Three Alternate Uses for a Roth IRA Other Than Retirement

Post on: 16 Март, 2015 No Comment

December 21, 2011

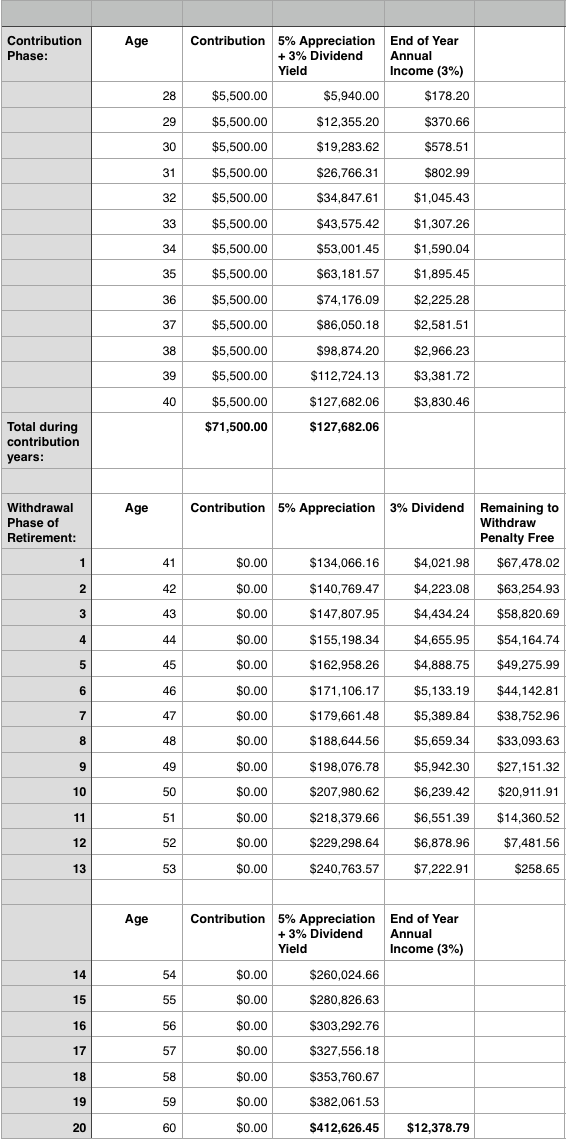

While a Roth IRA was designed primarily as a retirement plan for American citizens, the account’s flexibility allows it to be used for other financial goals besides retirement. The United States government has set up Roth IRAs to allow individuals to withdrawal funds from the account early and allow the proceeds to be used to pay for other things besides retirement.

Typically investors cannot withdrawal their earnings, interest, and income from a Roth IRA until you reach 59 ½ years-old. (You can always withdraw your contributions penalty and tax free.) An early withdrawal that does not qualify for an exemption is considered a non-qualified Roth IRA distribution. Early withdrawals not exempt are subject to a 10% penalty and taxation by the Internal Revenue Service (IRS). So, what are a few alternative uses allow for Roth IRAs?

Use A Roth IRA To Buy A House

You may withdrawal funds from your Roth IRA to buy a house before reaching 59 1/2 years-old. Your investment in the Roth IRA must have met the 5 year rule. used directly for purchasing a home as a down payment or closing costs, and you cannot withdrawal more than $10,000 from your Roth IRA for the home purchase. Early withdrawals for a home purchase from a Roth IRA are both penalty and tax-free.

Use A Roth IRA To Fund Education

Another alternative to You can withdrawal money for college from your Roth IRA if you have to. While you can withdrawal your investment to fund college education expenses, there are a few limitations that you must consider beforehand. You can withdrawal your contributions tax-free from a Roth IRA at anytime, but you must pay taxes on your earnings if you withdraw them before you reach 59 1/2 years-old and use the money to fund education expenses.

There is no 10% early withdrawal penalty if it is used for qualified education expenses. Qualified education expenses are tuition, fees, books, supplies, equipment, and room and board (in most cases), and you can use the funds for educational expenses for yourself, your spouse, your children or your grandchildren.

Use A Roth IRA To In An Emergency

You should have an emergency fund in place to help you in the event of an emergency. In fact most financial planners recommend that you should have three to six months of living expenses saved in an emergency fund. But, what if you don’t have an emergency fund available? If it is a true emergency, then you can carefully consider withdrawing money from your Roth IRA to help. This should be used as a last resort. There are serious consequences such as a 10% penalty and taxes if you prematurely withdrawal your earnings from a Roth IRA. Consider only withdrawing a portion of the contributions that you invested in your Roth IRA in order to avoid paying penalties and taxes should you need to raid your Roth in an emergency.

One of the best features of a Roth IRA is its flexibility. Senator William Roth and his committee developed the retirement plan to mirror the American Dream. With a Roth IRA’s flexibility, you can withdrawal money in order to fund different financial goals that you may have such as buying a home or sending your children to college.

Photo by liz west via Flickr