The Wild Wild World of Hedge Funds New York Magazine

Post on: 4 Апрель, 2015 No Comment

Search Listings:

The Running of the Hedgehogs

Maybe you were hoping that hedge funds were another passing fad that you could safely ignore. Well, they are a fad, but they show no evidence of passing, and we are now living in the wildest, most unrestrained financial moment in recent history. So its time to stop faking it and figure out what its all about.

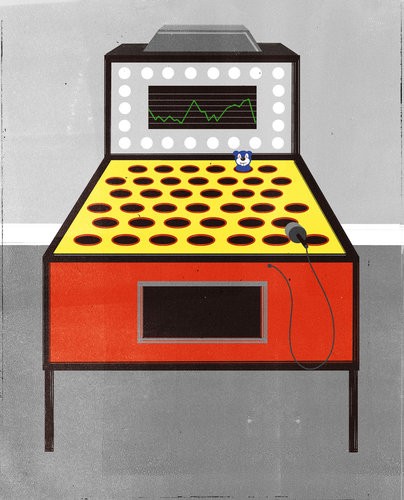

Illustration by Patrick Thomas

N ot so long ago, the talk about hedge funds was all about their money—some guy youd never heard of buying an $80 million piece of art or a $25 million teardown in Greenwich, Connecticut, or paying himself $1 billion for a single years work. It was a spectator sport, absurd but entertaining, to a degree. Then the talk started to get serious, like, were hedge funds artificially bidding up the price of oil? What about that deal where a single trader ripped through $6 billion on a bad hunch about natural-gas prices—should that concern more than just the pissed-off people who entrusted him with their money? Or those two little bouts of panic the market has suffered this year already: Are hedge funds the virus thats going to make the markets keel over? Are they an evil cabal?

Questions like this now come up in casual conversation, but those conversations run out of steam fast because, though plenty of people fake it, few know much about hedge funds, other than that they made George Soros so rich he can influence world events and then everybody else wanted in. But as for what a hedge fund actually does—the only ones who know work at them, and they dont talk about it. Plus you never see them anymore because theyre either in their caves or scuba-diving off Bora Bora.

But really, its time you understood them. As of March, by one estimate, there was a staggering $2 trillion invested in hedge funds worldwide, up nearly tenfold from 1999. Today, there are more than 9,000 hedge funds, 351 of which manage $1 billion or more. Traditional investment firms are bleeding talent to hedge funds, and theres a lot of room left for this thing to run: A recent study by consulting firm Casey, Quirk and the Bank of New York predicts that institutional assets in hedge funds could nearly triple by 2010. Last year, the average hedge fund was just 5.3 years old.

Lesson one: Just what is a hedge fund?

Its only a vehicle for investing, albeit one that happens to be less constrained than most. Your run-of-the-mill mutual fund, for example, buys stocks and bonds, and thats pretty much it. Most are not even allowed to employ short selling, a way of betting that the price of a security will fall. Hedge funds can employ whatever investing tools they want, including leverage, the use of derivatives like options and futures, and short sales. The New York Times decided years ago to incessantly refer to hedge funds use of these instruments as “exotic and risky,” thereby adding to their aura of mystery. The funny thing: Practically all financial institutions use these “exotic” instruments.

Theres a much simpler way of putting it, offered by one of the industrys luminaries. According to Cliff Asness of AQR Capital, “Hedge funds are investment pools that are relatively unconstrained in what they do. They are relatively unregulated (for now), charge very high fees, will not necessarily give you your money back when you want it, and will generally not tell you what they do. They are supposed to make money all the time, and when they fail at this, their investors redeem and go to someone else who has recently been making money. Every three or four years, they deliver a one-in-a-hundred-year flood.”

Although the origin of hedge funds dates back to Alfred Winslow Jones and the fifties, it wasnt until the late sixties that the category became a recognizable seedling of its current state: a group of highly skilled traders catering to a very wealthy clientele willing to gamble to get humongous returns. The first true stars of the hedge-fund universe—people like Soros, Michael Steinhardt, and Bruce Kovner—were experts in commodities and currencies and figured out how to exploit inefficiencies in those markets. Because they raised money privately—largely from friends and business associates—they avoided most of the disclosure requirements of U.S. securities laws. That meant they didnt have to explain to anybody how much money they had or what exactly they did with it. The deal, in effect, was this: Rich guys could gather up money from other rich guys without oversight, so long as they agreed not to utter a word to the general public that could be construed as “solicitation,” including “communication published in any newspaper, magazine, or similar media.” Not that there was any point in soliciting the public anyway. To get into a fund, you had to invest $2.5 million. Managers were expected to have their own money in the fund, an informal check against reckless risk-taking.

A mythology began to take shape.