Trading earnings

Post on: 1 Апрель, 2015 No Comment

This presentation is provided for informational purposes only.

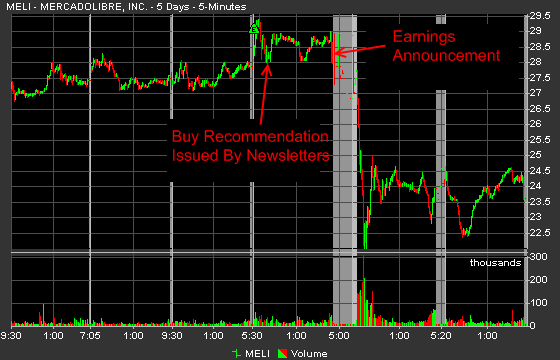

There is not much else that impacts stocks like earnings releases. Because of the potential for relatively big price swings, investor returns can be heavily influenced by how a company’s earnings report is received by the market. It is not unusual for the price of a stock to rise or decline significantly immediately after an earnings report.

This potential for a stock to move by a large amount in a certain direction in response to an earnings report can create active trading opportunities.

Make your forecast

Before considering how you might trade a stock around an earnings announcement, you need to determine what direction you think the stock could go.

This forecast is crucial because it will help you narrow down which strategies to choose. There are strategies for price moves to the upside, downside, and even if you believe the stock won’t move much at all.

Actively monitor

Whether you are considering trading an earnings announcement, or you have an existing open position in a stock of a company that is about to report earnings, you should consider actively monitoring the market buzz before and after the release, in addition to the results of the report itself. An earnings announcement, and the market’s reaction, can reveal a lot about the underlying fundamentals of a company, with the potential to change the expectation for how the stock may perform.

Moreover, the earnings impact upon a stock is not limited to just the issuing company. In fact, the earnings of similar or related companies frequently have a spillover impact. For example, if you own a stock in the materials sector, Alcoa Inc’s ( AA ) earnings report is of particular importance because it is one of the largest companies in that sector, and the trends that influence Alcoa tend to impact similar businesses. As a result of any new information that might be revealed in an earnings report, sector rotation and other trading strategies may need to be reassessed.

Additionally, Alcoa’s earnings have a unique significance because its release marks the unofficial beginning of earnings season 1 .

The direct route

If you are looking to open a position to trade an earnings announcement, the simplest way is by buying or shorting the stock.

If you believe a company will post strong earnings and expect the stock to rise after the announcement, you could purchase the stock beforehand. 2 Conversely, if you believe a company will post disappointing earnings and expect the stock to decline after the announcement, you could short the stock. 3

Options

Similarly, call and put options can be purchased to replicate long and short positions, respectively. An investor can purchase call options before the earnings announcement if the expectation is that there will be a positive price move after the earnings report. Alternatively, an investor can purchase put options before the earnings announcement if the expectation is that there will be a negative price move after the earnings report.

Traders should fully understand moneyness (the relationship between the strike price of an option and the price of the underlying asset), time decay, volatility, and options greeks in considering when and which options to purchase before an earnings announcement.

Volatility is a crucial concept to understand when trading options. The chart below shows 30-day historical volatility (HV) versus implied volatility (IV) going into an earnings announcement for a particular stock. Historic volatility is the actual volatility experienced by a security. Implied volatility can be viewed as the market’s expectation for future volatility. The earnings period for July, October, and January is circled.

Consider the greeks and implied volatility when trading options going into an earnings release

Source: Fidelity, as of March 1, 2013. Screenshot is for illustrative purposes only.

Notice in the period going into earnings there was a historical increase of approximately 14% in the IV, and once earnings are released, the IV has returned to approximately the 30-day HV. This is intended to show that volatility can have a major impact on the price of the options being traded and, ultimately, your profit or loss.

Advanced options strategies

A trader can also use options to hedge, or reduce exposure to, existing positions before an earnings announcement. For instance, if a trader is in a short-term long stock position, and expects the stock to be volatile to the downside immediately after an upcoming earnings announcement, the investor could purchase a put option to offset some of the expected volatility.

In addition to buying and selling basic call and put options, there are a number of advanced options strategies that can be implemented to create various positions before an earnings announcement.

One advanced, multi-leg options strategy that can be used to protect an existing position is a collar. A collar is a strategy that is designed to limit losses and protect gains. It is constructed by selling a call and buying a put on a stock that is already owned.

Other multi-leg, advanced strategies that can be constructed to trade earnings include:

- Straddles —A straddle can be used if a trader thinks there will be a big move in the price of the stock, but is not sure which direction it will go. With a long straddle, you buy both a call and a put option for the same underlying stock, with the same strike price and expiration date. If the underlying stock makes a significant move in either direction before the expiration date, you can make a profit. However, if the stock is flat, you may lose all or part of the initial investment. This options strategy can be particularly useful during an earnings announcement when a stock’s volatility tends to be higher. However, options prices whose expiration is after the earnings announcement may be more expensive.

- Strangles —Similar to a long straddle, a long strangle is an options strategy that enables a trader to profit if there is a big price move for the underlying stock. The primary difference between a strangle and a straddle is that a straddle will typically have the same call and put exercise price, whereas a strangle will have two close, but different, exercise prices.

- Spreads —A spread is a strategy that can be used to profit from volatility in an underlying stock. Different types of spreads include the bull call. bear call, bull put. and bear put .

Finding opportunities

Any of these strategies can only be implemented if you have a trade in mind for a particular company’s stock. Information about when companies are going to report their earnings is readily available to the public. More in-depth research is required to form an opinion about how those earnings will be perceived by the market.

Of course, traders can be exposed to significant risks if they are wrong about their expectation. The risk of a larger-than-normal loss is significant because of the potential for large price swings after an earnings announcement.

A company’s earnings report is a crucial time of year for investors. Expectations can change or be confirmed, and the market may react in various ways. If you are looking to trade earnings, do your research and know what tools are at your disposal.

Learn more

- If you have additional questions, contact an Active Trader representative.

- Research stocks .

- Find options contracts .

- Test single- and multi-leg option strategies with Fidelity’s Strategy Evaluator (login required).