The lifecycle of an investor money

Post on: 14 Июнь, 2015 No Comment

Money

A caterpillar hatches, spins a chrysalis, emerges as a butterfly and dies — all within the space of a few short months.

By comparison, the life-cycle of your garden-variety investor spans at least 60 years, but the changes in investment strategy during that time are just as dramatic as the butterfly.

Matching investment timeframe with risk is one of the keys to financial success, but it seems some Kiwis haven’t nailed it yet.

The long-term investment vehicle for many is KiwiSaver, which is now nudging two million members.

Financial Markets Authority boss Sean Hughes, commenting on the latest KiwiSaver report. is one of many to express concerns that not everyone has found the right fit or just choose one plan and stick with it.

He said people needed to take a longterm approach to investment, and make decisions based on their life stage, age and personal circumstances.

The type of KiwiSaver portfolio for someone in their 20s will be different from someone in their late 40s. It’s never a bad time to reassess your investment options in consultation with your KiwiSaver provider and your financial adviser.

Unlike a caterpillar’s hardwired transformation, changing investment portfolios doesn’t happen automatically.

But some KiwiSaver fund managers, like default providers Mercer and ANZ, argue that’s exactly what should happen. They are advocates of the life-stages approach, where the level of investment risk is adjusted on autopilot as people get older.

Mercer has taken it a step further, developing a whole-of-life investment approach that extends beyond retirement. This particular innovation is soon to reach our shores from Australia, but there’s no guarantee that it will work out for everyone.

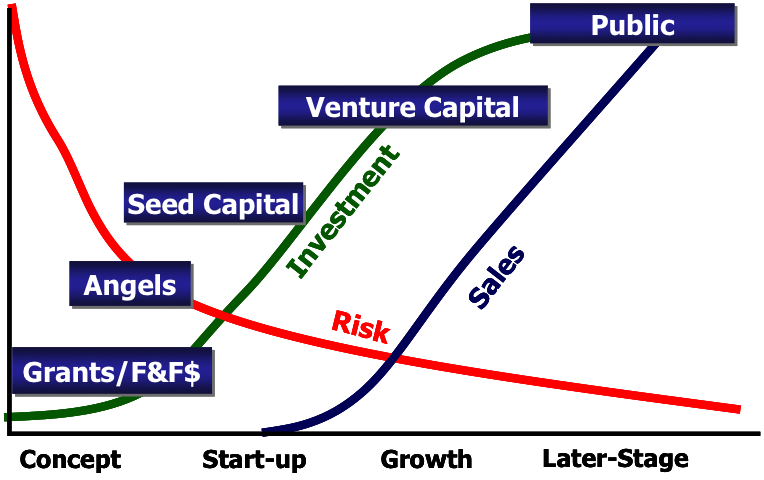

Here’s a refresher on the life-cycle of an investor, which shows where the life-stages approach might fit in.

Every time someone joins KiwiSaver, a new investor is brought into the world.

If they don’t choose their own managed fund, a proportion of their income is automatically channelled into a default option. These conservative funds invest mostly in low-risk cash and bonds. Theoretically, they were meant to be a holding pen for new KiwiSavers, but many have never left the safety of the fold.

Five years down the track, roughly a quarter of people are still in the default funds.

You might expect them to move out of it, but they don’t, says Mercer’s Graeme Mather, leader of the Australia and New Zealand Defined Contribution client unit.

He thinks there’s a big opportunity to transition to life-stages through the government’s review of the default funds, which is underway this year.

I would be very surprised if they weren’t looking at life-stages as one of the alternatives to the conservative approach they’ve taken in the past.

THE CATERPILLAR

Having emerged from the egg, the very hungry caterpillar begins its accumulation phase, eating everything in sight.

In KiwiSaver terms, this might be characterised as investing in a fund which has a higher proportion of riskier growth assets, like shares and property.

Mercer’s pitch is that younger investors should be automatically placed in these more aggressive funds:

A 25-year-old has 40 years before they retire, and hopefully a lot longer to live thereafter, so they’ve got a long time horizon, they can afford to take risk and maximise returns, says Mather.

But that may not gel with another growth strategy that Kiwis are particularly fond of- borrowing money to invest in a house. KiwiSaver contributions can be withdrawn for a first home purchase, with the added benefit of a nice government top-up.

Spicers financial adviser Jeff Matthews says if you’re saving for a deposit on a 5-10 year timeframe, you’d probably want to keep at least half of it in safer assets.

If you’re talking about someone in their early 20s, then that would be a relatively prudent way to go.

And he says if it’s only a couple of years before you want to make that deposit, then leave it alone in the safety of the bank. The automatic life-stages approach means you risk having your savings locked up in stocks and long-term growth assets right when you need to cash them in.

But Mather says the life-stages funds aren’t aimed at those savvy investors.

That type of person, I would expect to talk to a financial planner. We’re focused on members that don’t want to do something different, they don’t want to take an interest. They want somebody else to do it for them.

THE CHRYSALIS

At a certain point, the caterpillar’s appetite for risk slows and it starts to weave a cocoon around itself. This is the consolidation phase.

Middle-aged investors are still operating on a long time-frame and can take on risk, but it steadily diminishes with each passing year.

The need for protection from turbulence in the outside world is increasingly important, and the primary goal becomes saving for retirement.

Jeff Matthews’ rough rule of thumb is to take someone’s age, and use that as the proportion of their investments that should be in fixed interest- that is, bonds and in the bank.

It’s not scientific, but it actually works really well, he says.

That means a 25 year old would have three quarters of their investment portfolio in growth assets, while a 75 year old would be the opposite.

For home-owners, Matthews says it’s only once you’ve paid off your mortgage that you can really get stuck in to retirement saving. Under the Mercer whole-of-life model, at about age 45-50 the fund would slowly begin to shift towards safer investments.

THE BUTTERFLY

At age 65, the new retiree bursts forth from the cocoon, pumps blood into his or her wings and does. what? Until recently, fund managers have assumed the carefree butterfly simply flutters off into the sunset, or possibly down to the RSA for a beer and cheap meal.

The process doesn’t just stop when you hit 65, says Mercer’s head of investments, Philip Houghton-Brown. The KiwiSaver funds to date have not been structured to manage that process post-65, but its something we think providers should be looking at.

The key difference with the whole-of-life strategy is that it carries members through past retirement to provide them with an income. Unlike the relatively simple life-stages funds that exist here, it takes a more sophisticated approach to asset allocation, managing volatility, and tax structuring.

METAMORPHOSIS

Several simple life stages-type funds are already available, offered by the likes of SBS Bank and ANZ, though they’re not defaults.

Fund managers have at least some vested interest in moving people in to more aggressive funds which charge higher fees.

Retirement Commissioner Diana Crossan wants providers to get better at talking to customers, so that people can make the choice to switch to life stages by themselves.

Strict rules about selling KiwiSaver have made it expensive for them to reach out and talk to their members, though some are much better than others.

It’s certainly a lot cheaper and easier to wait and hope that the government overhauls the default system itself.

Mercer’s Graeme Mather says talking to members and educating them is critical, particularly if any changes are made.

Otherwise, we could end up with a pension scandal if people feel like they’ve been switched into higher-risk strategy without proper communication.

It also raises the spectre of blaming politicians for poor returns when the riskier growth funds go through periods of volatility. But leaving people to languish in conservative funds won’t work out well in the long run either.

- BusinessDay.co.nz