The VIX Volatility Indicator Investment U

Post on: 16 Март, 2015 No Comment

by Karim Rahemtulla Wednesday, May 12, 2010 Wisdom of Wealth

Wednesday, May 12, 2010: Issue #1258

Over the past few trading days, we’ve seen the awesome power of stock market volatility at its best — and worst.

Whether or not you believe the so-called fat finger theory responsible for last Thursday’s bone-chilling plunge for the Dow doesn’t matter. The point is, it was a prime example of how the market’s two powerful, primal emotions — fear and greed — produce huge volatility.

In this case, it was obviously fear that prompted an all-out mass panic, as the Dow traded in an incredible 1,138-point range between its high and low points on the day.

We saw the reverse on Monday when greed-induced volatility sent the Dow up by 405 points — its biggest daily gain in over a year.

So what’s your reaction to this?

If you’re not using this indicator, you’re missing out.

Want Help Making Your Buy/Sell Decisions? Check the VIX.

If you’ve followed the market over the past few months, you’ll know all about volatility.

But if you’ve read Investment U over the past few months, you’ll know exactly how to use it to your advantage through the CBOE Volatility Index (^VIX )

In early January, for example, I tipped readers off that volatility was back in the market and followed up a couple of weeks later with a simple way to profit from volatility with one investment.

Want to know the best times to buy and sell stocks? Just look at the VIX.

How to Translate the CBOE Volatility Index (VIX)

The Volatility Index’s movements work opposite to the broader stock market. For example.

When the VIX is High: When the VIX hits 40 points (or higher), it signals that investors are fearful. and sometimes in outright panic mode. This is the best time to buy stocks at cheaper levels because a rising VIX usually indicates that the market is falling.

We saw a super example of this last week. On Wednesday, the VIX closed at a comfortable 24.91 points. But on Thursday, as Mr. Chubby Finger sent the market into a tailspin, the VIX rocketed up to a high of 40.71 before closing at 32.80. It then shot up to 42 points on Friday before closing at 40 points.

When the VIX is Low: If the VIX drops under 20, or close to the 10-point level, it implies that investors are complacent. You should lighten up on your positions because when the VIX falls, it typically means that you should prepare for a selloff.

So how is the VIX calculated?

Get Ahead of the Market’s Moves by Using The VIX

The measurement behind the CBOE Volatility Index (VIX) is simple. It boils down to how many put options people are buying versus call options on the stocks in the S&P 500.

The VIX tabulates these trades and produces a number, which measures the likelihood of a market move in a certain direction. And crucially, that number is also a leading indicator, not a lagging indicator.

So let’s expand on the action you should take, based on what the VIX tells us.

What You Should Do When the VIX is High and Low

Remember, when the VIX is low — below 20 — it signals that the market is complacent and you should get defensive with your investments. How?

And when the VIX is above 40, you should do the opposite:

Last week, I engaged in all of the above activities.

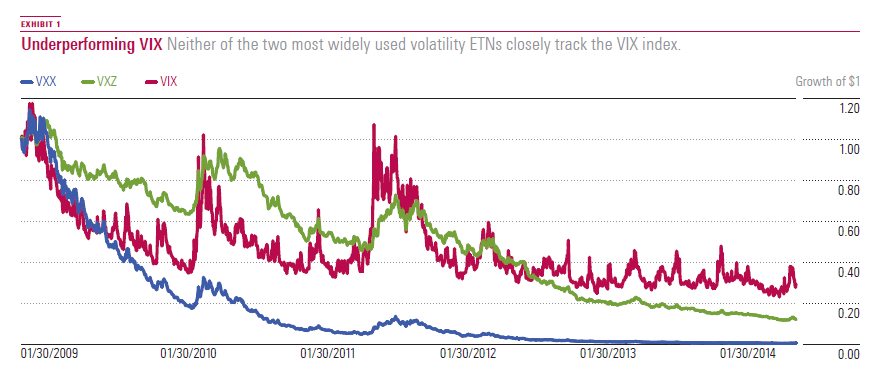

I’d recommended to my options-trading readers that they establish a position in the VXX a few weeks earlier. I was also short both the S&P 500 and the iShares FTSE/Xinhua China 25 Index (NYSE: FXI ) — the ETF that holds the largest Chinese equities. I also sold put options on e-Bay (Nasdaq: EBAY ), which moved higher due to the selloff.

I didn’t see my account soar in value, but it didn’t fall much either. Because I was hedged, it allowed me to sleep much better. Now it’s your turn.

Volatility is Inevitable. Are You Combating It?

If you’re looking for a signal about what you should be doing, the VIX should be at the top of your monitor.

That’s because in unpredictable times like these, volatility is the rule. not the exception. The chances of volatility increasing are also greater, too, with significant events occurring around the globe more frequently than ever before.

The results of those events will affect you and your investments. That means the need to respond quickly and effectively is critical.

So give your portfolio a check-up and make sure you’re prepared for the next bout of volatility.