Top 10 Online Forex Trading Platforms UK Best Platform

Post on: 29 Октябрь, 2015 No Comment

How to Find the Best Online Forex Trading Platforms

It’s never been easier to profit from the foreign exchange (forex) markets. With trillions of dollars of currency traded on a daily basis you can now access forex trading online through dozens of UK brokers.

But how does online currency trading work? And what should you look for when you compare online forex trading accounts?

How do you trade forex online?

Online currency trading involves you using your internet based forex account to predict whether a value of a currency will strengthen or weaken in relation to another currency. If you predict correctly then you’ll profit, get it wrong and you’ll incur a loss.

When you trade forex online you effectively buy one currency and sell another so, when trading currency online UK traders have to select a ‘currency pair’.

For example, you might buy the US dollar against the Japanese yen anticipating that the dollar will increase in value relative to the yen. If the dollar does rise relative to the yen during the period of your trade, you will make a profit. If it falls in value relative to the yen you’ll incur a loss.

The most commonly traded currencies in the world are the euro (EUR), British pound (GBP), US dollar (USD) and Japanese yen (YEN).

One of the main advantages of online forex trading UK investors benefit from is that you can trade ‘on margin’. This means that you can open a position far in excess of the capital in your forex account.

For example, if you wanted to trade Ј50,000 on the GBP/USD currency pair you would be required to have just Ј1,000 of capital at 2% margin.

However, if the forex market moved against you would need to have the full amount, plus any additional losses, available to settle your trade. This is why it’s important you don’t trade without having sufficient funds to leave you with the money to repay what you may owe.

What to compare when you’re looking for the best online forex trading platform

If you want to trade forex online then you’ll need a dedicated forex account with a broker.

There are three main factors you should consider when you’re looking for the best online forex trading platform:

- What type of online currency trading account it is

- The ‘spreads’ charged by the broker

- The range of currencies on offer

- How the broker lets you manage your account

Firstly, you should establish exactly what sort of account you want. There are different ways to trade currencies online including ‘contracts for difference forex trading’ (CFDs ), spread betting forex and traditional trading. You need to think about how you want to trade forex and make sure you get an account that allows you to trade the way that you want.

Secondly, it pays to compare the ‘spreads’ quoted by each broker for the currency you want to trade on. The ‘spread’ is the difference between the buy and sell price of the currency. Generally speaking, the best online currency trading accounts have a narrow spread as this is where the forex brokers take their profit.

Thirdly, there’s no point opening a forex account that doesn’t provide access to the currencies you want to trade on. So it’s important to check what’s on offer from each account before you apply.

While most forex brokers will offer access to the most popular currencies, if you want to go for something a little more exotic then your options are likely to be more limited.

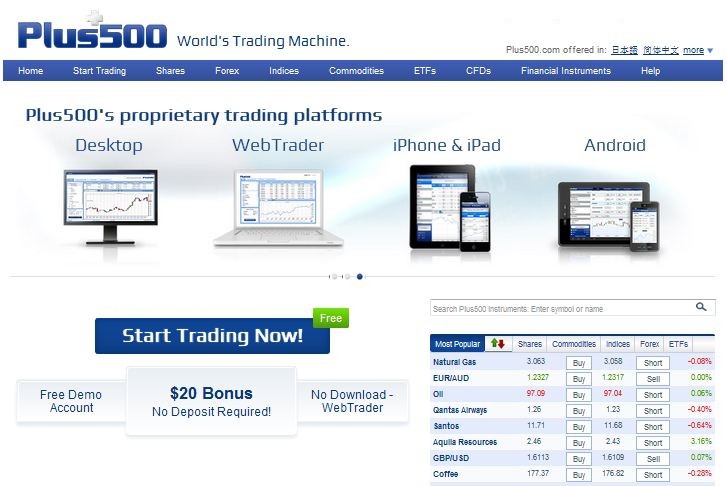

Finally, you should establish how you can manage your account. The best online forex trading platform will offer a range of ways to make trades and monitor your account.

Real time trading online should be an essential requirement while it’s also useful if a broker offers a mobile service that lets you manage your currency trades on the move, this gives you access to your trading platform wherever you are, giving you the added flexibility that is desired in the current climate.

Compare the different online forex trading platforms on offer from as many different UK forex brokers as possible and apply for the account that combines competitive spreads with flexible trading facilities.