Traditional and Roth IRA Contribution Limits

Post on: 16 Март, 2015 No Comment

You have more time than you might think to contribute to your 2012 traditional and Roth IRAs. Rather than an end-of-year deadline, you have until you file your 2012 taxes to make that contribution. Federal taxes for 2012 will be due on April 15, 2013, so this is the deadline for establishing and contributing to your 2012 IRA. If you file for an extension, however, your IRA deadline will not be extended; dont miss the April contribution deadline.

These contribution maximums are further limited by taxable compensation. If you only earned $3,000 in taxable compensation in any year, that is your IRA contribution limit in that year.

Traditional IRA rules

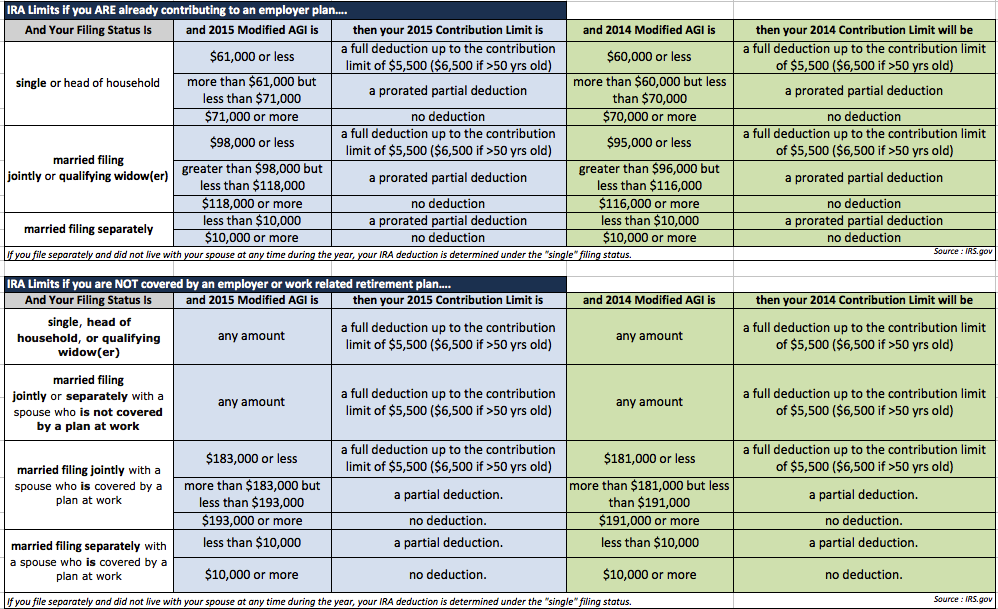

Contributions to a traditional IRA are tax deductible, but depending on your income and employment situation, the amount that can be deducted from your income varies. Any taxpayer not covered by a retirement plan from their employer can deduct their traditional IRA contributions in full. In 2013, for those who are covered by a retirement plan at work, when modified adjusted gross income reaches a certain level, the allowed deduction for traditional IRAs begin to decrease to zero. If youre in this situation, you can still contribute to a traditional IRA, but you wont benefit from the tax deduction as much or at all.

Here are the rules for those who are offered a retirement plan by their employers:

- Single taxpayers or heads of household can deduct the full amount of their contribution if their modified adjusted gross income is up to $59,000. Between that amount and $69,000, taxpayers can take a partial deduction. At $69,000, the deduction is completely phased out.

- Married taxpayers filing jointly (and qualified widows and widowers) can take the full deduction up to a modified adjusted gross income to to $95,000. The deduction phases out through $115,000.

- Married individuals filing separately can only take a partial deduction up to $10,000 in income.

If you are not covered by a retirement plan at work, the limits are more favorable.

- Single taxpayers, heads of households, and qualifying widows and widowers can deduct their full Traditional IRA contribution, regardless of income.

- Married taxpayers filing jointly can also deduct their full contribution unless their spouse is covered by a retirement plan at work. If that is the case, with a modified adjusted gross income (MAGI) of $178,000, the deduction phases out until the taxpayers reach an income of $188,000.

- Taxpayers who are married but filing separately can take a partial deduction through a modified adjusted gross income of $10,000, at which point the deduction is completely phased out.

Roth IRA rules

Your income limits your ability to contribute to a Roth IRA up to the maximum. This is different than the traditional IRA, where income affects tax deductions. Here, income limits contributions. You could be penalized by the IRS if you contribute to your Roth IRA beyond your allowable limit.

- Those filing as single, head of household, or married filing separately, can contribute the full $5,500 (or $6,500 if over age 50) to a Roth IRA as long as the MAGI is under $112,000. The limit begins to phase out until the MAGI reaches $127,000.

- Married taxpayers filing jointly (and qualified widows and widowers) can contribute the full amount to a Roth IRA while having a MAGI of under $178,000. The maximum decreases to zero as the MAGI approaches $188,000.

- Taxpayers who are married but filing separately can contribute the full amount with a MAGI of $0, but the contribution maximum phases out to zero as the MAGI approaches $10,000.

Plan for 2013

An IRA is an important piece of a retirement plan, and it should be high on most peoples priority lists, right below investing in a 401(k) up to the employers matching maximum.

If you have a good idea of what your income and tax situation will be in 2013, you can determine how much you can and will contribute to your 2013 IRA throughout the year. A convenient way to contribute is through automatic investments, so you can set it by December 31 and forget about it for the entire year. If you plan to invest in the stock market and dont want to invest in the IRA with your full years contribution at once, you can take advantage of dollar-cost averaging to reduce your exposure to swings in the market.

Set up an automatic transfer from your checking account to your IRA custodian of choice. I use Vanguard for my retirement funds, for example. Because there is no cost to transfer, I would create a plan that places my investment each week. With 52 weeks in a year and a $5,500 maximum contribution, thats about $105.76 a week or $458.33 a month.

Published or updated November 6, 2012. If you enjoyed this article, subscribe to the RSS feed or receive daily emails. Follow @ConsumerismComm on Twitter and visit our Facebook page for more updates.

3A%2F%2Fwww.consumerismcommentary.com%2Fimages%2Fgravatar.png&r=G /%