Time Value of Money Inflation and Opportunity Cost

Post on: 16 Март, 2015 No Comment

Could the phrase time is money actually be true and not just a commonly used quote? One of the most critical concepts to understand in the realm of personal finance is the time value of money. A solid understanding of this concept can change your view of many financial decisions, and in the end, save you a lot of money.

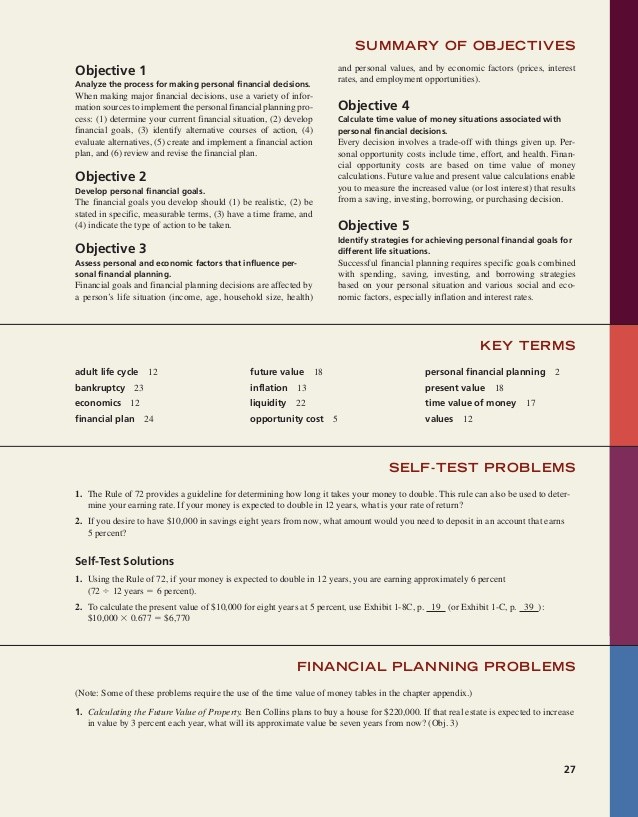

What is the Time Value of Money?

The time value of money (TVM) concept is used to compare two or more financial outcomes. The basic idea is that a dollar today is worth more than the same dollar at some point in the future .

If I offered you $1,000 today or $1,000 12 months from now, which would you choose? The logical person would of course select the $1,000 today because you wouldnt have to wait.

But what if I offered you $1,000 today or $1,050 in 12 months?

The decision becomes more difficult. If you took $1,000 today you would need to earn (using basic math) a 5% interest rate on the money to end up with $1,050 in 12 months. If you thought you could earn a higher return, then you would take the money now. If you didnt think that was realistic, then waiting 12 months for the money might make more sense.

Future Value and Present Value

One way to compare the two options is to use the financial formulas of future value and present value. If you took the money today, you would use the future value formula and an assumed interest rate you could earn to determine the future value of the money you had today. Likewise, you could determine the true value in todays dollars of the money you would receive in the future.

As noted above, if the interest rate assumptions are the same, then the money is worth the same today as it is in the future. But if the values are different in the money you would receive today versus the future, you need to compare the two to see which is best.

If you had the option of $1,000 today or $1,200 in three years, assuming a 2% interest rate if you saved the money today, which is the best choice?

The Future Value equation is

FV = Principal * ((1 + interest rate)^number of periods)

In our example, the future value of $1,000 is

FV = $1000 x (1+.02) to the third exponent = $1000 x (1+.02)^3 = $1000 x 1.061 = $1,061.21.

The Present Value equation is

PV = FV / ((1 + interest rate)^number of periods)

In our example, the present value of $1,200 in three years is

PV = $1,200 / (1.061) = $1,131.

If your interest rate assumptions for the three year period are accurate, you would be better off waiting for the $1,200 payment in the future rather than taking $1,00 today.

Time Value of Money, Inflation, and Opportunity Cost

The time value of money is a basic principal to compare two known scenarios: a payment today or the value of a payment in the future. But TVM also connects with inflation and opportunity cost. Inflation itself will devalue money you receive today. You need to be considering what the future value of the money sitting in your bank account is. Any money you have today that isnt earning any interest (as is the case with most major banks checking accounts) is slowly going down in value. You need to earn some sort of return to simply keep up with inflation.

Another important concept connected with the time value of money is opportunity cost. Even if the better decision is to wait until three years from now for the payment, you still might be better off by taking the payment now because no financial decision is made in a vacuum. You could take $1,000 today and pay off some credit card debt. build your emergency fund. or invest in a side business. Those decisions might better your financial situation immediately rather than waiting three years for $200 more.

Speaking of credit card debt, when you carry a balance on a credit card you are making a time value of money calculation. You are determining that whatever you are buying is more valuable than a larger amount of future dollars due to the interest you will pay. Youll put $1,000 on a credit card today, but end up spending a total of $1,600 over the next several years paying off the balance. Is the item really worth those extra payments? Understanding the time value of money can help you make better financial decisions.