Trading Call Option LEAPS

Post on: 10 Июль, 2015 No Comment

How do you know when its time to LEAP?

Trading LEAP Call Options can be a great way to improve your stock market investing returns. By using Long Term Equity AnticiPation Securities (LEAPS) you can easily add leverage to your stock portfolio. And if you trade LEAP call options effectively, adding leverage to your returns is safer than you think. So

In this short blog post Ill share my strategies for trading LEAP call options. And even if you have never traded options before, you will appreciate how LEAPS are a relatively conservative way to take advantage of options. Youll see how you can get high percentage returns without putting up too much capital. If you do it right, trading LEAP call options can be a classic twist on the buy-and-hold investing strategy. So lets jump into it

Trading LEAP Call Options What You Need To Know:

If youve never traded LEAP call options before theres a couple things to keep in mind. The most important thing to remember is that call options represent a long term bullish outlook on the stock idea youre considering. So when you buy call options you are betting that the price of the security will go up.

The other thing to remember when trading LEAP call options is that LEAPS usually expire in 2 years. This gives you a lot of time to wait for capital appreciation. And while LEAPS can be volatile, they can also be a low-cost way to take advantage of stocks with earnings growth. And since each option contract represents a lot of 100 stocks, you can leverage your returns quite easily.

Of course if youre not careful LEAPS can expire worthless. But even still, they are much safer than many other option trading strategies. Now let me show you exactly what I look for when Im trading LEAP call options

Strategy to Trade LEAP Call Options:

Trading LEAP call options is easier than you think. Your broker probably offers you LEAPS and you can buy them for most large cap companies the same way you buy stocks. While the commissions may be slightly higher you will probably hold the LEAPS for 6-24 months so the overall trading costs are pretty low.

So heres one successful way you can trade LEAP call options

(1) First you need to find your growth stocks. There are a lot of different approaches to finding growth-oriented stock ideas (as described in Common Stocks and Uncommon Profits ). One good starting point is to screen for safe momentum stocks. This can help you identify stocks that are the start of growth trends but not over-valued. Of course youll also want to do your own due diligence to see if the stock idea meets your investment criteria. So whats next?

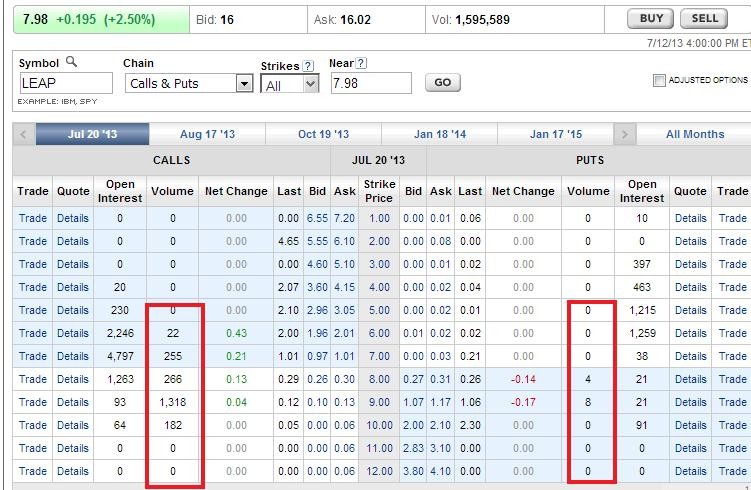

(2) Look up the option chain and find the furthest date out (e.g. January 2016). For more information on how to find LEAP call options on Google Finance look at the picture below

Click the option chain on the left hand side of Google Finance to find LEAP options for any highly-liquid stock.

(3) Deciding which LEAP you want to buy is a bit of an art. But some things you will want to consider are the strike price and the liquidity. So I usually want to see a couple of hundred open interest when Im buying LEAPS. This tells me there will be some liquidity and I can sell the stock when I need to. The other consideration is the strike price and how much money you want to spend. Strike prices that are far above the current stock price (out of the money) will be cheaper. But buying in the money LEAPS is a little bit safer. I usually go for the first strike price below the current price.

(4) Finally once Ive chosen the strike price of my LEAP call option (based on current price, my growth expectations for the company in question and the liquidity of the LEAPS) I watch the stock for a pullback. Since you are making a long term investment you can be patient with buying your LEAPS. Wait for the stock to sell off a few percent. This will help you get a cheaper entry because the LEAPS will go down in value as the underlying stock sells off. This can help you get a few more percentage return when youre trading LEAP call options

(5) The amount of trading you do with your LEAP call options is up to you. Often I let my LEAP call options ride right up until the week before expiration. If Im right on the growth hypothesis on the stock in question this typically works quite well. By trading LEAP call options this way its easier to get 40-60% returns, when the underlying stock only goes up 15-25%. Thats why trading LEAP call options is so profitable.

In Conclusion: Trading LEAP call options takes a little practice. So if youve never traded LEAP call options before I recommend you try out a mock option trading game to practice your approach to option trading. Make sense?

And By The Way: If youre looking for more trading strategies to reduce your risk and improve your returns, I encourage you to sign up for my free mini-ebook on safe swing trading strategies using the form below.