Trading Collars on ETFs in Volatile Markets

Post on: 17 Июнь, 2015 No Comment

Key Points

- ETFs can be useful in creating a diversified portfolio, but may not perform well in volatile or range-bound markets. For experienced options traders, an actively managed collar strategy can help smooth out volatility and generate short-term income. In non-tax deferred accounts, extra caution is needed.

As Michael Iachini explains in the article, Choosing Between ETFs and Mutual Funds , many traders are attracted to ETFs because they offer:

- Exposure to a market segment. The most common use of ETFs is to gain exposure to a specific or niche market segment without the risk of picking a single equity.

- Active trading. ETFs have real-time prices and are exchange-traded just like stocks. If you need to actively trade your investment, either with intraday trades, stop orders, limit orders, options or short selling, most ETF can be traded in this manner.

- Built-in diversification. Because most ETFs are composed of a basket of stocks, they provide built-in diversification. Even selecting an ETF that is focused on a narrow industry within a specific sector of the market is less risky than trying to choose a specific stock. Although, it’s important to note that a sector ETF would have greater risk than a broadly diversified ETF.

- Cost savings. In normal markets, ETFs typically offer liquidity and often have very low operating expenses.

- Tax efficiency. Non-leveraged equity ETFs are usually tax efficient 1 .

Options on ETFs

The majority of actively traded ETFs not only have options trading available, but many also have strike prices available at each dollar increment (something you don’t always see with stocks). This gives you the flexibility to use ETFs with almost any option strategy.

In times of high volatility, ETFs may not perform as expected. However, by incorporating collars on ETFs, you may be able to smooth out some of the peaks and troughs, offset all or part of the losses during the downtrends, and ultimately lower your overall cost basis.

A collar is a risk management strategy that essentially combines a covered call with a protective put. It’s typically used when you are concerned with protecting a position at minimal expense. When used for this purpose, the strategy is fairly passive. However, in a highly volatile, range-bound market a more actively managed collar strategy can be used to capture profits during the dips on positions for which you still have a long-term bullish outlook, and prefer to hold until the market settles down.

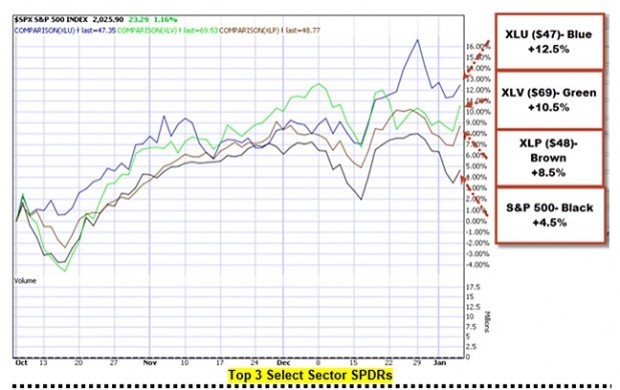

Many high volume ETFs have recently exhibited a very similar chart pattern, where a well defined upper and lower range have been established, and the ETF has been moving up and down within that range for several weeks.

Take a look at the chart below for the SPY (Standard and Poor’s Deposit Receipt) ETF. From August 5, 2011 until October 12, 2011 (the date of this writing) the SPY had been in approximately a 10 point range (112 – 122) and market volatility (as measured by the VIX) had been in about a 15 point range (30 – 45) which is quite high from a historical perspective. This is an ideal environment for an actively managed collar strategy.

SPY ETF

Symbols and market data shown are for illustrative purposes only.

Source: StreetSmart Edge®.

In implementing this strategy, your goal should be to establish the collar for a small credit (sufficient to cover the commissions 2 ). To do this use front-month options, each time the SPY (or any ETF) is close to the top of its range and then close it out at a larger credit each time the SPY moves back down toward the bottom of its range.

If the SPY does end up moving from the top of its range to the bottom of its range as you anticipated, you would get paid when the position is established and you would get paid even more when the position is closed out. During a downward move, both options will be working in your favor, so it’s not necessary to open the position exactly at the top, or close it out exactly at the bottom. Additionally, because both options are initially out-of-the-money, if the ETF stays relatively flat and the collar expires, establishing it at a small credit will allow you to earn an extremely small profit, even after commissions 2 .

Let’s look at some examples using actual mid-day pricing, not unrealistic intraday highs or lows:

On August 15, 2011, when the SPY was around 119.95 (well below the intraday high of 120.74) the following 5-point collar could have been established:

- Sell to open 1 8/20/2011 122 Call @ 1.15

- Buy to open 1 8/20/2011 117 Put @ .95

- For a net credit of .20 (before commissions) 2 (The net credit after commissions would be $9.55)

This .20 equates to a credit of $20 per 1×1 collar; more than enough to cover the standard commission charges of ($8.95 +.$0.75 per contract) or $10.45.

Three days later on August 18, 2011, when the SPY was at approximately 115.10 (well above the intraday low of 113.39), the collar could have been closed out as follows:

- Buy to close 1 8/20/2011 122 Call @ .10

- Sell to close 1 8/20/2011 117 Put @ 3.00

- For a net credit of 2.90 (before commissions) 2 (The net credit after commissions would be $279.55)

This 2.90 equates to a credit of $290 per 1×1 collar; which even after the standard commission charges of $10.45 are deducted, results in a total net profit of $289.10 when netted against the initial credit of $9.55 received when the collar was created. While the net loss on the SPY position was $500, the collar offsets more than half of that loss.

Once the SPY increases in price again, this (or a very similar) collar can be re-created. This is where you want to actively manage your position.

