The Underbelly Of Corporate America Insider Selling Stock BuyBacks Dodgy Profits

Post on: 16 Март, 2015 No Comment

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

The hollowing out of corporate strengths to enable short-term profiteering by the handful at the top leads to systemic fragility.

Where is the data showing insiders buying hand over fist at these valuations?

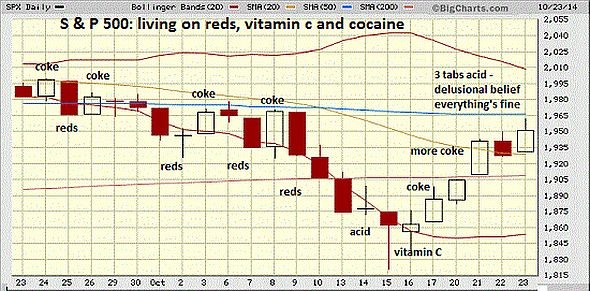

Insider selling has been raising red flags since March 2014: In-the-know insiders are dumping stocks

Where is the data proving Corporate America isnt borrowing billions of dollars and using the nearly-free money to buy back shares? Buying back shares reduces the float (stocks available for purchase by the public), reducing supply and creating demand which pushes prices higher.

Stocks Biggest Gains Are an Inside Job. Companies spent $598.1 billion on stock buybacks last year, according to Birinyi Associates in Westport, Conn. That was the second highest annual total in history, behind only 2007, Birinyi calculated. The pace picked up in the first quarter of 2014, when companies spent $188 billion, the highest quarterly amount since 2007.

Where is the data showing Corporate America has added jobs?

Who actually creates jobs: Start-ups, small businesses or big corporations? During the 1990s, American multinational companies added 2.7 million jobs in foreign countries and 4.4 million in the United States. But over the following decade, those firms continued adding positions overseas (another 2.4 million) while cutting 2.9 million jobs in the United States.

As for dodgy accounting: when the dodgy accounting has been institutionalized, its no longer viewed as dodgy. Which brings us to the money shot of the comment: Executive compensation based on stock performance is killing corporate America.

When executives and others at the top of the corporate pyramid have such an enormous incentive (stock options worth tens of millions of dollars) if they can push the stock price higher with buy-backs paid with borrowed money and accounting gimmicks that inflate headline earnings, then why wouldnt they do precisely that?

The profits are as bogus as the stock prices: both are relentlessly gamed to make sure fortunes can be reaped in a few years by those at the top.

As the comment noted, this hollowing out of corporate strengths to enable short-term profiteering by the handful at the top leads to systemic fragility. No shock is needed to bring down these fragile corporate structures: existing debt and the slightest tremor of global recession will be enough to topple the rickety facade.