The Married Put Option Strategy Investment U

Post on: 16 Март, 2015 No Comment

by Karim Rahemtulla Tuesday, November 3, 2009

Tuesday, November 3, 2009: Issue #1129

Here’s the situation. We have an uncertain, volatile stock market that can’t figure out its next move.

Thanks to the rally for much of this year, many investors have recovered a good chunk of what they lost in 2008. Some are even sitting on some big profits in a few positions.

What do you do now?

Some investors will lock in their gains and retreat to the sidelines. Others will stay invested and take their chances.

Whose approach is right?

Neither. There’s a better way to protect your profits without selling anything, and you can do it by executing a married put option strategy. Here’s how it works.

The Art of Put Options

Put options primarily used to accomplish two things.

- Buying stocks: When you sell a put option. you’re obligated to buy the underlying stock at the designated strike price, as long as the shares are trading below that strike price.

Today, we’re going to focus on the buy side.

Let’s say we bought Intel (Nasdaq: INTC ) for $13 back in March. Today, we’re sitting on a $6 profit.

In a market like this, that gain could evaporate in a hurry. Alternatively, it might not if the market heads higher. So we’re stuck, right?

Well, no.

Most ordinary investors would employ a simple 20% trailing-stop from current levels, meaning they’d sell the position if the stock falls by $3.80. An important admirable strategy in order to protect profits, or limit losses — and one we frequently preach here.

But what if you could actually protect your downside for less money for a pre-determined period of time?

How to Marry Your Stock Position With a Downside Hedge

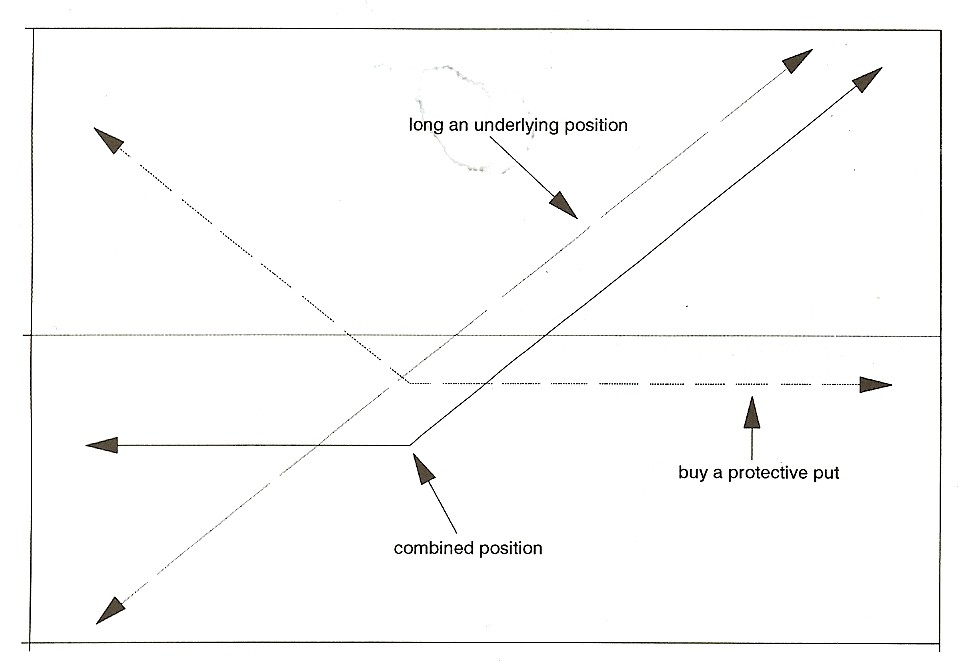

If you buy a put option, you’re hedging against downside on the underlying shares. So if the stock declines, the option will increase in value. On the other hand, the option will decline in value if the stock rises.

But at no time will you risk losing more that what you paid for the option.

So let’s say we expect the market to be rocky for the next six months. Here’s what we could do.

Buy the Intel April 2010 $19 puts (at-the-money), trading for about $1.90 per contract.

This means that if Intel falls below $17, we’ll start making money on the put option (remember, we have to subtract the price we paid for the option). We’ll make more money if the decline occurs sooner, since the amount of option premium allocated to time and risk would increase, especially the risk component.

When we buy this option, we’re essentially saying that we’re willing to give up $2 in profit (the cost of the at-the-money option you bought) in order to protect us from any fall in price below that.

It also means that we’ve added $2 to our cost in the position (consider it insurance). If Intel moves the other way and heads into the $20s, we’ll lose 100% of the amount paid for the option if Intel closes above $19 by expiration, but we will still participate in the upside of the share price move. However, we could sell the put earlier to recoup some of the cost if a clear uptrend is evident.

The Married Put Option Strategy

This type of option trade is known as a married put. where you buy a put option against shares that you own.

While this trade is just an example, you could execute the married put strategy today if you wanted to. Just buy Intel at $19 and buy the April 2010 $19 put option against the position for $1.90 and you achieve two things.

- You’ll establish an automatic stop-loss of $1.90 that will be in place until the April expiration.

- For about 10% of your cost, you’ll protect your downside completely. Not an expensive proposition in a market like this one.

And remember, the most you can ever lose when you buy an option is the amount you spent on the option.