Time to Buy Ford LEAPS Calls

Post on: 15 Июнь, 2015 No Comment

TK All-Star posted on 11/21/08 at 03:36 AM

Doc Maher discusses the merits of this strategy.

I noticed Ford has been ending the trading day under $2.00 per share. It occurred to me that either Ford would go into Chapter 11 bankruptcy and become worthless or it would survive the auto and financial industry crises and be worth considerably more than $2.00. There is a lot to consider here. It may be that the auto industry is “too big to fail”. That is, the Government can’t allow them to go into bankruptcy because something like one in ten jobs in the country is connected to the auto industry. On the other hand the public is weary of multi-billion dollar bail-outs for the private sector.

So my thinking went something like this. If I believe that there is a reasonable chance that Ford will survive, how could I take advantage of it? My first thought was that there is so much uncertainty surrounding the big three (Ford, GM, and Chrysler). If I made a play on Ford, I realize there is a very real possibility that I could lose everything I invested. On the other hand, if I am taking a big risk, I should also be able to receive a big reward.

This obviously led me to think about an option trade, because options allow me to leverage my investment while limiting my risk. So with Ford so cheap what could I do?

Well looking at the options chain I see the lowest strike for Ford is 2.50. If Ford should survive, it would probably recover to well over that however I have no idea when that might happen. So I considered a LEAP option. “LEAPS” is an acronym for Long Term Equity AnticiPation Security. This amounts to an option with a very long expiration date. Equity LEAPS expire in January and can be as much as two years out. So buying a LEAPS call would give me the maximum time for Ford to recover.

Looking at the option chain for Ford at left, we can see that the longest LEAPS expirations date listed at this point is January 2010. If Ford hasn’t recovered by then, it probably won’t recover. This should be enough time.

The market for the January 2010 2.50 call is $0.81 bid and $0.85 ask. Ford stock closed at $1.80. If I buy this call for $0.85, my break-even at January 2010 expiration would be $3.35 (Strike A + premium). The premium of $0.85 per share would allow me to participate in a Ford recovery for less than half of the price of the stock.

Does this sound good? Well it didn’t sound very good to me. I was expecting it too cost a lot less. After all the 2.50 strike is $0.70 out of the money. That may not sound like a lot, but that is almost 39% of the price of the stock. Even the January 2010 5 strike would cost $0.60. So what’s going on here, why is it so expensive?

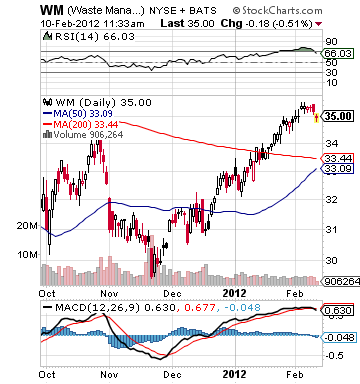

Let’s look at the chart at right for Ford. This is a weekly candle chart for the last 12 months. We can see that Ford has been as high as $8.79 but that in October it took a big drop. However since then it hasn’t bounced around that much and is slowly settling in at the current price of $1.80. This chart doesn’t tell the whole story of why the options are so expensive. Click the image for a larger chart.

So we’ll look at the Implied Volatility (IV) chart at left. Wow! Ford’s IV is currently over 200%. Just to give you an idea of how high that is we can see here that the low for the year was 36% back in February. What does this tell us? IV is a measure of how expensive an option is considering the strike, the time left and the volatility of the underlying. This IV chart is telling us that Ford options are very expensive. Implied volatility levels of 200 are typically found in options of Pharmaceuticals companies that are awaiting an FDA approval. I didn’t expect to see this kind of IV for Ford.

However I should have expected a very high IV. Considering that Ford has a real possibility of going out of business, the demand and therefore prices of put options would have to be pretty high. Additionally if the government bails them out, the stock price would immediately shoot up. With all this uncertainty I should have expected that the market would be pricing the options this way.

So where does that leave my trading idea? Well I think the price of the options is just too high. I was looking for a bargain, but the potential movement of the stock is already priced in to the call price. Of course it could work out; it’s just not as good a bet as I would have liked.

In high Implied Volatility environments, buying a call is not attractive. If the government does bail them out, the IV will drop like a rock and my call value will not increase as much as one might predict. If Ford goes under, my call will be worthless.

So what to do? Well if you’re still willing to make a bullish play on Ford, buying the stock might be an alternative. Then it is not subject to implied volatility and it never expires. Of course you would give up the advantage of leverage. Another consideration would be to make a spread where dropping IV might actually help, but that’s a discussion for another time.