The Impacts Of Ifrs On The Financial Statement Accounting Essay

Post on: 6 Май, 2015 No Comment

RIESE CORPORATION Effects of switching from U.S. GAAP to IFRS Financial reporting in the U.S. is changing dramatically. Consistent with the

Answer 1)

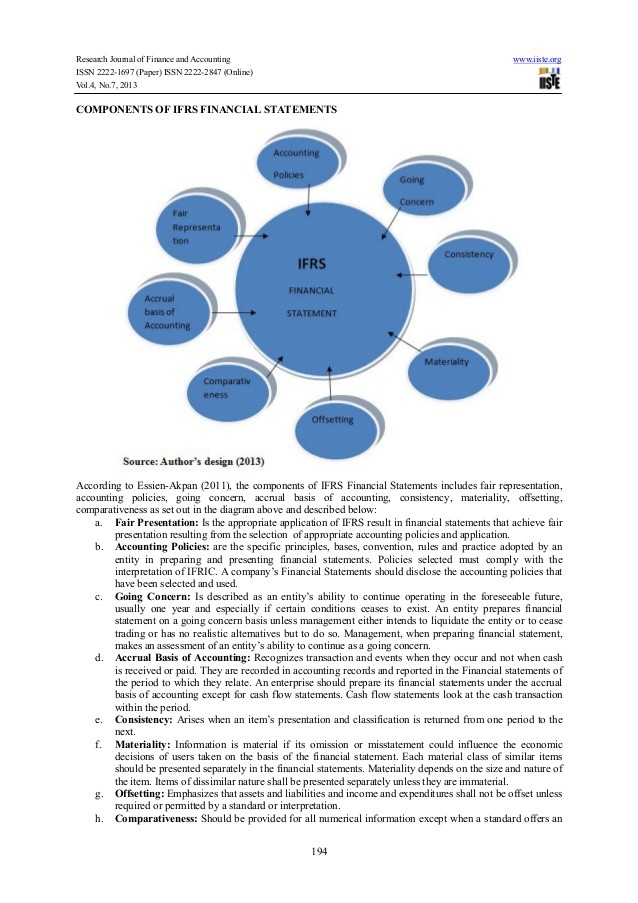

The impacts of IFRS on the financial statement while switching from US GAAP:

Statement of Financial Position-

The statement of financial position would be grouped by major activities

(operating, Investing. and financing), not by assets, liabilities, and equity as it is

today. The presentation of assets and liabilities in the business and financing

sections will clearly communicate the net assets that management uses in its

business and financing activities. That change in presentation coupled with the

separation of business and financing activities in the statements of comprehensive

income and cash flows should make it easier for users to calculate some key

financial ratios for an entity’s business activities or its financing activities.

Assets and liabilities would be disaggregated into short-term and long-term

subcategories within each category unless an entity believes presenting assets and

liabilities in order of liquidity provides more relevant information. Totals for

assets and liabilities and subtotals for short-term and long-term assets and

liabilities would be presented in the statement of financial position or in the notes

to financial statements.

Statement of Comprehensive Income-

The proposed presentation model eliminates the choice an entity currently has of

presenting components of income and expense in an income statement and a

statement of comprehensive income (two-statement approach) or, alternatively, of

presenting information about other comprehensive income in its statement of

changes in equity (U.S. generally accepted accounting principles only). All entities

would present a single statement of comprehensive income, with items of other

comprehensive income presented in a separate section. This statement would

Similarities

The ultimate goal of UK GAAP and IFRS is same – to present information about

financial performance and position to all concerned stakeholders. If the aim is

same, then should be the main approach adopted by both accounting standards.

Differences

Though the overall aim is same, the differences in implementation and financial

reporting do occur due to social, economic and political backgrounds of different

nations.

Main concepts behind UK GAAP and IFRS are same, but when we look at micro

level, we see many differences at the individual standards level. Following are the main differences

between UK GAAP and IFRS:

The Statement of Principles allows use of both historical cost and current value

approaches in measuring balance sheet categories. The dual use of historical and

current value methods is known as modified historical cost basis (ASB, 1999).

Under historical cost, the carrying values of assets and liabilities are stated at the

lower of cost and recoverable amount. This approach is more conservative as

compared to IAS approach which uses fair value method. Also the choice of

historical or current value method is based on subjective analysis of a company’s

management and hence it is open to some manipulation.

