Trailing Stop How to Use a Trailing Stop

Post on: 16 Март, 2015 No Comment

Trailing Stop: How to Use a Trailing Stop

Trailing Stop: How to Use a Trailing Stop

In our last lesson we continued our course on the logistics of stock trading, with a look at how to place a Once Cancels Other order, or OCO for short. In today’s lesson we are going to finish up our module on how to place stock trades with a look at another advanced order type, which is referred to as a trailing stop.

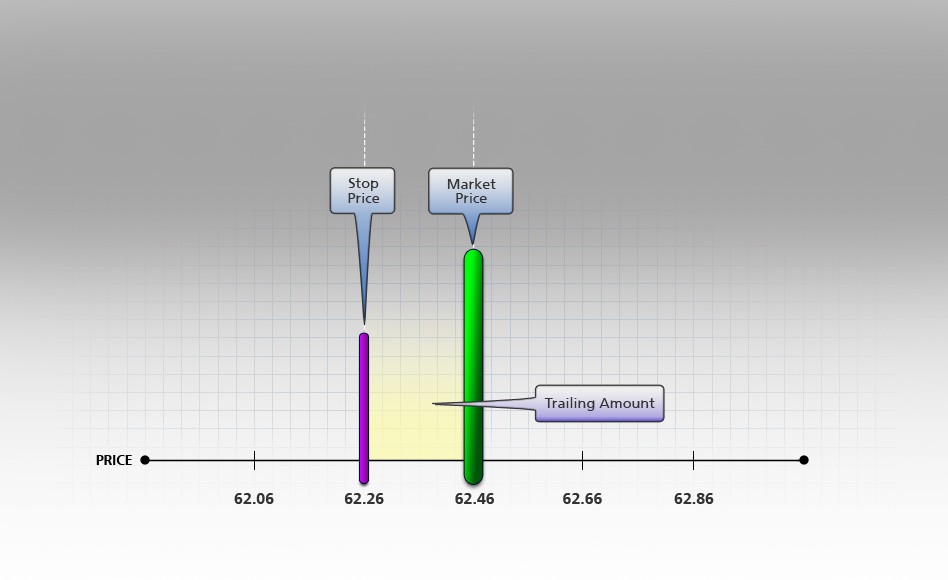

In our previous lessons, we learned how to protect our positions from further losses through what is known as a stop order. A trailing stop is similar to a stop order in that it is an order which is used to close out of a position should the market begin to move against you. The difference with a trailing stop however, is that it is designed to follow along behind the market should the market move in the traders favor and lock in a portion of that favorable move.

As an example, lets say that I buy 100 shares of a stock at $100 per share and place a stop order to sell that position at a loss if the market trades to $90 per share. Next lets say that over the next several weeks the stock trades up to $120 per share. If I were to leave my stop at $90, the risk on this trade has now increased from $10 when I first open the trade to $30, when factoring in the profit I have on the open position now that it is at $120. To lock in some of the gains here, some traders will chose to move the stop up to $110 for example, so they can protect some of the profit they have going on this trade from an adverse move in the market.

While traders can do this manually, some platforms offer what is known as a Trailing stop which automatically trails the market as a position moves in your favor. As an example lets say that I buy this same $100 stock, but this time instead of placing a normal stop, I place a trailing stop $10 below the market at $90. This time as the stock moves in my favor, the stop order will automatically move so that it always remains $10 behind the market as the market trades in my favor. If the market moves against me however the stop does not move, therefore locking in the favorable market move.

So to continue this example, if the stock I bought for $100 a share moves up $1 then my trailing stop which was originally set to $90, will move up to $91, and if the stock trades up to $110 then my trailing stop will automatically move up to $100 and so on and so forth. If however the market moves from $100 to $99 first, then my stop will remain at $90. Similarly if the market trades to $110 my stop will move up to $100 and if the market then trades lower to $108, then my stop will remain at $100.

Lets go ahead and login to our ThinkorSwim demo accounts so we can learn how to place a trailing stop order on the platform. If you have not done so already, I encourage you to hit the pause button and click the link above this video where you can register for a free ThinkorSwim demo so you can follow along as well.

After logging into the platform I am going to go to the equities section of the accounts tab where you can see that I have an open position in Google long from 336.84. To place a trailing stop on this position, I would click the blue dot beside the potion and select the first option in the dropdown menu that appears which is to close the position. This will populate the order window, where I can then change the order type column from limit to trailing stop. This will bring up another set of options which will allow me to change the amount that allows me to change the amount that I would like to trail the stop by. You can also see here that there is a column which says link which allows me to set what price I would like the order to be tied to. It defaults to the mark which is the mid point between the bid and the ask price, however if you click on the column to bring up the dropdown menu you can see that there are several options there such as the bid and the ask if you would rather the order float in relation to that.

You can also see in the order window the price column, which allows you to change the amount that you would like the stop to trail by. For this example I am going to trail the stop by $10. Like all the other pending orders that I place, I want the order to remain on the platform until I cancel it so I am going to change the rules column from Day to Good till Canceled.

Once I have done that I can click the confirm and send button, and then send in the order window that appears to place the trailing stop. That’s our lesson for today, in our next lesson we are going to cover trading on margin so I hope to see you in that lesson. As always if there are any questions or comments please leave them in the comments section below, and good luck with your trading!

Links to Help You Learn More About Trailing Stops