There is evidence that small government countries grow faster The Commentator

Post on: 16 Март, 2015 No Comment

Share by Email

Cancel

The publication of the TPA and IODs 2020 Tax Commission this week has reopened the debate over whether government size affects economic growth. They suggest there is plenty of evidence that small governments grow faster. Others, like IPPRs Nick Pearce, say there is no evidence that government size is important at all. How can both views be reconciled, and who is right?

Our starting point should be that all effective economies require a government to enforce property rights, protect the nation, provide public goods, and to intervene in markets which exhibit large externality effects. This stability should be regarded as almost a prerequisite for growth, which requires tax revenues to fund.

But many rich countries now have governments which do far more than these basic tasks. Endogenous theories emphasise the positive effects that investment in R&D and human capital (especially education and health) can have on economic growth, and advanced economies all engage in expenditure in these areas. But this tends only to amount to between 25 percent and 33 percent of total government expenditure for rich countries, meaning the differential in size of most advanced economies is mainly determined by non-growth enhancing spending or transfers.

These transfers also have to be funded via taxation. Supply-side economists argue that these larger states, with higher distortionary taxation, create larger inefficiencies in big government countries. Whats more, the lower marginal tax rates which small government countries are able to enjoy encourage more entrepreneurial and risk-taking behaviour. Coupled with increased efficiency, this leads to higher productivity and faster economic growth. Economic growth itself therefore increases the ability to provide high quality public services, meaning there is no prior reason to expect small governments to deliver worse objective social outcomes.

The debate about the extent to which this is true is therefore an empirical one do smaller governments lead to higher growth or not? In a CPS Pointmaker. released today, our evidence suggests they do.

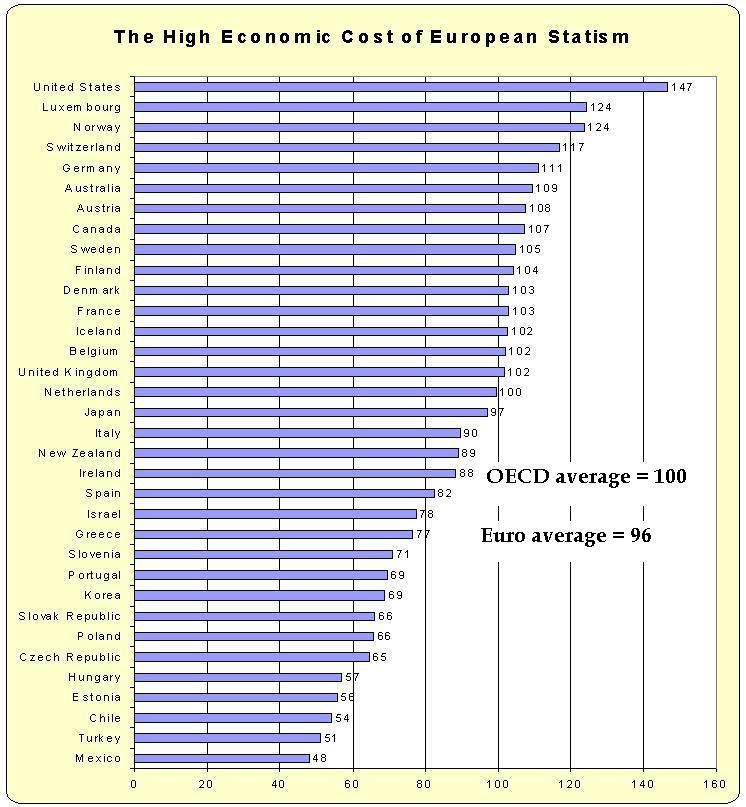

We examined all OECD countries defined as advanced by the IMF between 1965 and 2010, and used regression analysis to control for a multitude of other factors in addition to government size which we might expect to affect growth, including individual country effects which might be fixed over time. Our results suggest that reducing the tax or spending to GDP ratio by 5 percentage points increases the GDP per capita growth rate by 0.5-0.6 percentage points per annum. This is robust to controlling for shocks affecting all countries over time, the openness of the economy and the proportion of dependents within the population.

Looking at a broader sample of all advanced countries (defined by the IMF) over the past ten years supports these findings. Defining small countries as all those who have had tax and spending to GDP ratios of less than 40 percent, we see that these have grown at an average annual rate of 3.1 percent compared to 2.0 percent for all bigger government countries.

Is this conclusive proof that cutting the size of government will always increase growth? Of course not. The accumulation and quality of the other factors of production is also important and theres tonnes going on. But what this evidence shows is that other things equal, countries with smaller governments and with smaller tax burdens grow faster.

Some will no doubt highlight that our equation doesnt examine the quality or improvements in quality of other factors of production. There is no evidence, however, especially from the past ten years, that bigger governments result in statistically different social outcomes for key measures of health and education, which are associated with higher human capital, suggesting that there is little link between total government outlays and overall quality. In fact, small government countries have performed significantly better in the PISA educational outcomes, for example.

What to conclude? Our findings add to the already significant body of literature which suggests that smaller states grow more quickly after accounting for other factors associated with mainstream growth theory. It also shows that there appears to be little correlation between government size as a proportion of GDP and some key outcomes in health, education, employment growth or household consumption growth. The implication is that in the medium term, constraining the size of the state can be good for growth, and there is no need for overall cuts to the size of the state to result in damaging objective social outcomes.

Its important to note here, that if a small state with a low tax burden leads to significantly higher growth, it is likely to have more resources to devote to public service provision, even if it dedicates less as a proportion of GDP. A good example here is Singapore, which has a life expectancy of 81 despite spending 3.3 percent of national income on public health.

The policy implications:

1. Reducing the size of the state as a proportion of the economy should have been an aim in itself, even if we didnt have a deficit right now.

2. Policymakers should focus on outcomes rather than inputs when discussing public services. In particular, it makes no sense to judge competency in a policy area by the proportion of GDP spent on it.

This second point might seem obvious, but Labour did exactly that with healthcare spending targets under Blair.

Ryan Bourne and Tim Knox are available for comment and interview. Follow CPS on Twitter @CPSThinkTank