By August 25, 2011, the SPY was back up to 118.80 intraday (well below the intraday high of 119.40) but since the October expiration had passed, the following 6-point collar could have been established:

- Sell to open 1 9/22/2011 121 Call @ 2.40

- Buy to open 1 9/22/2011 115 Put @ 2.25

- For a net credit of .15 (before commissions) 2 (The net credit after commissions would be $4.55)

The next day, August 26, 2011, by the time the SPY had dropped to 114.10 (well above the intraday low of 113.85); the collar could have been closed out as follows:

- Buy to close 1 9/22/2011 121 Call @ 1.00

- Sell to close 1 9/22/2011 115 Put @ 4.00

- For a net credit of 3.00 (before commissions) 2 (The net credit after commissions would be $289.55)

Again, while the SPY dropped 5 points, the collar resulted in a net credit of only 3 points, but because you have now done it twice in only a couple of weeks, you have earned more than 5 points, even while the SPY is only down a aggregate total of about 5 points. The very next trading day, August 29, 2011, the SPY was again back up to 121 (before reaching an intraday high of 121.43) and another collar could be established, and the cycle repeats itself once again. In fact if you look at the SPY chart above, it’s easy to see that this strategy could have been repeated several more times during the month of September alone.

Because the intraday swings have been both extreme and unpredictable, you can manage this strategy by using GTC (good ’til cancelled) limit orders and not being too greedy.

If you have several ETF positions, use the collar screen on any of our trading platforms to set up a few orders for .15 — .25 credits. As the markets moves around some of them are likely to be executed. Once that happens, use GTC orders again with larger credits to close them out. The markets have recently been most volatile at the open and near the close. It’s likely that, many of them may get filled during the first and last 30 minutes of the day.

Possible outcomes

In the first example above, the SPY was towards the bottom of the range as the August expiration approached, so the collar was sold at a profit, but if it had been at the top of the range at expiration, the call would have been in-the-money. In that scenario you would have two choices; let the SPY position be called away at the strike price, or close out the August collar and establish a new September collar using similar strike prices. Just like when you re-establish within the same expiration month, you could try to do this at even money or a small net credit. Because you are a month away from expiration again, once the new collar is established, it should allow you to maintain your ETF position and continue the strategy for the next month. While early assignment can occur at any time, it is most likely to occur the day before ex-dividend date, or during the week of expiration.

The risks

While this strategy can be effective in a highly volatile, range-bound market, like many option strategies, it has some serious risks that need to be considered:

Early assignment: You could be assigned any time the call option goes in the money. This would result in an assignment before you have the opportunity to rollout to the next expiration, resulting in the loss of your ETF position, and often a taxable event.

Downside breakout: If you close out your collar at a profit when the ETF is at the bottom of its range, but it continues to go lower, you will have missed out on the potential for additional profits in the collar while also incurring additional losses in the ETF.

Upside breakout: If you establish the collar when the ETF is towards the top of its range, but it continues to go higher, you will not only miss out on the opportunity to profit from the collar, but also cap your upside potential in the ETF. This could be partially mitigated by repeatedly rolling out to the next expiration. However, early assignment risk will always be there. Also, if the call goes deep enough in the money, the rollout may require a net debit to establish it, which is usually not a smart trade.

Tax complications: While this strategy can generally be used in an IRA and other tax-deferred account without any problems it’s important to seek professional tax advice when using it in a non tax-deferred account. As Rande Spiegelman explains in the article Hedging: Tax Traps for the Unwary , in a non tax-deferred account, there are a number of complications that could arise:

- Be sure that both the call and the put option are out-of-the-money when your collars are established or you could run afoul of the IRS straddle rules.

- If you have not yet owned the ETF position for 12 months (qualifying for long-term capital gains treatment) establishing a collar could freeze or reset the holding period of your ETF position.

- If the ETF goes ex-dividend during the time your collar is in place, the dividend probably will not qualify for the 15% long-term rate.

- If the ETF position is closed out at a loss (whether through assignment or sale), IRS wash-sale rules will disallow the loss if you buy the ETF back again within 30 days.

- All income earned on the collar options will typically be taxed at your ordinary income rate.

For more information on the tax rules regarding options please consider reading the following publications:

Bottom line

The goal of this strategy is to earn short-term income that may partially or fully offset declines in the value of your ETF positions, but it is clearly not a tax-efficient strategy, nor is it a strategy for inexperienced option traders. Because this strategy requires active management and close monitoring, I recommend you test it out with paper-trading first, and don’t use it unless you can keep a close watch on your account and the markets.

While an actively managed collar can also be employed for individual equities, I couldn’t possibly cover all of the potential variations, risks or opportunities associated with it here.

For additional information on collars or for assistance with other options strategies, please contact a Schwab Trading Specialist at 800-435-4000 .

1 Most equity ETFs track indexes and hold positions for long periods of time. Since there is very little buying and selling, there are very few taxable capital gains distributed to shareholders. ETF managers also have the ability to rid their portfolios of the lowest cost basis equity shares whenever an Authorized Participant redeems ETF shares, thus lowering the potential for future capital gains. In addition, trades in ETFs are transacted between investors in the marketplace rather than directly with the ETF, so, unlike mutual funds, the ETF doesn’t need to liquidate holdings (which could potentially generate capital gains) when other investors sell shares. More details can be found in the article What Makes ETFs Tax-Efficient .

2 Typical Schwab online commission charges for a 1×1 collar transaction would be $8.95 +.$0.75 per contract or $10.45. All broker-assisted and automated phone trades are subject to service charges. See the Charles Schwab Pricing Guide for details.