The Iron Condor Strategy Explained

Post on: 26 Июнь, 2015 No Comment

The Iron Condor Strategy Explained

Saturday, May 10th, 2014 by Tim Lanoue

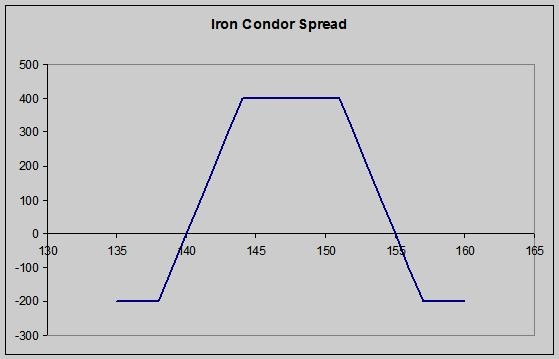

The Iron Condor strategy is a controlled risk and non-directional bound strategy that has the main function of generating a small volume of profits when the targeted asset is displaying relatively low volatility. In order to better grasp the concept of this idea, it is a combination of bull and bearish spreads set for the same expiry time.

The Implementation of the Iron Condor Strategy

The Iron Condor strategy requires four different trades to occur. The first and second trades would be selling a lower strike out-of-the-money put and then placing a even lower put. The third and fourth trades consist of selling a higher out-of-the-money call and then buying a high out-of-the-money call, as a result a net credit is created.

Iron Condor Profit & Risk Limitations

In order to receive maximum profit when using this profit the asset must expire between the strikes and puts of our trades. While the maximum loss with this strategy occurs when the stock price of the asset falls equal too or below the lower strike of the put purchase, which would be the second trade we placed, or equal to the higher buy call, which is the last trade that we place.

Max Profit= Net Gain Received – Commission Payments

Max Loss = Call Price of 4th Trade – Sell Price of 2nd Trade – Net Gain Received + Commissions Paid

Neutral Points

When using this trading strategy there are two opportunities where this strategy would result in no loss or gain. The first would be when our 1st trade that we place is equivalent to the Net Gain Received. The second would be when our 3rd trade is added to our total Net Gain Received.

Iron Condors Example

Lets say the stock ZZZ is trading at a value of $50 in July. Any option trader has the ability to execute this iron condor strategy by buying AUG 40 put for $55, writing an AUG 45 put for $110, writing another AUG 50 call for $100 and buying another AUG call for $50, the net credit earned when entering the trade is $100.

When this option expires in August, ZZZ stock is still trading at a value of $50 so all of our investments expire worthless and option traders get to keep the credit received as profit, which is also our maximum profit. However, if the ZZZ stock expires in August at a value of $50 then all our put investments are not valued, meaning they are worth nothing. The ZZZ stock has an intrinsic value of $500, meaning the real face value of the stock. The initial $100 credit received is $100, $500 $100 = $400 maximum loss in this case. Chances of this scenario of happening is very rare and not likely to occur.

This strategy is applicable to binary options but you need a broker that requires longer expiry periods as offered by the pioneer of binary options Anyoption with expiry times up to 30 days. If you guys have any other questions please feel free to ask, if you need any help please do not hesitate to ask!

4 Responses to The Iron Condor Strategy Explained

- James maladino Says:

I have to say this is an amazing strategy. Which broker is the best for longer expiry times?

Michael Freeman Says:

Hi James, thank you for the comment! Anyoption offers long expiry times but most brokers limit the expiry to 24 hours max. Checkout the Anyoption Review for more information. Cheers! Mike

jon Says:

Is there any video you guys can recommend where this strategy is explained? which brokers are recommended to do this

Michael Freeman Says:

www.investopedia.com/articles/optioninvestor/06/ironcondor.asp Anyoption is the ideal broker for this strategy because they offer longer expiry times. Checkout the Anyoption Review

Leave a Reply

Name (required)

Mail (will not be published) (required)