The Value of Growth for SaaS Companies

Post on: 16 Март, 2015 No Comment

I received a report from SaaS Capital titled Leaders and Laggards: SaaS Growth and the Cost of Capital. The subject of the report is how the public markets value a high growth SaaS company (their definition of high growth is >25% YoY).

The report states, 13 public SaaS companies tracked by Pacific Crest Securities have increased in value 40% since the beginning of 2008. During that same period, the S&P index has yet to return to its pre-recession value.

It goes on to say, not all public SaaS companies have performed equally well. To be a standout in this space, growth needs to be greater than 25% per annum, and the market opportunity needs to be significant (e.g. CRM, ERP, HCM, etc).

They claim that growth dominates over profitability for a couple of reasons. The first is that the SaaS market is still immature with only a third of the entire software market spend. The second is that these companies have been able to demonstrate significant profitability after sales and marketing spend is cut back.

Im not sure I necessarily buy into this last statement because Ive yet to see any high growth SaaS companies that have cut back on their sales and marketing spend in favor of profitability. In fact, I remember a few years ago speaking with Phill Robinson, the then-current CMO of Salesforce. His comment to me was that he had not reached a point of diminishing return from his investments in Google Adwords and Salesforce has continued to invest heavily in sales and marketing mostly brand marketing v demand marketing surprisingly.

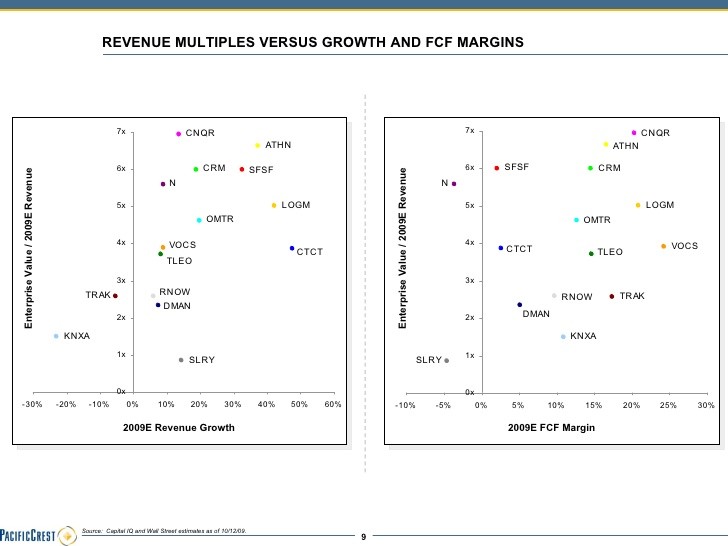

Here is the chart that SaaS Capital showed with the relative performance of each of the 13 public SaaS companies.

So, its true for public SaaS companies but does high growth spell high valuations for private SaaS companies?

The answer is a resounding yes. In fact, even more so. For fast growing private SaaS companies, valuations have recently been over the top. In the public markets, the high multiple ranges but is about 10x-12x annual revenues.

In the private markets, a high growth SaaS company with only a 12x multiple could be a great deal for an investor. One of the companies I looked at last year had less than $5M in revenue but the pre-money valuation of the round when it was completed was in the mid $100M range all because its YoY growth rate and its pipeline had grown so fast and it was in a very large and addressable market.

In contrast, a low growth SaaS company is in a precarious position. The authors of the SaaS Capital report cite a private SaaS company they have been working with that generated $11M in revenues and is profitable but only growing somewhere north of 10% per annum. The company was unable to find any interested strategic investors and is hoping to get a financial buyer to pay 1.5x revenue this year. If they do, I think they should consider themselves fortunate.

So, if you want a successful outcome for your SaaS business, by defnition it needs to generate high growth. To do that, you need the capital to invest in sales and marketing. And, as I have written about in previous blogs, in a high volume SaaS model, lead generation not sales capacity , fuels growth. This is one reason why I believe we havent seen any leading SaaS companies emerge that havent been venture backed at some point to fuel growth.

So, by definition, if youre a SaaS company its incumbent upon you to find marketing personnel who are experts at lead generation. I know this is one of the critical hires in each one of my SaaS portfolio companies and it is becoming increasingly more difficult to attract this highly sought after talent.

Given the importance of lead generation for the SaaS model and company valuations, I suspect over the next few years, that marketers with proven lead generation skills in the SaaS market may see base + variable compensation on the same level as sales personnel.