Traditional vs Roth 401k

Post on: 30 Март, 2015 No Comment

Check this out. Recently my employer made a big announcement to our 401k plan: We now have the choice to save our money under a Roth option if we want to!

If you already have a Roth IRA. then you’re probably already familiar with how this would work. As a quick refresher, the Roth option basically means that:

- Your contributions to the 401k will be invested using after tax money (i.e. you’ll pay your taxes now rather than later)

- Your money still grows tax free just like it did in a regular 401k

- When you finally retire, you DON’T pay any taxes.

When you weigh a traditional vs Roth 401k, the Roth is considered to be a good thing for you and your money for a lot of reasons. By paying your taxes now, you’ll enjoy a tax free retirement. Plus if you plan to be in a different tax bracket when you’re older (meaning you plan to be richer than you are now – and hopefully you are), then you’ll have saved yourself thousands of dollars by avoiding extra taxes.

BUT is the Roth really the better deal?

Why the doubt? Doesn’t every financial article in the world always try to tell you that the Roth is the better option for sure?

Yes it does. But you CAN’T always go around believing every one-size-fits-all piece of financial advice you hear. Usually the numbers are dynamic, and that might mean that in some circumstances you would be better with one option as opposed to another.

But how can we really know? Simple – Do the math!

I’m a big fan of taking on these kinds of “what-if” scenarios and building a financial model to simulate what would happen. By spending just a few minutes crunching out the numbers, I could potentially save myself thousands or even millions of lost dollars in the future.

Recall that not long ago we did a really deep dive into how big the differences were between a taxable and tax-sheltered account for your retirement savings. (As a matter of fact, we did that same exercise twice thanks to finding out a lot of good information from our readers).

Knowing what we learned from working out the math on both types of scenarios using some very realistic assumptions, let’s apply that same technique to see whether the traditional vs Roth 401k is really the better deal. You might be surprised at what you discover …

Traditional vs Roth 401k $10,000 Contribution Example:

Just like in the other exercise, we’re going to set up our model using two scenarios:

- You can invest $10,000 (pre-tax) in a Roth 401k

- You can invest $10,000 (pre-tax) in a traditional 401k

Here are the rest of the variables:

- We’re going to use the tax rates from 2013 .

- Assume we’re a married couple filing a joint return (tax status).

- We’ll during our working years that we’re in the 25% tax bracket with a modified adjusted gross income (MAGI) between $72K-$146K.

- Our inflation adjusted gains will be an annualized average rate of 6% (9% 3% inflation).

- After 30 years of working and investing, we’ll declare retirement in year 31. Retirement contributions will cease. Also assume were old enough not to have to worry about the 10% early withdrawal penalty.

- During retirement for living expenses, we’ll withdraw $30,000 per year for both strategies.

- Also during retirement, assume the kids have moved out of the house by then and can no longer be claimed as dependents on your income tax return.

Our Working Years:

If we opt to go with the Roth 401k, then during our working years we’ll have to give up 25% ($2,500) of our $10,000 contribution before it goes into our account, meaning only $7,500 will make it in.

With the traditional 401k, the entire $10,000 contribution will enter into our savings account tax free. That means that for a long time we’ll be saving and growing a lot more money in the traditional 401k account.

When We Retire:

At year 31 when we retire, that’s when we’ll stop taking making contributions to our 401k plans and start taking out money. We’ve arbitrarily selected $30,000 per year to withdraw. So what happens?

With the Roth 401k, we don’t pay any taxes on our withdrawal. So in this case we get to take out the entire $30,000 tax-free.

With the traditional 401k, we’ll pay ordinary income taxes on whatever we take out for living expenses. To compute this, the first thing we’ll have to do is subtract our Standard Deduction ($12,200) and a Personal Exemption for both me and my wife ($3,900 each).

$30,000 – ($12,200 + (2 x $3,900)) = $10,000 of taxable income

When looking at the tax brackets, your first $17,850 is taxed at 10%.

$10,000 x 10% = $1,000

Therefore we’ll be paying $1,000 of our $30,000 withdrawal to taxes.

