The Volatility Index Reading Market Sentiment

Post on: 23 Сентябрь, 2015 No Comment

The Chicago Board of Options Exchange (CBOE) creates and tracks an index know as the Volatility Index (VIX), which is based on the implied volatility of S&P 500 Index options. This article will explore how the VIX is used as a contrary market indicator, how institutional sentiment can be measured by the VIX and why an understanding of the VIX tends to favor long and short puts. (For a comprehensive overview of options, refer to our Options Basics Tutorial . )

Measuring Market Movers

As stated earlier, the VIX is the implied volatility of the S&P 500 Index options. These options use such high strike prices and the premiums are so expensive that very few retail investors are willing to use them. Normally, retail option investors will opt for a less expensive substitute like an option on the Spyders’ SPY, which is an exchange-traded fund (ETF) that tracks the S&P 500. If institutions are bearish, they will likely purchase puts as a form of portfolio insurance. The VIX rises as a result of increased demand for puts but also swells because the put options’ demand increase will cause the implied volatility to rise. Like any time of scarcity for any product, the price will move higher because demand drastically outpaces supply.

Mantra Maxims

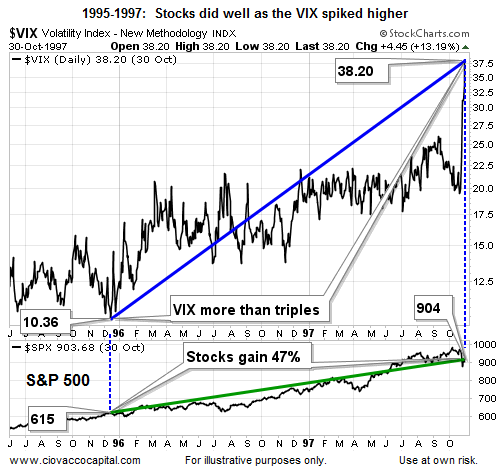

One of the earliest mantras investors will learn in relation to the VIX is When the VIX is high, it’s time to buy. When the VIX is low, look out below! Figure 1 attempts to identify various support and resistance areas that have existed throughout the VIX’s history, dating back to its creation in 1997. Notice how the VIX established a support area near the 19-point level early on in its existence and returned to it in previous years. Support and resistance areas have formed over time, even in the trending market of 2003-2005. When the VIX reaches the resistance level, it is considered high and is a signal to purchase stocks – particularly those that reflect the S&P 500. Support bounces indicate market tops and warn of a potential downturn in the S&P 500. (Take a closer look at support and resistance concepts in Support & Resistance Basics . )

Perhaps the most important tidbit to glean from Figure 1 is the elastic property of implied volatility. A quick analysis of the chart shows that the VIX bounces between a range of approximately 18-35 the majority of the time but has outliers as low as 10 and as high as 85. Generally speaking, the VIX eventually reverts to the mean. Understanding this trait is helpful – just as the VIX’s contrary nature can help options investors make better decisions. Even after the extreme bearishness of 2008-2009, the VIX moved back within its normal range.

Optimizing Options

If we look at the aforementioned VIX mantra, in context to option investing, we can see what option strategies are best suited for this understanding.

If the VIX is high, it’s time to buy tells us that market participants are too bearish and implied volatility has reached capacity. This means the market will likely turn bullish and implied volatility will likely move back toward the mean. The optimal option strategy is to be delta positive and vega negative; i.e. short puts would be the best strategy. Delta positive simply means that as stock prices rise so too does the option price, while negative vega translates into a position that benefits from falling implied volatility. (To learn more about options greeks, see Getting To Know The Greeks and Using the Greeks to Understand Options .)

When the VIX is low, look out below! tells us that the market is about to fall and that implied volatility is going to ramp up. When implied volatility is expected to rise, an optimal bearish option strategy is to be delta negative and vega positive (i.e. long puts would be the best strategy).