Theta and Gamma An Option Trader s Tradeoff

Post on: 25 Июнь, 2015 No Comment

optionsguy posted on 02/11/10 at 12:19 PM

TradeKing’s Brian Overby explains options for beginners in this back-to-basics series. Today’s post discusses vega, the options Greek measuring the effect of volatility on your position.

What are the options “Greeks”? This refers to a set of calculations with mostly Greek-sounding names like delta, theta, vega, gamma and rho. The Greeks help you measure the impact of variables – like interest rates, time passing, and so on – that will likely affect the price of your options contract.

First I introduced delta. the most widely-discussed Greek measuring the relationship between the underlying stock’s movement and its options price. Delta is dynamic. it moves not only as the underlying stock moves, but as expiration approaches.

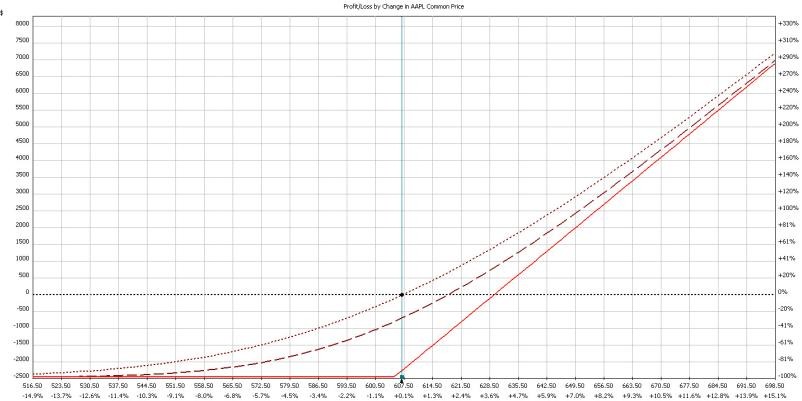

Next we moved on gamma. the amount a theoretical option’s delta will change for a corresponding one-point change in the underlying’s price. Last week we introduced theta. which measures the effect of time decay on your options position. Today we’ll explore gamma and theta’s symbiotic relationship: with explosive gamma-acceleration comes similarly accelerated time decay.

High gamma means high theta

Let’s break down the trade-off between high gamma and theta.

Theta, the time-decay Greek, responds to volatility swings. If volatility increases, theta becomes a larger negative number for both near- and longer-term options. As volatility decreases theta usually becomes a smaller negative number. Put in plainer terms, then, a high-volatility option tends to lose more value due to time decay than a lower-volatility option. If you like trading high-volatility options for the action they bring, you’re also fighting time decay harder with these contracts.

Here comes the tradeoff part. If you want to slow down time decay — that is, get a low theta — Gamma is the Greek you’ll have to sacrifice. If you recall from my gamma post, gamma operates like acceleration, an attractive quality to options buyers. Also, options with the highest gamma values are the nearest-term ATM option contracts. Bottom line: if you want low theta, or undramatic time decay, you will by default be trading an option that has low gamma or slower acceleration, too. Similarly, throttling up the gamma will do the same for time decay.

Next week, I’ll walk you through how to evaluate theta, or time decay’s effect, on your entire portfolio. It’s a big-picture view on your positions that you won’t want to miss. See you then!

Regards,

Brian Overby

TradeKing’s Options Guy

www.tradeking.com/ODD.

Any strategies discussed or securities mentioned, are strictly for illustrative and educational purposes only and are not to be construed as an endorsement, recommendation, or solicitation to buy or sell securities.

Even though the Greeks represent the consensus of the marketplace as to how the option will react to changes in certain variables associated with the pricing of an option contract. There is no guarantee that these forecasts will be correct.

Supporting documentation for any claims made in this post will be supplied upon request. Send a private message to All-Stars using the link below the profile image.

TradeKing provides self-directed investors with discount brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice.