The Difference Between Finance and Accounting Degrees

Post on: 12 Август, 2015 No Comment

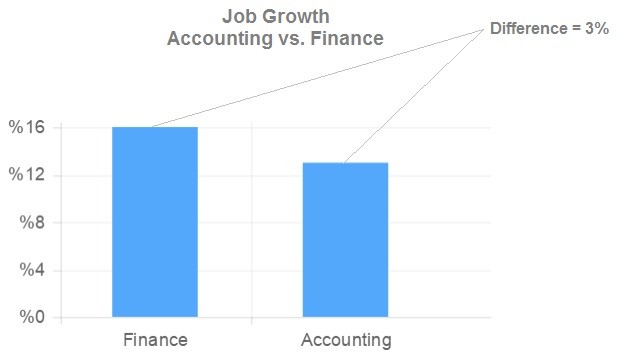

While many similarities exist between the finance and accounting career fields—including a fast rate of growth in the coming years, as predicted by the Bureau of Labor Statistics—the two are by no means synonymous. A bachelor’s degree in accounting and a bachelor’s degree in finance prepare students for distinctly different professions, and prospective students should explore both fields carefully before deciding upon either course of study.

Accounting and Finance Defined

Accounting can be broadly defined as the preparation, evaluation and management of financial records, while finance is best described as the study and management of investments. Accountants are therefore more concerned with budgets, audits, taxes and business financial operations, while financial analysts are typically experts in stocks, bonds and various other financial products available to corporate or individual investors.

Accountants deal with concrete numbers expressing real sums in present time, such as accounts payable and receivable or taxes owed. Financial analysts deal with more ephemeral or uncertain figures, including projected returns on investment (ROI) or stock prices. Accountants manage today’s revenue, and financial analysts anticipate tomorrow’s profits.

Degrees in Accounting and Finance

Because accountants and financial analysts must both be proficient in basic computational math and quantitative analytics, the core competencies required for either bachelor’s degree overlap to some extent. Coursework in financial management and/or business administration as well as higher math is usually required for both.

Future accountants are also required to take classes in business law, business administration, marketing, accounting ethics, statistics, accounting theory and any number of specialty topics, such as fraud, taxation or cost management. Financial analysis degree programs emphasize international and domestic finance and trade, risk management, corporate finance, financial engineering, and portfolio management, among other specialized topics.

Students enrolled in either degree program should consider concentrating their electives on the areas of expertise necessary to one or more of the career options below.

Careers in Accounting

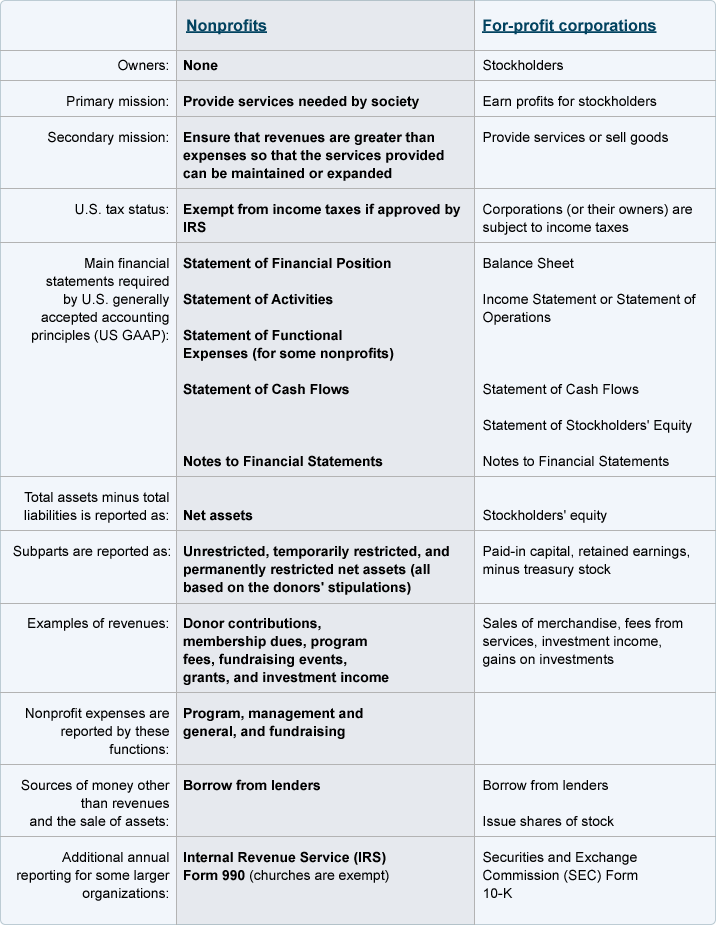

Accounting professions fall into two primary categories: accountants and auditors. Accountants generally work within a business or other entity; auditors are often employed by external auditing firms that routinely check other businesses, usually within a certain industry or sector, for financial improprieties or mismanagement. However, some accountants and auditors are employed directly by businesses or individuals (consulting) and internally monitor financial documentation.

Accountancy itself can be subdivided into public, management and government specializations. Public accountants are responsible for recording and managing all the financial documents their clients, usually corporations, individuals or government entities, are required by law to disclose; many focus exclusively on tax law and preparation. Forensic accountants work within the subcategory of public accountants and investigate or analyze financial crimes such as embezzlement, contract violation and securities fraud. Certified Public Accountants (CPA’s) are masters of the accounting trade, having received extensive training in financial and tax reporting. CPA’s must pass one of the most rigorous post-graduate examinations in the world, which has a less than 50% first-time pass rate, and typically command top employment and salary prospects within their field.

Unlike public accountants, management accountants work for private companies and oversee internal financial documentation, including budgets and cost analytics. Their duties overlap with those of financial analysts in that management accountants may also advise on investment opportunities and asset management. Government accountants specialize in financial operations subject to government oversight or conducted by government itself, and their employers are both private and public, from the municipal to the federal level.

Careers in Finance

Some financial analysts can be categorized according to their expertise in popular investment products. For instance, fund managers buy, sell and project the future value of hedge or mutual funds; portfolio managers oversee their clients’ entire investment portfolios, which may include stocks, bonds and real estate.

Other financial analysts are adept at certain analytical or financial activities, such as ratings analysis, the study of a business or government’s ability to repay its debts and risk analysis, which involves projecting ROI on various investments and advising clients accordingly.

Another way of dividing financial analysts is “buy-side” versus “sell-side.” Buy-side financial analysts provide investment procurement and management strategy for their clients; sell-side financial analysts advise sales teams disbursing stocks, bonds and other financial products.

The Bottom Line

Perhaps the most important consideration when differentiating between careers in accounting and financial analysis is personality. Accountants must have a high tolerance for detail and strong organizational, quantitative and analytical skills, as well as the ability to self-manage and work independently. Their duties are process-oriented and require both concentration and precision.

Although financial analysts share accountants’ need for strong mathematical and analytical skills, they are uniquely required to make good decisions quickly, often under tremendous pressure. Their work is results-oriented and requires confidence and strong communication skills.

Given these important distinctions, a wide variety of personalities can be well-served by a bachelor’s degree in accounting or financial analysis.