The Differences Between Exchange Traded Notes and Funds

Post on: 4 Май, 2015 No Comment

Exchange Traded Notes Are Not The Same As Exchange Traded Funds

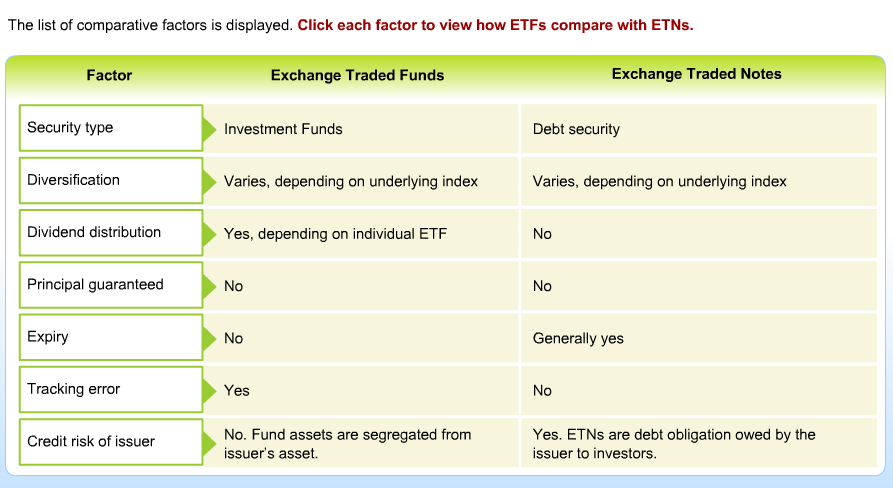

Although Exchange Traded Notes (ETNs) are similar to Exchange Traded Funds (ETFs), there are important distinctions between these two types of financial instruments that investors need to understand to avoid investing pitfalls. Their different structures can cause different performance outcomes, and therefore investors need to understand these differences.

Exchange Traded Notes are issued by major banks as senior unsecured debt notes that are backed by the financial institution that issues them. Exchange Traded Funds, on the other hand, are either a financial security, or in some cases a commodity or currency derivative contract, which includes options and futures. Although the process of buying Exchange Traded Notes and Exchange Traded Funds is the same from the investor’s point of view, when Exchange Traded Notes are purchased . an investor is actually buying a debt contract sold by the issuer that is similar in nature to a bond. The debt contract is essentially a promise to pay what is due per the contract, whereas a derivative contract is valued based only on the valuation of the underlying assets. The terms of the debt contract between the issuer and investor is based on the structure of the Exchange Traded Notes and is detailed in the notes’ prospectuses.

The investment returns from Exchange Traded Notes are linked to the performance of a market benchmark index or strategy that the Exchange Traded Notes are designed to track, minus maintenance fees. As a debt contract, when Exchange Traded Notes are purchased or sold, the value of the Exchange Traded Notes are based on the contractual agreement by the banks that underwrite the Exchange Traded Notes to value their Exchange Traded Notes based on the value of the tracking index or other financial instrument, minus maintenance fees. This arrangement means Exchange Traded Notes have an additional risk compared to Exchange Traded Funds, since a bankruptcy by an issuing bank could cause Exchange Traded Notes issued by the bank to lose value, since Exchange Traded Notes are backed by the creditworthiness of the bank.

An important distinction between Exchange Traded Notes and Exchange Traded Funds is that Exchange Traded Notes do not realize the value of dividends paid by financial securities within the tracking index or other tracking financial instruments, unless the tracking index or other tracking financial instruments themselves realize the value of dividends. Exchange Traded Funds, on the other hand, receive dividend payments directly from their holdings of securities that track indexes or financial instruments, and realize the value of dividends that are paid regardless of how the tracking index or other tracking financial instruments handle dividends.

Trading Exchange Traded Notes

Exchange Traded Notes trade in the same manner as stocks, which means traders and investors can buy and short sell Exchange Traded Notes using brokerage accounts in the same way they buy and short stocks. Exchange Traded Notes can be purchased using a margin account to increase trader and investor exposure to Exchange Traded Notes. The valuation and pricing of Exchange Traded Notes are continuously updated during the trading day, based on the underlying value of the tracking index or other tracking financial instruments and market supply and demand for Exchange Traded Notes.

In rare instances, the price that Exchange Traded Notes trade at can become detached from the underlying value of the tracking index or other tracking financial instruments since the issuing banks must continually create new trading units (shares) of Exchange Traded Notes to meet market demand for Exchange Traded Notes. If the banks stop creating new trading units, due to risk concerns regarding over-issuance and risk exposure, demand for Exchange Traded Notes can cause Exchange Traded Notes to trade at a significant premium to the underlying value of the tracking index or other tracking financial instruments.

Stay up to date on Exchange Traded Notes by getting on our FREE eMail list !

By clicking ‘Submit’, you agree to our Disclaimer and Privacy Policy. We are 100% Anti-Spam and will never share or sell your information!