Over time, what does that do to us? Do the taxes on the traditional vs Roth 401k out weigh one another?

The Results:

Amazing! As time goes on, our savings with the traditional 401k out paces the Roth 401k. This is largely due to the ultra low average tax rate we’d end up paying during retirement (3% in this example) on the traditional vs Roth 401k taxes paid during our working years (25%).

If this is the case, why in the world would anyone ever invest in the Roth 401k ever? Are there any scenarios where the Roth 401k is the better deal?

Roth vs Traditional 401k – Maximum Contribution Example:

Let’s try our model again but this time use the maximum contribution for both types of 401k plans . If we were able to that and then withdraw $60,000 at retirement, what would the results look like then?

Wait?? What happened? How come the Roth 401k is now a better deal when compared to the traditional 401k?

The difference between the two is due to the way the law is written. Let me explain further:

You Effectively Invest More with the Roth 401k:

Notice how I said “the maximum contribution for both types of 401k plans”. The IRS defines the 2013 limit for employee contributions to their 401k as a maximum of $17,500 for both types of plans. BUT does that make them equal?

Absolutely not. Observe.

When you reach the maximum savings with a traditional 401k, $17,500 simply comes out of your paycheck BEFORE taxes. No taxes are paid at this time and so the net transfer is simply $17,500 both before and after the transaction.

This is not the case with a Roth. Because when you save with a Roth option, your contributions transfer to your account AFTER you pay taxes. Therefore, in order for $17,500 to make it into your 401k account, you had to start out with $17,500 / (1 – 25%) = $23,333 BEFORE taxes.

In this case, you’re effectively deferring $5,833 more money towards your retirement initiative with the traditional vs Roth 401k option ($5,833 towards taxes and $17,500 towards your retirement savings). You might say “that’s not fair”, but that’s the way the government has set it up.

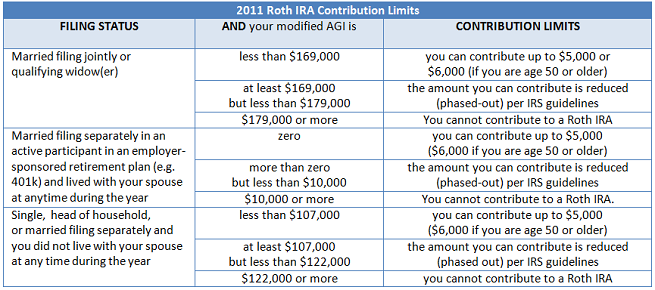

(By the way – the same thing is also true for a traditional vs Roth IRA. Even though the 2013 maximum limit is $5,500, you effectively get to defer $5,500 / (1 – 25%) = $7,333 with the Roth option).

Understanding this phenomenon clearly, you can see that (all things held constant) both plans grow at basically the same rate until the day you retire. This was NOT the case when you were simply investing some number below the maximum contribution limit we saw in the graph from the first example.

In year 31 when we finally retire, now we owe taxes on our traditional 401k withdrawals. If we had the Roth 401k we would owe no taxes. Hence as time goes on a gap starts to form between the two options with the Roth 401k taking the victory as the better retirement plan for this scenario.

(Of course we could also really complicate this story problem and look at what would happen if we had added an extra $5,833 to the traditional 401k balance to even them up through an alternative retirement savings account, and then seen which strategy comes out on top. But this post is already too long, so we’ll save that for another time …)

Conclusions:

So to conclude our examples and go back to answer my original question of whether or not I should go for the Roth option, the answer is NO. I should stick with the traditional 401k option unless I have sufficient reason to believe that:

- I’ll be investing somewhere the maximum 401k contribution limit every year

- I’ll be in a higher tax bracket and a larger average tax rate during retirement than I am right now if I were to take the Roth 401k option.

Due to the likely preferential tax treatment you’ll experience during retirement, the traditional option is the more tax-effective one as long as my retirement income stays reasonable close to what I enjoy right now.

Readers – What about you? Which kind of 401k plan does your work offer? What makes you want to choose a traditional vs Roth 401k?