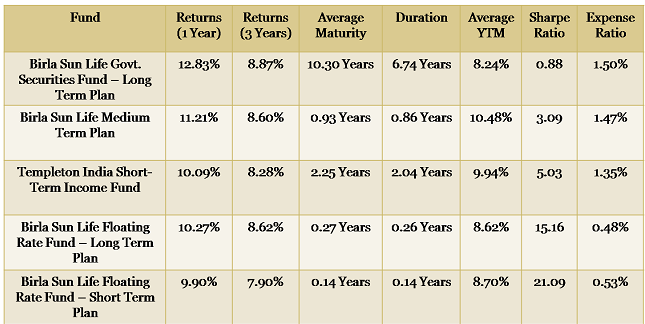

- Maturity Date. The shorter the term of bond maturity, the less the risk involved with regard to interest rate changes. Heres an explanation about the relationship between interest rates and bond prices .

- Duration and Bond Price. It is known that bonds with a high duration have a greater price variation than those with a lower duration. The coupon rate. maturity date, and yield to maturity have a significant impact on the price volatility seen in bonds.

Is it for the Average Investor?

Ultrashort term bonds are a lot of risk for too small a gain. GICs and money market funds may be a better option for many investors looking for a short-term parking spot for their cash (not to mention a savings account at a bank ). However, for investors who see otherwise, there are several options available to invest in them.

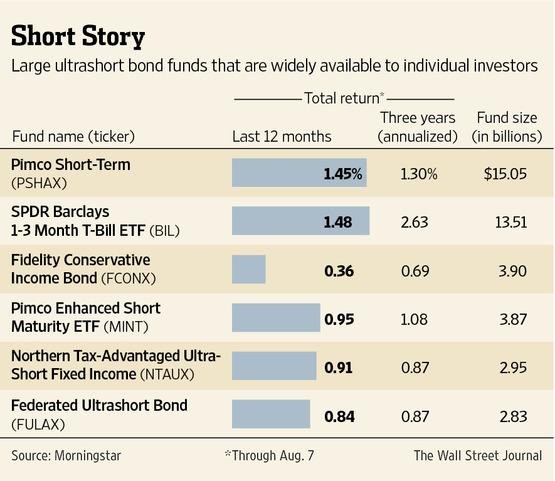

There is a list of top-performing ultrashort funds at MSN Money that could help your search. More funds of the same type can be found on this page but there may be some repetitions from the previous link. Canadian funds are limited; TD seems to be the only big player in this market and the performance of their ultrashort funds can be found on Page 7 of this PDF link .

Have you invested in ultrashort bonds (mutual funds or ETFs)? If so, how did your fund/ETF fare? Do you think they are worth the risk?

About the Author. Clark works in Saskatchewan and has been working to build his (DIY) investment portfolio, structured for an early retirement. He loves reading (and using the lessons learned) about personal finance, technology and minimalism. You can read his other articles here .