The Difference Between an Asset Sale and a Stock Sale

Post on: 16 Март, 2015 No Comment

Manchester, CT 860.646.2465 • Niantic, CT 860.739.5459 • Storrs, CT 860.429.7885

The Difference Between an Asset Sale and a Stock Sale

Closely Held Businesses looking to negotiate a sale of their business will either do an Asset Sale or a Stock Sale.

Asset Sale

With an asset sale, the buyer is buying the assets of the business. These assets will be identified in the purchase and sale agreement. They may include accounts receivable, inventory and fixed assets including office furniture, machinery and vehicles. Additionally they may include intangible assets like customer lists, work force in place, goodwill and a non-compete agreement. Most buyers would prefer an asset sale as:

- The buyer (generally) wont take on any of the seller’s liabilities. Unless specified in the purchase and sale agreement, the buyer is usually just buying assets. This gives the buyer some level of additional comfort as they are not taking on any.

- The buyer will be allowed to take depreciation and / or amortization expense on the assets purchased. Caution must be exercised as both the buyer and the seller will be required to complete IRS Form 8594, Asset Acquisition Statement. This document will allocate the purchase price among the assets and will be filed with both the buyers and the seller’s income tax return. This allocation is binding on both the buyer and the seller. Interestingly enough however, it is not binding on the IRS. Even though the buyer and seller agreed to the allocation, the IRS can challenge it. This is why it is important to have an independent appraisal of the assets done.

A seller may pay higher income taxes in an asset sale. Depending on how the price is allocated among the assets, the seller may have to pay taxes at ordinary income tax rates on some of the assets sold.

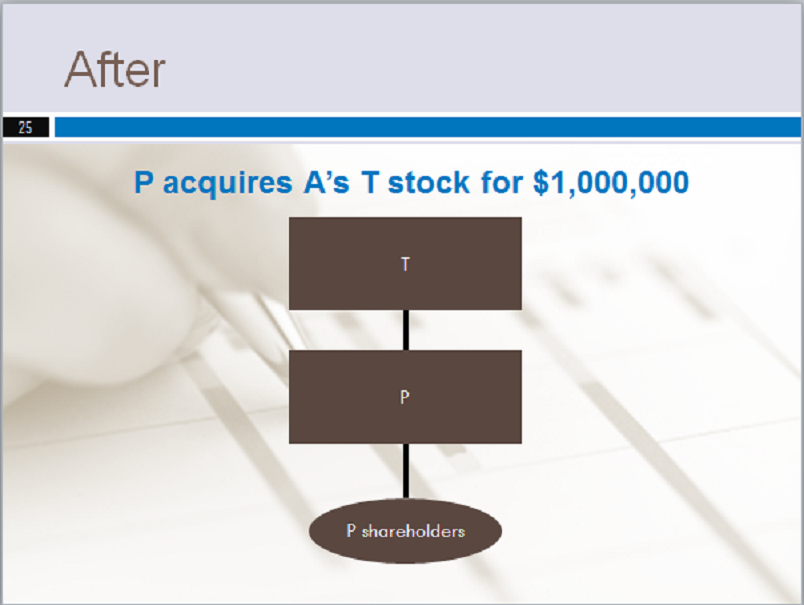

Stock Sale

With a stock sale, the buyer is buying the stock in the company. As part of this, the buyer assumes responsibility for all of the liabilities of the company. Additionally, the buyer will not be entitled to any depreciation and / or amortization deductions like they would have received in an asset deal as they are buying stock. Both of these attributes should cause a buyer to be cautious when considering a stock purchase. Sellers naturally would prefer a stock sale as this will be a capital gain to them.

ACTION ITEM: Buyers and sellers of closely held businesses need to be aware of the differences between an asset sale and a stock sale. Buyers and sellers need to work closely with their CPA to review the tax consequences and their attorney to draft the appropriate contracts and documents.

Thomas F. Scanlon, CPA, CFP®