Trading Covered Calls

Post on: 17 Февраль, 2017 No Comment

Trading Covered Calls

Option traders frequently start their trading career as options buyers. That can be a great strategy when executed properly but time value works against you. When you are an option buyer, you have to be right about market direction and about the amount of time it will take the market to move. But did you know that it is possible to be on the other side of the trade as well?

[VIDEO] Trading Covered Calls: Part 1

An options writer sells, or writes the option contract that option buyers are paying for. By creating the option, the option seller is taking on the opposite responsibilities of the option buyer. If the option buyer wants to “exercise” their option, you as the seller will need to deliver on the contract. That gives the writer an obligation to deliver.

For example, imagine you want to sell a call. The transaction is relatively simple. You would anticipate being paid the bid price or premium for the sale and now you have the obligation to deliver the stock if the option buyer exercises his option.

There are some distinct benefits of selling options:

- You get paid your potential profits up front in the form of the option’s price or premium.

- If the option expires out of the money, which most options do, then no one will want to exercise the contract and you will keep your entire premium.

- As time value melts, the decline in the option’s value reduces your liability and risk as the options seller. Because you already sold the option for a high price and took the premium, you can later buy it back for a cheaper price as time value melts, allowing you to exit the trade any time you like.

- You can close your trade at any time. All you need to do is to remove the obligation by buying the option back and washing out the trade. This can be done on the open market at any time.

There is, however, risk with selling options that needs to be controlled. If you sell a call, you have the responsibility to deliver the underlying stock if prices rise and the option is exercised. You can see this graphically in the chart below.

If you had sold a call in April on Google (GOOG) below, with a strike price of $450 per share and the stock gapped up (like it did later in the month, to $550), you are still responsible to deliver the stock to the options buyer for $450. That means you will lose $100 per share as you buy the stock on the open market for $550 to deliver it to your options buyer for $450.

GOOG April Call Example

The good news is that this risk can be controlled, and is partially offset by the premium you were initially paid. Once they are netted out, these losses may not be as much as you think. I am using an extreme example of a large gap to make the point that options selling does not need to be scary. In the video above we will look at how this trade worked out.

Covered Calls Strategy

In this section of this lesson we will discuss the covered calls strategy, to illustrate how you can further protect yourself from these disadvantages while still retaining the benefits of being an option writer.

The core principle of writing covered calls is that you are controlling risk and attempting to improve returns on a stock or ETF that you own. You can do this by selling a call option against that stock or ETF and collecting the option premium. A covered call consists of a two step process that is easy to implement by new and experienced investors alike.

[VIDEO] Trading Covered Calls: Part 2

The first step in writing a covered call is to be long the underlying stock or ETF. Sometimes investors are selling a covered call against a stock they may have owned for a long time and other times an investor may be buying the stock and selling the call option at the same time, which is sometimes called a buy-write.

The second step in writing a covered call is to sell a call against that long stock or ETF position. There are several factors to consider when you are selling the call including, expiration date, strike price and premium. Lets walk through a case-study of a covered call to begin answering these questions.

Imagine you own 500 shares of Apple (AAPL) and you want to sell 5 call contracts to make some income from those option’s premiums. That trade is a covered call.

The covered call is “covered” because you already own the stock. If prices rise and the call buyer wants to purchase the stock, you have the ability to fulfill on the contract without going to the open market because you already own the stock. This alleviates the problems with selling a call alone as discussed in part one of this series.

Let’s assume you had owned 500 shares of AAPL in late March 2008 when the stock was priced at $140 and sold a call against it with a strike price of $145 and a premium of $6.00 per share or $600 per contract.

As the seller, you were paid $600 of premium per contract for 5 contracts of AAPL calls you sold, for a total of $3,000. That sounds good so far – you made three grand.

However, let’s now look at what happened to those options you sold at expiration, when that obligation to deliver the stock was due.

By April’s expiration the stock was priced at $155 per share and the call buyer wants the stock. She has the right to buy it for the strike price of the calls, or $145, as detailed above you already own it and your broker would just take it out of your account automatically.