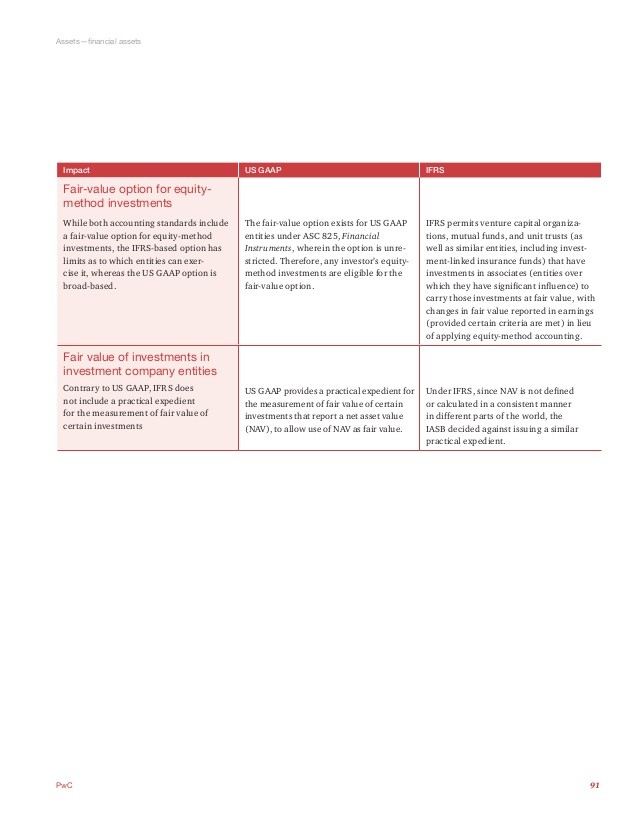

Fair value — If we look at global level, both UK GAAP and IFRS have adopted fair

value method as the foundation of their accounting standards. IFRS takes fair value

adoption even higher when it says that income statement will include the changes

in the fair value of items that have not been yet traded like derivatives. The emphasis in new accounting standards is on mark-to-market fair value of assets and

liabilities rather than on actual market price based fair values. Now both realised

and unrealised changes in fair values would be incorporated in income statements.

The first year of transition will see high volatility in earnings and balance sheet

statements. Though this brings higher volatility, it will also test the management

skills in proper presentation and explanation of changes. It may also change the

benchmarks of success for managements.

Acquisitions- Acquisition accounting will change under new accounting standards.

Under UK GAAP, companies can choose between purchase and merger accounting.

Under IFRS, companies will have to account under purchase method only.

Goodwill- UK GAAP allowed amortisation of goodwill and companies had the

option of not segregating intangible assets from goodwill. Under IFRS, intangible

assets have to be separated from goodwill. Goodwill can not be amortised now but

companies will have to undertake annual impairment tests to justify the value of

goodwill on the balance sheets.

Consolidation of accounts- Under new accounting rules, companies may have to

consolidate certain additional subsidiaries into group accounts. On the other hand

companies will have to exclude certain subsidiaries or special purpose vehicles

which were not included till now.

Research and development costs- Under IAS 39, research costs can’t be carried on

the balance sheet and would have to write them off as incurred. Companies would

still be allowed to capitalize development in line with UK GAAP.

Stock options- Internet and share market last boom in late 1990s led to rapid

increase in share options as a way to reward employees. The new requirements to

record an expense on income statement for the value of share options granted to

employees could have a significant impact on earnings. AstraZeneca said in its pro

forma 2004 IFRS numbers that new accounting rules on stock options has made it

re-consider the use of stock options in rewarding its employees (Tricks, 2005).

Distributable profits- Organizations ability to pay dividends is dependent on their

distributable profits. Following are some of the major impacts of IFRS on

distributable profits — Inability to discount deferred tax liabilities, higher provisions

for deferred tax when companies move from historical costs to fair value and

inclusion of pension deficits in income statement. All of the above will reduce

distributable profits. Many companies would have to financially restructure

themselves in order to have sufficient distributable profits to meet dividends paid

in last year.

Deferred tax credit- Deferred tax credit is available under UK GAAP but not under

IFRS. Inclusion of business disposals gains in profits from operations. Adding

disposal gains to operating profits will make it harder for investors and analysts to

separate the earnings from continuing businesses.