Top 5 Benefits of Investing in an ETF

Post on: 3 Август, 2015 No Comment

Posted by Aaron Smith on March 15, 2011 at 10:30 am

Over the last several weeks, Stockbrokers.com has featured ETFs (Part 1 | Part 2 | Part 3 ) because of the way they are transforming the way investing works. The meteoric rise in popularity seen by ETFs is a clear sign that investors are seeing some real advantages to investing in an ETF. These innovative investment options come with plenty of perks, but what are the top benefits of investing in an ETF?

Top 5 Benefits of Investing in an ETF

1. Cost-Efficiency- The wise investor will always carefully monitor the cost-efficiency of an investment, and ETFs are a home run in this area! The ETF doesnt have annual expenses like a mutual fund, and because most are passively managed, they are extremely tax-efficient. While some mutual fund index funds have low annual expenses, none can match the amazing expense ratio of an ETF. Most index ETFs cost less than 0.10% on an annual basis. An ETF brings cost-efficiency at the time of purchase and at tax time.

2. Liquidity- Since an ETF trades like a common stock on the market, it can be bought or sold whenever the investor wishes to do so. The ability to buy or sell your investment on an intra-day basis is a big benefit for investors. There is no waiting for the close of the day to calculate an NAV like there is with a mutual fund. Move your money when you want it moved with an ETF.

3. Access to New Alternative Assets- One area that some experts overlook is the tremendous amount of access to alternative investment classes ETFs provide. There are numerous areas that either were very difficult to invest in, or were completely closed to most investors that are now readily available through an ETF. Three of the most popular ETF classes are commodity ETFs, foreign ETFs, and currency ETFs. All three of these investment classes were complicated before, but by investing in an ETF investors have easy access to these important investment options.

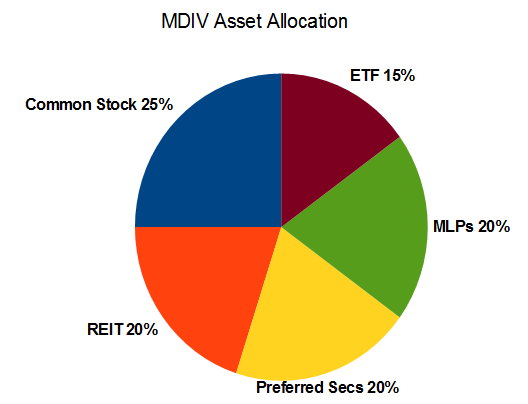

4. Asset Allocation- Asset allocation allows an investor to balance risk and reward in an investment portfolio. The ETF makes asset allocation many times easier than it ever was before. The liquidity of an ETF allows an investor to re-balance their portfolio whenever necessary. As your financial needs and goals change, your investment portfolio should move in the same manner. Using ETFs to find the right mix of every type of investment option available is huge plus for the individual portfolio.

5. Flexibility- If I could pick one word to describe exchange-traded funds it would probably be flexible. Successful investing requires flexibility on the part of the individual investor, and no investment vehicle provides a greater level of flexibility than the ETF. It is easy to short an index or sector using an ETF, which previously would have required a margin account. The ability to purchase inverse ETFs or sector ETFs allows the investor to achieve an even higher level of diversification.

Its clear that the amazing increase in popularity among ETFs is not just a passing fad, but it is a changing of the guard in the industry. If you havent already looked into investing in an ETF, consider doing so to help your investment portfolio moving forward. Check out our online broker reviews for more information.