You bought the shares of AAPL for $140, so by selling it for $145, you made an additional $5 per share, or $2,500, plus you keep the premium for the calls of $3,000. A good profit, but the downside of the option is that by selling the right to buy at the $145 strike price, you missed out on another $10 per share on the rise in the price of the underlying stock.

The advantage of owning the stock was that is protected you from the liability created by the big breakout in April. Otherwise you would have been responsible for acquiring the stock on the open market for $155, which you would have had to sell for the $145 strike price. The difference is substantial, in that the covered call was a profitable trade, whereas just writing a call without owning the stock would have resulted in a loss.

The advantage of selling the call is not as evident when the market is rising but really comes into play when prices drop. Selling the call and earning the premium provided $3 per share of protection against losses. This protection has the effect of reducing account volatility and improving returns. Over the long run the reduction in losses is well worth the opportunity cost of losing a little upside potential.

AAPL Call Example

In the video above I will look at this situation in more detail and contrast it with other scenarios like when the stock’s value goes down. Covered calls are not only a great way to limit your liability as an option writer but they are an excellent way to hedge risk on your stock holdings as well.

Final Concepts to Keep in Mind

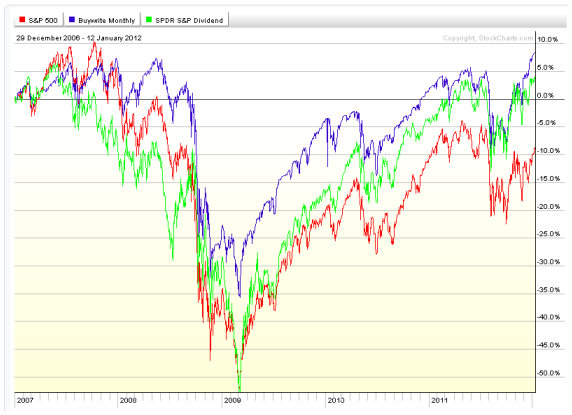

Covered calls, when applied consistently over the long term, deliver significantly lower account volatility without decreasing profit potential. In fact, long term covered call indexes show that account volatility is reduced and returns are increased. A covered call is one of the very few ways to accomplish these two objectives at the same time and is a gateway to learning more about using options as an investor.

[VIDEO] Trading Covered Calls: Part 3

As we discussed earlier in this article, during short-term rallies a covered call can sometimes cap profit potential on the underlying stock. This happens because you can only make the premium you were paid when you sold the option plus the strike price for the stock itself. If the stock is running away to the upside you may have made more just holding the stock.

However, if the market breaks to the downside, the option will expire worthless and you get to keep the entire premium because you will not have to sell the stock at expiration. That premium offsets some or all of the losses you might have accumulated on the underlying stock when it dropped.

Over the long term the reduction in losses more than offsets the opportunity cost of limited gains when the market really takes off.

When you net out the affects of capped gains and hedged losses with covered calls, the end result is a strategy that can reduce the ups and downs of your portfolio but still deliver great returns. In the video, we will look at a classic illustration of this concept that can be monitored in the market every day.

There are a few final concepts to keep in mind as you become a covered call investor.

- Be careful about commissions if you buy the stock and sell the call at the same time, this trade is called a buy-write. Call your broker and talk to them about this order type and any restrictions or additional costs they may have.

- Covered calls require the lowest level of options trading approval from your broker. Call and make sure this is something you have permission to do in your account.

- You can exit a covered call at anytime. If you want to get out, all you need to do is buy the call back at the current ask price and sell the stock.

- Many traders will choose to exit a call that has moved in the money that could be exercised at expiration to avoid having to sell the stock they own in their account. There is nothing wrong with this; it is really up to you. It can avoid the hassle and transaction costs of clearing the underlying stock, especially since you’ll often write calls on the same stock over and over.

- There are a lot of options writing and covered call “advisory services” promising huge returns. These are seldom true and may come with big fees and lots of account volatility. If you see promises or examples of huge monthly returns from covered calls, be careful; you are probably not getting the whole story.