The Covered Call Option Strategy – How To

Post on: 23 Январь, 2017 No Comment

The Covered Call Option Strategy – How To

How to Trade the covered call option strategy, also referred to as a buy write. The covered call trade strategy involves, buying the stock and selling one call option, against every one hundred shares that is owned.

Take a look at Microsoft stock ticker $MSFT as an example of buying and selling a covered call.

If we were to buy 100 shares of stock in Microsoft, Ticker MSFT for $25.80 a share and then sell the $26 call. This would be a covered call.

Let’s dig deeper and see what just happened.

In the picture below we have the option chain for Microsoft. The example shows the front month options that will expire in 26 days.

Recommended for You Webcast: A Week in the Life of an Agile Creative Team

It is July 26 th and we own stock in Microsoft, which we paid $25.80 a share, what can we do to make money on it besides waiting for the stock to go up? We can sell a call.

A call option gives the buyer the right to buy the stock from us on option expiration day. The call option also gives the seller the obligation to sell the buyer the stock for the predetermined price.

If we look at the $26 call, it is trading at $0.50 – $0.53 per contract. This amounts to $50 per one hundred shares. If we sell the $26 call and on options expiration day Microsoft stock is still below $26 a share we get to keep the $50 from selling the call and the stock stays in our account. If the stock is trading above $26, say $26.10, on option expiration day, the stock will be sold from our account for $26.00 a share and we will keep the $0.50 from selling the option contract. Either way we will have made a 2% profit in one month! If we manage to do this every single month it would be 24% profit on the year.

This sounds very exciting and enticing, but there are downsides to selling covered calls.

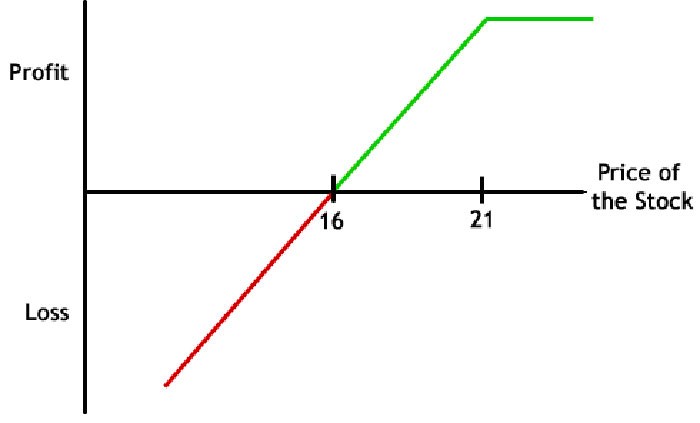

One downside to the covered call trade can happen when the stock losses too much of its value and then the profit from selling the call doesn’t cover the losses from the stock itself.

Example: We sold the $26 call for $0.50. We bought the stock for $25.80. On expiration day the stock is now at $25.05. We will have made 2% on the calls but lost 3% on the stock.

OK, so we are only down 1% overall on expiration day, let’s do it again and sell the $26 call for the next month.

Another negative to the covered call trade is when a call is sold and then the stock far surpasses the strike price and now the profit was limited.

Example: We sold the $26 call for $0.50. We bought the stock for $25.80. On expiration day the stock is now at $27.00. We will have made $0.20 on the stock, $0.50 on the options we sold and the other $0.50 that we could have made, is now the profit of the person who bought the option.

If you are like me and every time you buy stock it goes down. Then the covered call is a very good trade. Buy the stock, immediately sell a call against it. The stock goes down, and along with it the call option starts declining in value. Now at least there is some profit to go along with the loss.

If we go with the false assumption that the stock market will return on average 8% a year, doing a covered call that returns 1% a month will beat the market and do 12% a year.

When you are creating a covered call trade, it can be done at one time by placing a combination trade. A combination trade is when the stock it bought and the call is sold simultaneously. Or, if you already own the stock you can sell a call, either the weekly option or the option that expires in six months from now. Selling a call against stock you own is called sell to open (just like short selling). Some brokers have two different order types for selling options and you will need to select “sell to open”. To buy it back you will “buy to close”.

Do I need to wait for the option to expire?

No. You can go back and buy the option you sold, either for a profit or loss. Sometimes people will sell the call that expires in this month and then the stock has an earnings announcement and the volatility of the option drops giving them a profit on the far out of the money call that they sold. They can lock in profits by placing a “buy to cover” order on the call and sell another call that expires next week or next month.