The Discreet Charm of the VXX ETN

Post on: 3 Июнь, 2015 No Comment

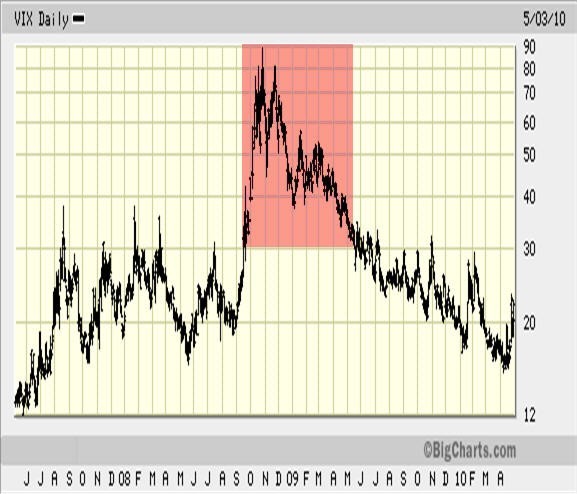

This is the fourth post in the series Im writing to introduce the VIX Portfolio Hedging Strategy. To review: the purpose of the VIX (VXH) strategy is to provide cost-effective protection against tail risks and market crashes. The strategy takes positions in short-term VIX-based products, and varies its allocation to those positions in response to changes in the market environment.

In this post, I discuss the use of the iPath S&P 500 VIX Short-Term Futures ETN (NYSEARCA:VXX ) in lieu of VIX futures. Many investors and money managers are unable to trade futures, for regulatory and other reasons. For such investors, VXX is a natural alternative: it is an ETN that tracks an index that takes rolling positions in first- and second-month VIX futures to achieve a constant 30-day maturity.

But isnt the conventional wisdom that VXX is unusable? VXX has attracted a lot of criticism since its launch, centered primarily on the negative roll yield caused by contango in the VIX futures. My Expiring Monthly colleagues Bill and Adam have covered this topic in some detail, but if youre unfamiliar with the issue, the problem is just that, given an upward-sloping (contango) futures term structure, a long VXX position will incur regular daily losses as it sells front-month futures and buys higher-priced second-month futures, which will in turn gradually decay as time passes and they approach expiration.

(Barclays recently launched an inverse ETN XXV designed to capture this roll yield, but it has its own problems. Traders with speculative intentions might consider simply opening a futures account, instead of paying management fees for dubious structured products.)

The chart below compares the prices of VXX and a rolling 2-month VIX futures contract (rolled at expiration) since the inception of VXX. VXX is on the left axis; the VX future is on the right.

(Click to enlarge)

The difference can be explained in part by the fact that VXX holds front-month futures, which decline to meet the spot VIX level more rapidly. It should also be noted that the 2-month VX future plotted here does not account for monthly rolling, i.e. it simply shows the values of the serial contracts. But a trader looking at this comparison might be understandably worried that implementing the VXH strategy with VXX shares will incur undue costs and/or will fail to replicate historical returns.

To focus the question even further: recall that the key innovation of the VXH strategy is that it allocates capital to varying degrees based on changes in the market environment. As I demonstrated in VIX Portfolio Hedging in a Crisis-Free World. our variable allocation dramatically outperforms a fixed allocation approach.

So the question about the use of VXX is, really: Is the variable allocation method able to overcome the relative disadvantages of VXX versus the futures?

The answer, I think, is an unqualified yes.

(Click to enlarge)

Lest we focus inordinately on the last several weeks on the chart, look instead at the relationship between the hedged portfolios over time: notice that there is an intuitive relationship between the futures-hedged and VXX-hedged equity curves, such that the futures-hedged variation outperforms the VXX-hedged variation slightly when volatility contracts sharply and underperforms when volatility expands.

I say this is intuitive because the presence of a front-month contract in the VXX calculation guarantees more sensitivity in general to fluctuations in volatility: it lags the futures variation in a strong bull market but catches up when the market pulls back. Over the long term, therefore, we should expect the VXX version not to deviate significantly from the VXH strategy using VIX futures. For the statistically inclined:

Again, this is using less than two years of data, so it would be wise to hold on loosely to any conclusions drawn here. But behavioral finance tells us that what we all really care about, really, is achieving positive returns with minimal volatility. Notice that both the VXH(vx) (i.e. using futures) and VXH(vxx) variations exhibited lower volatility and smaller maximum drawdowns than an unhedged SPY portfolio.

So, in conclusion: even though I strongly advise against making a large, fixed allocation to VXX, when used in conjunction with the VXH strategy, VXX offers meaningful portfolio protection at a reasonable cost.

Disclosure: Complex position in VIX futures and options